Network based lighting controls have failed to gain much traction over the last 5 years despite the benefits that they can deliver for improving operating costs and reducing CO2 emissions. So why will the influx of LED lighting into the commercial building market open up new opportunities for controls?

This is now the most exciting time for the lighting industry since the early twentieth century, we are truly at an inflection point, and the forthcoming shakeout over the next 5 years will determine the winners and losers in the game, as well as who will be the lighting giants of the future.

It is the impact of LED technology that is providing vast opportunities to improve lighting products and controls and their efficiency, which has coincided with the mandated demand to reduce CO2 emissions in buildings that has created this challenging opportunity.

Our new research report “The Global Lighting Controls Business 2013 to 2017” shows that the world value of lighting control products in 2013 was approximately $1.67 billion at factory gate prices. The report forecasts that the global market for Lighting Controls from 2013 to 2020 will grow at a CAGR of 12% to 2020. Over the next 7 years growth in the developed markets of Europe and North America will increase at a little more than half this rate whilst China an Asia will well exceed the average growth across the world. These figures do not include any other controls and value-add services that could well become part of the lighting controls contract in the future.

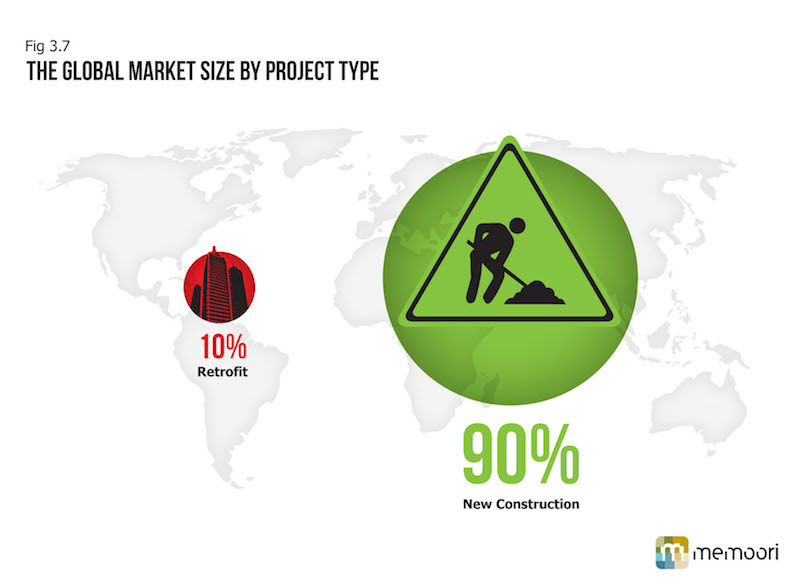

These are indeed high rates of growth particularly for the rather mature lighting business. Growth in demand for lighting controls will be assured in the new construction sector particularly in the developing markets of the world thanks to the growth in LED lighting and its drive down into medium sized buildings. The big major imponderable is when the retrofit market will kick in, because this currently contributes only 10% of total sales but has a latent potential to more than treble its contribution.

Looking back over the last 7 years shows a volatile and disappointing performance for lighting controls in the developed markets of the world. The main reason for this has been serious decline in the construction of new buildings. The UK market is a typical example of the poor performance of lighting controls during this period. The market peaked at £197 million at installed prices in 2008 following the liquidity crisis in 2007 and the financial meltdown in 2008. Demand for lighting controls dramatically declined in the following 2 years and bottomed out in 2010 when new construction in the commercial sector started to pick up. For the last 3 years demand has grown by approximately 4% per annum.

Global Market Size by Project Type

We forecast that it will take until 2016 to show any significant growth over the last 8 years and this will require a CAGR of 4.2% from 2012 to 2016. Thereafter the full force of LED Lighting together with the gradual opening up of the retrofit market will provide a growth in demand of 7.5% to 2017 and beyond. In the last 5 years supervisory software has become an important part of the lighting control systems business in major buildings and this has increased the value in these applications.

As the report shows this new importance of sophisticated control over lighting has also opened up new opportunities to extend its domain into providing other building technical services such as controlling the environment, demand response, emergency lighting, parking management and more. These applications fit in well with the low voltage contact and how this business is conducted in the construction of new buildings.

Having struggled for the last 15 years to get all the environmental services in buildings to work together we have now reached a point where connectivity can be achieved directly through IP allowing the Internet of Things to become a reality. This report shows how LED Lighting controls could act as a catalyst for the IoT in buildings and now with this network in place it is a relative simple matter to extend it to other value add services.

Each new LED fixture can, in essence, become the node on an intelligent control so turning off the lights when people aren’t around or dimming them when exterior light can be harvested. But those sensors can also be used to harvest other useful data about temperature, occupancy and their surroundings that have many other applications.

Historically, building controls applications have been HVAC centric since that was the element of the building where controls could add significant value, particularly in new construction applications. At the lower end of the market the ROI rate for HVAC oriented building energy management has not been compelling, so the majority of buildings around the world are still waiting to be converted to “Smart.” LED lighting controls could deliver much more; they penetrate further down the building size spectrum and then act as a “Trojan horse” by adding many other building services to it’s network. As the report shows this is happening today and it has the potential to increase its share of the business.

However if the lighting controls market is to maximize the growth opportunities that we forecast then it must increase its share of the retrofit market. Whilst the case for retrofitting buildings with LED lighting has become very compelling it needs wireless technology in order to bring down the installation cost and improve the ROI. Yet again LED lighting and its control will be retrofitted in many thousands of buildings that don’t have Building Energy Management Systems (BEMS) and this presents an even stronger case for connecting to the bus-based lighting controls, fan coil units, chilled beams and natural ventilation controls. The BEMS suppliers will contest this but it could be welcomed by the product manufactures after a slight tweaking of the distribution channels.

|

The disruption of the lighting controls market is about to start. For those both currently in the business and about to enter who take up the challenge, the next 10 years will prove to be the most interesting and profitable for many decades.

More details about the report “Smart Buildings: The Lighting Controls Business 2013 to 2017” can be found here – http://www.memoori.com/portfolio/smart-buildings-the-lighting-controls-business-2013-to-2017/

- See more at: http://www.memoori.com/why-2014-is-a-good-time-to-be-in-the-lighting-controls-business-2/#sthash.zYH714EF.dpuf