Highlights

-

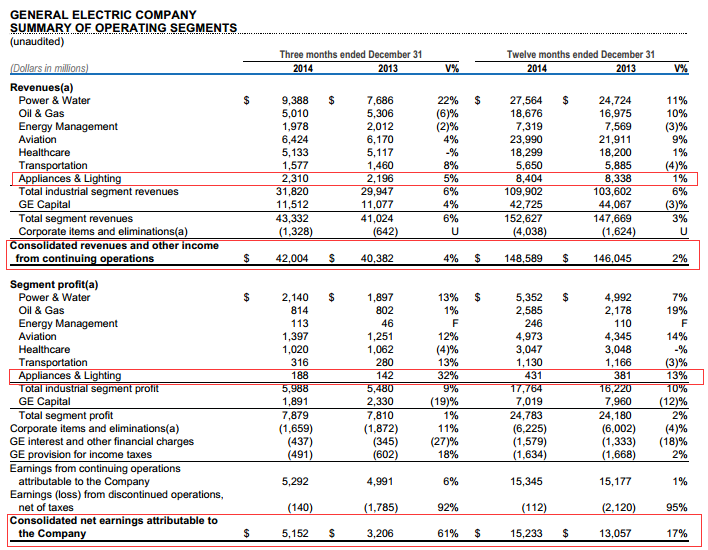

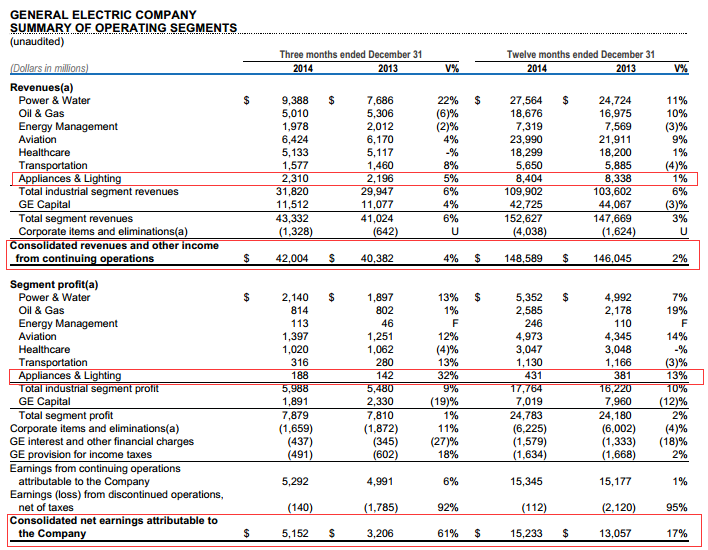

4Q industrial segment profit +9%, with 6 of 7 segments growing earnings

-

4Q revenues US $42.0 billion, +4%

-

4Q industrial segment organic revenues $32.2 billion, +9%;

-

FY2014 $108.0 billion, +7%

-

4Q margins +50 bps vs. 4Q’13; full-year margins +50 bps

-

$1.2 billion reduction in Industrial structural costs in 2014, ahead of plan

-

2014 GE CFOA of $15.2 billion, +6%

-

4Q Industrial CFOA of $7.2 billion, +64%; +30% excluding NBCU deal related taxes

-

GE Capital ENI (excluding liquidity) at $363 billion, -5% vs. year-ago

-

Underlying performance as expected in Oil & Gas. Organically, achieved: orders -4%, revenue flat, operating profit +6%. Reported: orders -10%, revenue -6%, operating profit +1%.

|

|

GE's 4Q14 revenue results. (Source: GE) |

“We are pleased with our execution in 2014: meeting our commitment to grow industrial segment profits 10%, industrial segment organic revenue growth of 7%, increasing operating margins 50 basis points, decreasing costs by $1.2 billion, reducing the size of GE Capital and returning $11 billion to shareowners,” said Jeff Immelt, Chairman and CEO, GE.

|

|

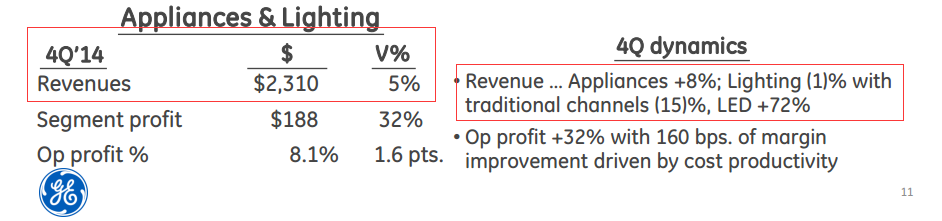

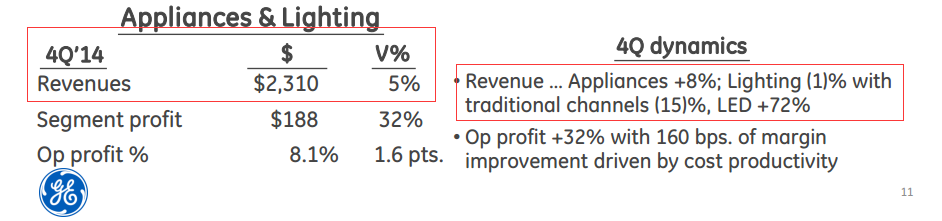

GE's 4Q14 revenue results. (Source: GE) |

Based on the revenue report, the company’s appliances and lighting business revenue was up 5% YoY to reach US $2.31 billion last quarter. Profits from this business sector also was up by 32% YoY to US $188 million. Revenues from GE’s lighting business was down 1%, but LED lighting had grown 72%, while traditional lighting slid by 15%. Moreover, LED lighting now makes up 27% of GE lighting’s revenue, which was 16% last year.