LED manufacturers all over the world have suffered from low profit and market uncertainty due to continuous price competition and on-going trade dispute. Besides cutting off lighting business, LEDinside observed the strategies developed by worldwide LED companies under the difficult circumstance to alleviate impacts on their business.

Micro LED and Mini LED: the Turning Point for Taiwan LED Manufacturers

Taiwan-based LED companies were challenged by Chinese competitors with their low price strategies in the past few years. However, Mini LED and Micro LED opened a new direction and become the development focus for Taiwanese industry players to compete with Korean and Chinese firms.

Chip makers and packagers like Epistar, Lextar, Harvatek, and Everlight have been investing in Mini LED and Micro LED development. Despite that the development of Micro LED encountered several challenges; these companies have successfully achieved several Mini LED products for a wide range of applications.

(Image: Epistar)

Epistar and Lextar are shipping Mini LED backlight products for gaming monitors and notebook. Everlight is also working on Mini LED backlight automotive displays as well as Mini LED taillights. Fine-pitched display featuring Mini LED RGB is also rising up with increasing demands in large control rooms and cinema. Chip producers and panel makers have collaborated to launch large size Mini LED RGB signage for applications in medical, meeting, commercial and educational areas.

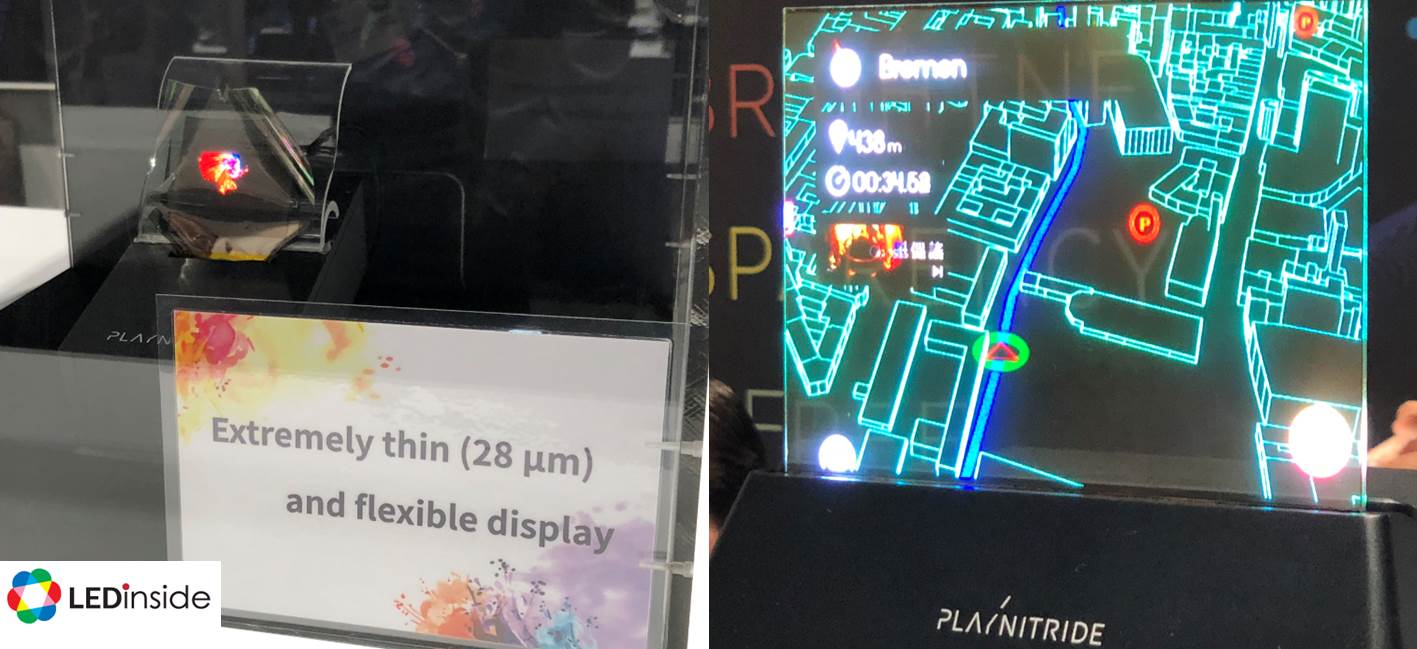

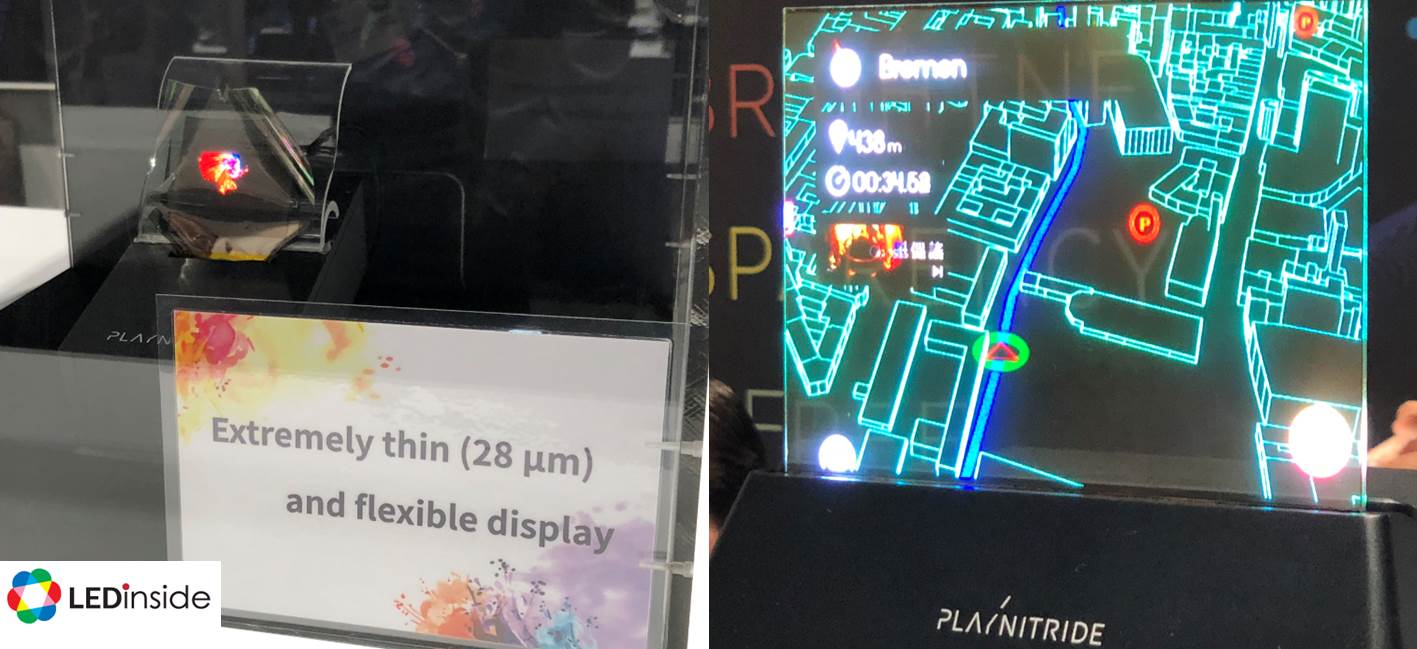

As for Micro LED, Taiwan’s PlayNitride, have supplied its chips to several international panel makers and partners RiTdisplay to product wearable Micro LED products. Other companies mentioned above have been involved in Micro LED related research and development as well.

Japan and Korea Companies Continues Diversified Development in UV LED and Special Lighting

On the other hand, Japanese and Korean LED makers remain low profile with continuous progresses in different products targeting special applications such as horticulture lighting, circadian/human centric lighting and commercial lighting. UV LEDs are also an advantage for Japan and Korea LED companies.

Nichia and Seoul Semiconductor have both introduced LED products featured with natural light wavelengths. Nichia’s products are used in museums and art galleries while Seoul has teamed up with different partners to leverage the edges of its SunLike LEDs.

As for UV LED, LEDinside has released revenue ranking for UV LED manufacturers with Japan and Korea including Seoul Viosys, LG Innotek, Nitride Semiconductors and Nichia dominating the top rankings.

LED manufacturers from Japan and Korea have also revealed their plans for Micro LED development. Seoul Semiconductor disclosed recently that it will begin Micro LED products supply to its customers and is planning to showcase its Micro LED in the second half of 2019.

CN

TW

EN

CN

TW

EN