|

|

|

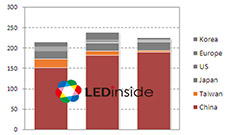

In late 2013, LEDinside team forecasted major company restructure market trends will continue throughout the year. The trend has been consistent in 2014, as more lighting manufacturers take necessary restructure measures to remain competitive in the market, such as Philips, Epistar or NVC Lighting. Top players restructure decisions in the fast changing LED industry landscape further reinforces the trend that large companies will become even bigger and influential, while smaller manufacturers will find it increasingly difficult to compete. |

|

|

|

|

|

More manufacturers are turning to emerging markets that hold high growth potential as maturing U.S., Europe and Japanese markets become saturated. Emerging markets including India, Thailand, and Russia hold many business opportunities for LED manufacturers, due to their high reliance on LED chips, components and package imports.

|

|

|

|

|

|

Where did this production capacity come from? Production capacity seen in 2014 mostly came from 2Q13 LED package expansions. A cloud of doom crept over the industry in 2012, as the industry’s oversupply situation triggered price wars and bankruptcy tsunami. Yet, in 2Q13 severe LED package shortages emerged as the slumping lighting market abruptly boomed. Many LED package manufacturers shared an optimistic market outlook at the time, some even doubled production capacity in a relatively short period.

|

|

|

|

|

|

The Chinese LED package industry entered another production expansion peak in 2H14, with many large LED package manufacturers announcing production expansion plans.

Refond Optoelectronics used its own finances to invest in full color LED displays in August 2014. The company plans to invest a total of RMB 430 million (US $69.25 million) to expand production of LED lights and full color LED displays.

|

|

|

|

|

|

Global LED package market is estimated to achieve US $14.6 billion in 2014, and grows at a CAGR of 3.2% during 2014-2018. Among all LED applications, LED lighting has the highest estimated revenue of US $4.8 billion in 2014, soaring with a CAGR of 12%. These figures suggest that LED lighting market has entered a high growth phase. Nevertheless, the prices of LED lighting products, such as lighting bulbs and tubes show a steady downfall trend. |

|

|

|

|

|

For many LED manufacturers, 2014 has been a prosperous and challenging year. Lighting market demands were stronger than expected in 1H14, leading to a period of LED supply shortages. Despite the positive development, the industry was impacted by clients double booking and distributors rising inventory levels during second half of the year. Many manufacturers were impacted by the markets cooling demands, and price competition as a result. As a result a lot of manufacturers’ performance in first and second half of the year was very polarized.

|

|

|

|

CN

TW

EN

CN

TW

EN

Read more

Read more