Login |

Register |

Management | Member Center | Contact Us

CN

TW

EN

CN

TW

EN

Login |

Register |

Management | Member Center | Contact Us

CN

TW

EN

CN

TW

EN

|

|

|

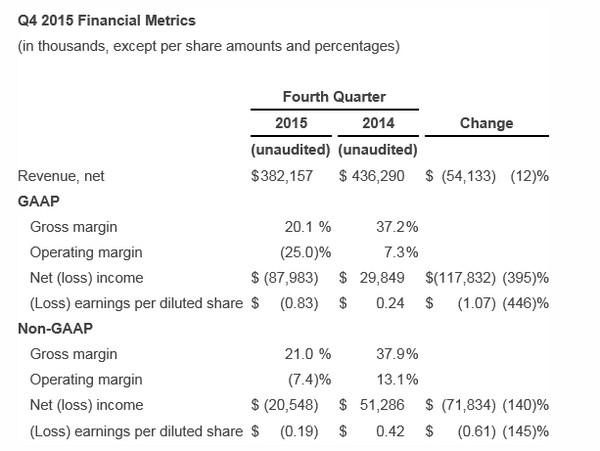

Cree, a market leader in LED lighting, announced revenue of US $382 million for its fourth quarter of fiscal 2015, ended June 28, 2015. This represents a 12% decrease compared to revenue of $436 million reported for the fourth quarter of fiscal 2014, and a 7% decrease compared to the third quarter of fiscal 2015. GAAP net loss for the fourth quarter was $88 million, or $0.83 per diluted share, compared to GAAP net income of $30 million, or $0.24 per diluted share, for the fourth quarter of fiscal 2014.

On a non-GAAP basis, net loss for the fourth quarter of fiscal 2015 was $21 million, or $0.19 per diluted share, compared to non-GAAP net income for the fourth quarter of fiscal 2014 of $51 million, or $0.42 per diluted share. During the fourth quarter of fiscal 2015, Cree recognized $84 million of costs related to the LED business restructuring that was announced on June 24, 2015.

The restructuring charges included $27 million of LED revenue reserves, $11 million of LED inventory reserves and $46 million of factory capacity and overhead cost reductions. The revenue and inventory reserves are included in both the GAAP and non-GAAP results, while the capacity and overhead charges are included in the GAAP results only.

“The actions we took in Q4 to restructure our LED business position us for solid revenue growth and margin expansion in fiscal 2016, driven by the strength of our commercial lighting business.”

For fiscal year 2015, Cree reported revenue of $1.63 billion, which represents a 1% decrease compared to revenue of $1.65 billion for fiscal 2014. GAAP net loss was $64 million, or $0.57 per diluted share, compared to $124 million of net income, or $1.01 per diluted share, for fiscal 2014. On a non-GAAP basis, net income for fiscal year 2015 was $72 million, or $0.64 per diluted share, compared to $203 million, or $1.65 per diluted share, for fiscal 2014.

"Fiscal 2015 was a year of good progress in our Lighting and Power and RF businesses, mixed with challenges in the LED industry," stated Chuck Swoboda, Cree Chairman and CEO. "The actions we took in Q4 to restructure our LED business position us for solid revenue growth and margin expansion in fiscal 2016, driven by the strength of our commercial lighting business.”

|

| (Source: Cree) |

Recent Business Highlights:

Business Outlook:

For its first quarter of fiscal 2016 ending September 27, 2015, Cree targets revenue in a range of $410 million to $430 million, with GAAP gross margin targeted to be 31.3%+/- and non-GAAP gross margin targeted to be 32.0%+/-. Our GAAP gross margin targets include stock-based compensation expense of approximately $3 million, while our non-GAAP targets do not. GAAP operating expenses are targeted to be approximately $142 million, and non-GAAP operating expenses are targeted to be approximately $107 million. The tax rate is targeted at 25.0% for the first quarter of fiscal 2016. GAAP net loss is targeted at $16 million to $22 million, or a loss of $0.16 to $0.21 per diluted share, due to the additional restructuring costs and the estimated fair value loss based on our Lextar investment current stock price. Non-GAAP net income is targeted in a range of $19 million to $24 million, or $0.18 to $0.23 per diluted share. The GAAP and non-GAAP per diluted share targets are based on an estimated 103 million diluted weighted average shares. Targeted non-GAAP earnings exclude $0.39 per diluted share of expenses related to stock-based compensation expense, the amortization or impairment of acquisition-related intangibles, net changes associated with our Lextar investment, and charges associated with the LED business restructuring.