Two Taiwan-based LED companies, Epistar and Lextar, announced yesterday (June 18) that they will jointly set up a new holding company via share conversion. Through the collaboration, the two companies aim to integrate their resource and focus on their expertise to speed Mini LED and Micro LED technology development.

For the new holding company, Epistar and Lextar will swap one share for 0.5 and 0.275 shares respectively. The share swap is scheduled to be completed on October 20, 2020. Once the new holding company is listed upon the share swap date, both Epistar and Lextar will be delisted and become subsidiaries of the new company. The two parties said that they will continue to operate independently with no impact on the customers and employees. On August 7, 2020, Epistar and Lextar will both hold emergency shareholders meeting to seek for shareholder’s approval.

After the integration, Epistar will focus on LED upstream and midstream technology covering wafer production and chip manufacture while Lextar will concentrate on downstream packaging technologies. Epistar will become Lextar’s supplier and the two parties will reinforce the integration of resource and technology development for faster commercialization and efficient investment and cost management. In addition, the two companies plan to leverage their strength to push Mini LED and Micro LED technology applications.

The capitalization of the new holding company is expected to be NTD 6.8 billion (US$ 220.83 million). And its operation will be coordinated by the Steering Committee jointly established by Epistar and Lextar that both parties will have two representatives in the Committee.

LEDinsight Prospective:

With the rise of Micro LED and Mini LED commercial opportunities, leading manufacturers such as Apple and Samsung are placing high hopes in the future of these two emerging display technologies and forecasting a high demand for Micro/Mini LED suppliers’ production capacities. However, as Taiwanese LED manufacturers have suffered continuous financial losses over the past few years, most of them can no longer afford to expand their production capacity on a large scale to meet demands from end-product brands. Furthermore, the recent surge in CAPEX by Chinese LED chip manufacturers and LED packaging companies, as well as their partnership with domestic panel manufacturers, has alarmed Taiwanese LED companies to the hypercompetitive state of the LED industry. By forming a holding company, Epistar and Lextar are now able to jointly bear the enormous burden of investing in new equipment, in turn lowering their operational risk and helping them gain a foothold in the market for new types of displays.

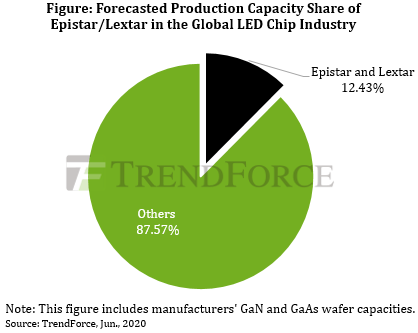

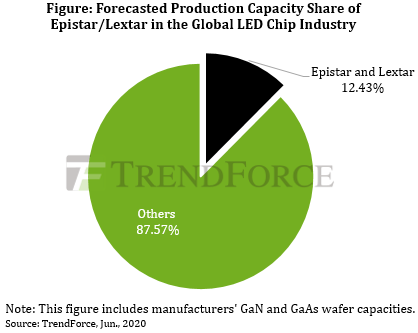

TrendForce estimates that Epistar and Lextar will collectively account for 12.43% of the global LED chip production capacity after the formation of the holding company.

Supply chain integration allows Epistar and Lextar to collectively pursue client orders

Epistar’s production capacity is primarily focused on LED epitaxy and LED chip fabrication, whereas Lextar specializes in LED packaging and modules. The partnership between the two companies will result in a total vertical integration throughout the entire LED industrial supply chain. Given that both companies have been actively investing in Mini LED backlight R&D, the collaboration between Epistar and Lextar will serve to reduce their competition with each other over client orders as Mini LED backlight demand from panel manufacturers and branded end-product OEMs skyrockets.

Gold+ Member Report

-

LED Industry Demand and Supply Data Base- Backlight / General Lighting / Architectural Lighting / Automotive Lighting / Digital Display / Projection & Horticultural Lighting / UV LED / IR LED / μLED Mini LED Applications

-

LED Player Revenue and Capacity- Chip Market and Player Capacity & Revenue / Package Market and Player Capacity & Revenue / LED Player Revenue Ranking in Each Application

-

LED Industry Price Survey- Sapphire / Chip / LED Package (Backlight / Lighting / Automotive / Digital Display / UV LED / IR LED)

-

LED Industry Quarterly Update- Major LED Player Quarterly Update (EU, US, Japan, Korea, Taiwan, China)

-

Micro / Mini LED Market Prospective Analysis- Vendor Dynamics, New Technology Import

|

LED Industry Demand and Supply Data Base |

Demand Market Forecast:

2019-2024 Demand Market Forecast

(Projection and Display / General Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck / Digital Display / SSL Like / UV LED / IR LED / Micro LED & Mini LED) |

PDF / Excel |

1Q (February) / 3Q (August) |

Supply Market Analysis:

1. Chip Market Revenue (External Sales, Total Sales)

2. WW new GaN & AlInGaP MOCVD Chamber Installation volume / WW Accumulated GaN & AlInGaP MOCVD Chamber Installation

3. GaN & AlInGaP Epi Wafer Market Demand (Total / By size)

4.GaN & AlInGaP Sufficiency |

|

LED Player Revenue and Capacity |

LED Chip Market Analysis:

Top 10 Chip vendors' MOCVD installation, wafer capacity, and revenue

|

PDF / Excel |

2Q (May) / 4Q (November) |

LED Package Market Analysis:

LED Package Vendors’ Revenue and LED Revenue, and Capacity

Top 10 LED Package Revenues in Backlight, Lighting, COB, Automotive, Display, UV LED |

|

LED Industry Price Survey |

Price Survey- Sapphire & GaAs Substrate / Chip / LED Package (Backlight, Lighting, Automotive, Digital Display, UV LED / IR LED, VCSEL)

|

Excel |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November) |

|

LED Industry Quarterly Update |

Major Players Quarterly Update

EU- Lumileds, Osram Licht AG, and Osram OS

US- Cree

ML- Dominant

JP- Nichia, Citizen, Stanley, and Rohm

KR- Samsung, LG Innotek, Seoul Semi, and Lumens

TW- Epistar, Opto Tech, Epileds, Everlight, Lextar, Lite-on, AOT, Unity-Opto, Harvatek,

CN- San’an Opto, Changelight, HC SemiTek, Aucksun, Focus Lightings

Nationstar, Hongli, Refond, Jufei, MTC, ChangFang Lighting, MLS

|

PDF |

1Q (February) / 2Q (May) / 3Q (August) / 4Q (November)

|

|

Micro / Mini LED Market Prospective Analysis |

Vendor Dynamics, New Technology Import

|

10-15 Pages

PDF

|

March, June, September 2020

|

|

|

If you would like to know more details , please contact:

If you would like to know more advertising details , please contact:

|