Annual Revenue increased 14% to a record $988 Million

Annual Net Income was $147 Million

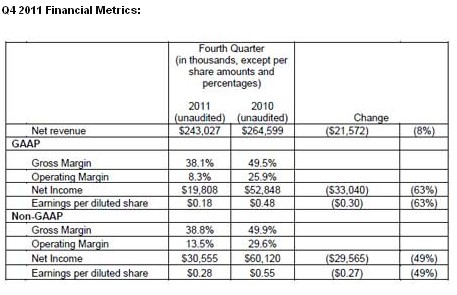

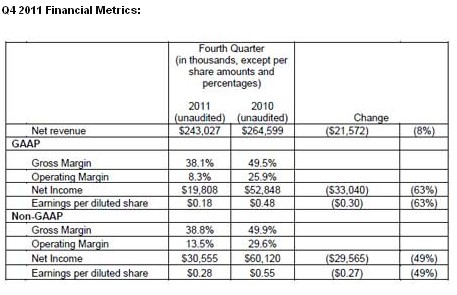

Cree has announced revenue of $243.0 million for its fourth quarter of fiscal 2011, ended June 26, 2011. This represents an 8% decrease compared to revenue of $264.6 million reported for the fourth fiscal quarter last year and an 11% increase compared to the third quarter of fiscal 2011. GAAP net income for the fourth quarter of $19.8 million, or $0.18 per diluted share, decreased 63% year-over-year compared to GAAP net income of $52.8 million, or $0.48 per diluted share, for the fourth quarter of fiscal 2010. On a non-GAAP basis, net income for the fourth quarter of fiscal 2011 of $30.6 million, or $0.28 per diluted share, decreased 49% year-over-year compared to non-GAAP net income for the fourth quarter of fiscal 2010 of $60.1 million, or $0.55 per diluted share.

For fiscal year 2011, Cree reported revenue of $987.6 million, which represents a 14% increase compared to revenue of $867.3 million for fiscal 2010. GAAP net income of $146.5 million, or $1.33 per diluted share, decreased 4%, compared to $152.3 million, or $1.45 per diluted share for fiscal 2010. On a non-GAAP basis, net income for fiscal year 2011 of $186.8 million, or $1.70 per diluted share, increased 4%, compared to $179.2 million, or $1.71 per diluted share, for fiscal 2010. Cree generated $251.4 million of operating cash flow and $14.3 million of free cash flow (cash flow from operations less capital expenditures) during fiscal 2011.

"Q4 results were in-line with our targets, and we are encouraged by the 11% sequential growth in quarterly revenue," stated Chuck Swoboda, Cree chairman and CEO. "Over the last fiscal year, we continued to have success leading the LED lighting revolution and growing our LED lighting business, while at the same time managing through a challenging business cycle for our LED component and LED chip product lines. As we look ahead to Q1, demand has improved from earlier in the calendar year, and we are well positioned to continue to lead the LED lighting revolution."

* Cash and investments ended the quarter at $1,085.8 million, which was an increase of $12.7 million from Q3 of fiscal 2011.

* Accounts receivable (net) decreased $7.4 million from Q3 of fiscal 2011 to $118.5 million, with days sales outstanding of 44, a decrease of 8 days from Q3 of fiscal 2011.

* Inventory increased $6.9 million from Q3 of fiscal 2011 to $176.5 million and represents 106 days of inventory, a decrease of 13 days from Q3 of fiscal 2011.

Recent Business Highlights:

* Revolutionized commercial lighting with the release of the Cree CR family of LED troffers, which deliver shorter payback, better light quality and better efficacy than comparable fluorescents.

* Achieved another industry-best efficacy record of 231 lumens per watt for a white high-power LED in R&D.

* Unveiled a concept LED light bulb that exceeds the DOE’s 21st Century Lamp L PrizeSM requirements by delivering more than 1,300 lumens at 152 lumens per watt using Cree TrueWhite® Technology.

* Launched patent licensing program for remote-phosphor applications.

Business Outlook:

For its first quarter of fiscal 2012 ending September 25, 2011, Cree targets revenue in a range of $245 million to $255 million with GAAP and non-GAAP gross margin targeted to be in a similar range as Q4 at 38-39%. GAAP operating expenses are targeted to increase by approximately $2.0 million to $75 million, or $62 million on a non-GAAP basis. The tax rate is targeted at 20% for fiscal Q1. GAAP net income is targeted at $16 million to $19 million, or $0.14 to $0.17 per diluted share. Non-GAAP net income is targeted in a range of $28 million to $31 million, or $0.25 to $0.28 per diluted share. The GAAP and non-GAAP net income targets are based on an estimated 110.2 million diluted weighted average shares. Targeted non-GAAP earnings exclude expenses related to the amortization of acquired intangibles of $0.02 per diluted share, and stock-based compensation expense of $0.09 per diluted share.