|

|

Walmart Effect Puts Pressure on LED Bulb Price |

|

Starting next year, the U.S. government phase out of incandescent bulbs goes into effect in hopes of encouraging consumers to switch to more energy efficient lighting. Although consumers recognize the benefit of LEDs, the high prices are still hard to swallow. That however is all about to change with companies such as Cree and Walmart launching LED bulbs at cost-friendly prices. With prices as low as US $ 10, LED manufacturers are feeling the heat in the increasingly fierce price competition.

|

|

|

|

It's the Survival of the Fittest in the LED Industry |

|

Looking back in 2013, the LED industry has finally rebounded after years of depression. Large manufacturers are taking advantage of other companies during their weak moments, burying the hatchet with well matched companies, or joining hands to defeat competitors. Many less competitive weaker companies receded from the market this year. The survival of the fittest is anticipated to continue well into 2014. Restructuring of LED chip and package manufacturers will continue until 2015-2016, remarked Epistar chairman B.J. Lee.

|

|

|

|

China 2013 LED Policies Show Excessive Subsidizing Trend |

|

Good government policies can help propel an industry forward but bad ones can hinder development. Although China's policies are aimed at developing the LED industry, the subsidies have gotten out of control recently, said LEDinside Director Roger Chu. These policies can pose long term issues for the LED industry, as the government continues to issue subsidies despite oversupply situations.

|

|

|

|

Are EU and U.S. 2013 LED Policies Setting up Tech Barriers? |

|

In the previous article we highlighted how China's LED industry faces serious over subsidy situation due to overlapping funds issued by local and central governments. Compared to the Chinese government's generous LED subsidy programs to manufacturers, the EU and U.S. are more focused on establishing new energy efficiency standards Some Chinese media outlets have interpreted this as setting up technical barriers. In this article we take a look at whether these claims are true.

|

|

|

|

LED Manufacturers Full Blown Patent Disputes |

|

With the LED industry rebounding in 2013 due to developments in LED lighting, patent disputes between LED manufactures continue to rage on with no end in sight. The most notable has been the long fought out dispute between Japanese LED package manufacturer Nichia and Taiwanese package manufacturer Everlight, dragging their patent war through courts in Japan, China, the U.S., Germany, and more. Lawsuits between Nichia and Taiwanese LED package manufactures Unity Opto and Harvatek have also garnered a lot of news coverage.

|

|

|

|

Package Free LED Technology under the Spotlight in 2013 |

|

A review of 2013 LED products indicates package free products have been under the industry lime light for the whole year. The new trendsetter in the LED industry is not an innovative technology, LED manufacturers have already invested resources in package free LED R&D for several years. As the market becomes increasingly mature, there is no doubt that 2013 is a package free year.

|

|

|

|

EMC Production Expansion Could Mean Trouble for PCT |

|

As 2013 comes to a close, LED lighting demands have sky rocketed. The industry has finally gotten past two years of harsh winters to welcome a warm spring. While LED upstream manufactures have been busy with flip-chip technology, LED package manufacturers have not been idle either. Introducing EMC lead frames into package manufacturing process has become the main target for many manufacturers.

|

|

|

|

LED Driver IC to Maintain Strong Demands in 2014 |

|

In the previous article we highlighted how China's LED industry faces serious over subsidy situation due to overlapping funds issued by local and central governments. Compared to the Chinese government's generous LED subsidy programs to manufacturers, the EU and U.S. are more focused on establishing new energy efficiency standards Some Chinese media outlets have interpreted this as setting up technical barriers. In this article we take a look at whether these claims are true.

|

|

|

|

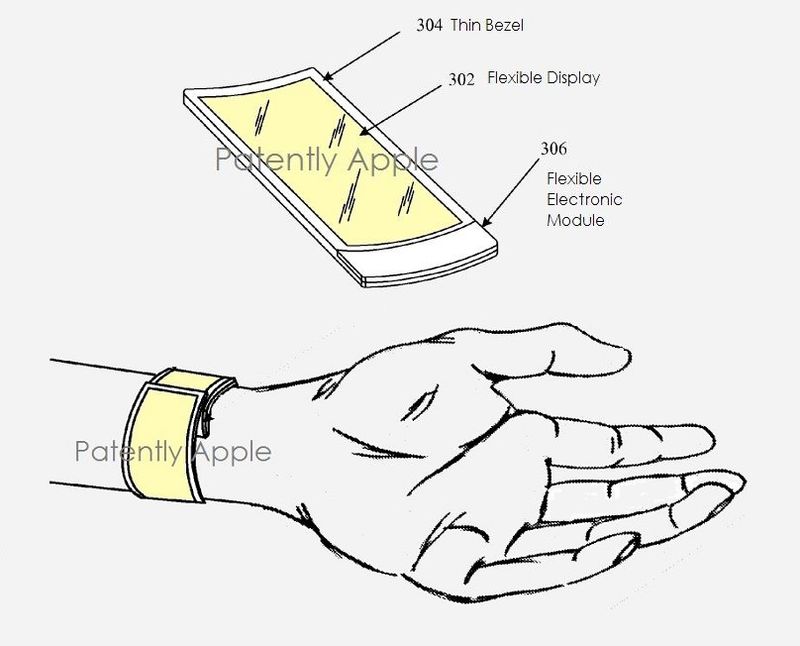

Apple Product Demands to Drive Sapphire Substrate Developments |

|

Apple has done it again. In 2013, the company drove up sapphire substrate smartphone demands with the adoption of the material in iPhone 5 and iPhone 5S home buttons and camera lens covers. It does not stop there, though. The company's recent patent applications reveal intentions of introducing sapphire substrate onto flexible wearable OLED device covers, which is likely to ignite new sapphire demands in 2014.

|

|

|

|

Smart Lighting Changing the Way We Experience Light |

|

Lighting is no longer just about providing enough light in a given space, but rather about allowing users to both feel and experience light in ways that can benefit their health and mood. LED technology is making es smart lighting possible.

|

|

|

|

The Future of OLED |

|

In recent years, LED technology has been the fastest growing in solid-state lighting, with a market penetration rate estimated to exceed 60 percent in 2014, according to LEDinside. Rapid improvement and the ever-increasing interest of large electronic manufacturers in OLED technology could lead OLEDs into the spotlight in 2017, analyzed LEDinside.

|

|

|

|

The Dark Side of Blue LEDs |

|

In the previous article we highlighted how China's LED industry faces serious over subsidy situation due to overlapping funds issued by local and central governments. Compared to the Chinese government's generous LED subsidy programs to manufacturers, the EU and U.S. are more focused on establishing new energy efficiency standards Some Chinese media outlets have interpreted this as setting up technical barriers. In this article we take a look at whether these claims are true.

|

|

|

|

Forecasts for the upcoming year

LEDinside: Top Six LED Industry Trends 2014

In 2013, the LED package market value was US$ 12.5 billion and is expected to reach US$ 13.39 billion (Year-on-Year +7%) in 2014, according to a LEDinside gold member report. Tablets and smartphones are still highlights of the LED market in 2014. The two applications have shown stable growth as it benefited from increased resolution and market demands. |

|