Group Financials have been restated as of the fourth quarter of 2014 and for prior periods to show the results of the combined businesses of Lumileds and Automotive as discontinued operations in connection with the process of attracting third-party investors.

|

|

Philips overall revenue performance. (Philips/LEDinside) |

Fourth-quarter highlights

-

Comparable sales declined 2%

-

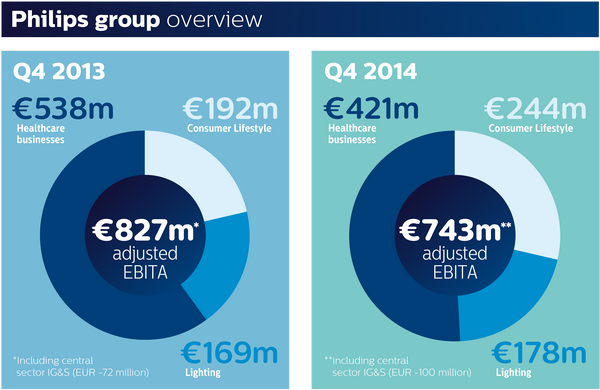

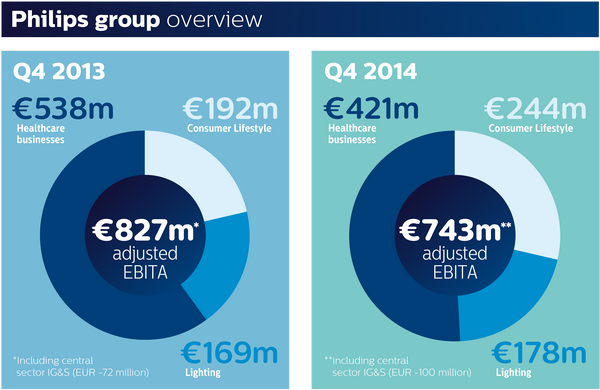

EBITA, excluding restructuring and acquisition-related charges and other items, amounted to EUR 743 million (US$ 842.18 million) , or 11.4% of sales, compared to 12.9% in Q4 2013

-

EBITA amounted to EUR 262 million, impacted by restructuring costs and other items, compared to EUR 789 million in Q4 2013

-

Net income amounted to EUR 134 million, compared to EUR 412 million in Q4 2013

-

Free cash flow improved to EUR 559 million, compared to EUR 481 million in Q4 2013

Full-year highlights

-

Comparable sales declined 1% to EUR 21.4 billion

-

EBITA, excluding restructuring and acquisition-related charges and other items, amounted to EUR 1.9 billion, or 9.0% of sales, compared to EUR 2.3 billion, or 10.5% of sales, in 2013

-

EBITA amounted to EUR 821 million, or 3.8% of sales, compared to EUR 2.3 billion, or 10.4% of sales, in 2013

-

Net income amounted to EUR 411 million, compared to EUR 1.2 billion in 2013

-

Free cash flow improved to EUR 497 million, compared to EUR 82 million in 2013

-

Return on invested capital was 4.5%, compared to 13.9% in 2013

-

Proposal to maintain dividend at EUR 0.80 per share

|

|

Philips revenue growth across global markets. |

Frans van Houten, CEO:

“The fourth quarter underscored a challenging 2014 for Philips. Our transformation efforts continued to show good results, even as we addressed performance issues, ongoing softness in end-markets like China and Russia, and stronger than anticipated foreign exchange impacts, particularly in emerging markets.

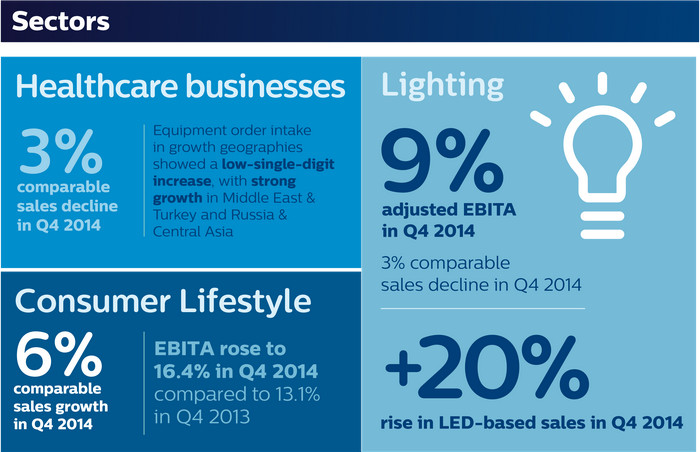

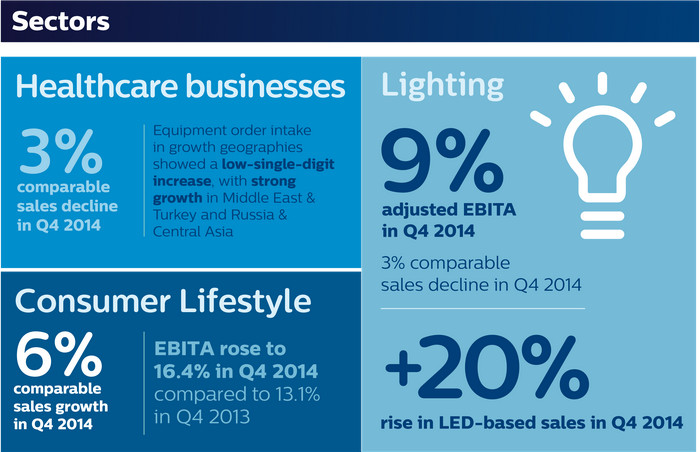

Healthcare was down overall, mainly caused by operational issues and soft markets. We were encouraged by market share gains in image-guided therapy and recorded strong orders in Europe and the Middle East, where we signed four multi-year solution deals. Our Cleveland factory resumed shipments to customers in January, marking an important milestone. Consumer Lifestyle performed very well in the quarter, continuing its three-year market-outperformance trend. Our Health & Wellness business delivered double-digit growth and we saw overall strong growth in EBITA.

Lighting recorded 20% sales growth in LED and expanded its margins in LED despite strong price erosion. Performance was, however, negatively impacted by results in China, Professional Lighting Solutions North America and conventional lighting. We took action to further restructure our manufacturing footprint in conventional lighting.”

|

|

Philips revenue growth among different business sectors. |

Lighting

Lighting (excluding the combined businesses of Lumileds and Automotive) comparable sales declined 3% yearon- year. LED-based sales grew 20%, offset by a decline of 14% in overall conventional lighting sales. LED sales now represent 37% of total Lighting sales, compared to 31% in Q4 2013. The EBITA margin, excluding restructuring and acquisition-related charges and other items, amounted to 9.0%, compared to 8.8% in the fourth quarter of 2013.

“As one of the leaders in providing lighting solutions for businesses, cities and consumers that deliver value beyond illumination, we signed a contract to provide the city of Madrid with what is the world’s largest street lighting upgrade to date, involving the replacement of 225,000 luminaires. Our performance in North America was unsatisfactory and our business in China was affected by deteriorating market conditions. We have taken further steps, including the appointment of a new head of our Americas Lighting business, to significantly strengthen our ability to deliver new levels of business value. We’ve also launched exciting new offerings, such as the SlimSurface LED downlight, the thinnest luminaire on the market, which will prove very effective for commercial real-estate customers.”

Update on Financial Targets

“Overall, 2014 was a setback in our performance trajectory. We have been taking clear actions to drive stronger operational performance across our businesses and expect sales growth and EBITA margin improvements in 2015 and beyond. However, looking ahead, we remain cautious regarding the macroeconomic outlook and expect ongoing volatility of some of our end-markets. We also anticipate further incidental costs in 2015 and 2016, mainly in relation to restructuring and the separation.

Due to these factors, we are tracking 1 percentage point behind on the path to achieving each of our 2016 comparable sales growth, EBITA and ROIC Group targets. We are convinced that this does not change our longer-term performance potential, considering the attractiveness of the Lighting Solutions and HealthTech markets and our competitive position. Later this year, as we progress with the separation of Philips and reallocation of IG&S, we will update the market about the integral performance targets for each of the two operating companies.”

Accelerate! and Separation Update

“Accelerate! continues to drive improvements across the organization, resulting in increased customer centricity, enhanced customer service levels, faster time-to-market for our innovations and better cost productivity.

In Lighting, Professional Lighting Solutions enhanced its product portfolio for the indirect channel in Europe, which drove more than 60% sales growth as a result of its strong price-performance ratio, locally relevant value proposition and delivery time commitment of 5 days.”

Overhead cost savings amounted to EUR 35 million for the quarter, bringing the total overhead cost savings in 2014 to EUR 284 million. The Design for Excellence (DfX) program generated EUR 123 million of incremental savings in procurement in the fourth quarter, bringing total DfX savings for 2014 to EUR 284 million. The End2End productivity program achieved incremental savings of EUR 22 million in the quarter, which brings the total End2End productivity savings to EUR 79 million for full-year 2014. Philips expects restructuring costs in 2015 of approximately EUR 250 million.

In September of last year, Philips announced its plan to separate into two standalone companies, positioning each one to better capitalize on the highly attractive HealthTech and Lighting solutions opportunities. Philips is confident in its ability to deliver additional growth and create more value through enhanced focus and agility. As indicated previously, the separation process will take approximately 12-18 months and further updates will be provided over the course of the year. The company currently estimates separation costs to be in the range of EUR 300-400 million in 2015.

The company is in discussion with external investors for the combined Lumileds and Automotive lighting businesses and expects to complete a transaction in the first half of 2015.

As of December 31, 2014, Philips had completed 41% of the EUR 1.5 billion share buy-back program.

Innovation, Group & Services

EBITA was a net cost of EUR 339 million, including a EUR 201 million provision for ongoing legal matters. Sales decreased from EUR 224 million in Q4 2013 to EUR 184 million in Q4 2014, mainly due to higher one time settlements in IP royalties in Q4 2013.

“We were pleased to receive the CE mark for diagnostic use of our Philips Digital Pathology system and software in the fourth quarter. Pathologists will now be able to use the full digital solution as an aid in diagnosis for routine pathology, which will improve workflows and collaboration and, in turn, increase efficiency and productivity. In the quarter, it is exciting to see that sales in the Healthcare Incubator almost tripled. We also opened a new healthcare imaging systems refurbishment facility in the Netherlands, which marks the next step in bringing the financial and environmental benefits of ‘circular economy’ to the healthcare industry.”