Description Primary author: Dr Norman Bardsley Dr Bardsley has consulted for the DOE on SSL and has worked for numerous OLED companies. Co-author: Dr Khasha Ghaffarzadeh, Head of Consulting, IDTechEx

The lighting industry is a large, global and yet fragmented market place. The fragmentation is driven both by technology differentiation and customer need diversity. The technologies vying for market share include incandescent lamp, compact fluorescent lamp (CFL), halogen lamp, light-emitting diodes (LEDs) and, most recently, organic light emitting diodes (OLED). The target markets are also very diverse, each serving different needs and demanding different price points. These markets include;

-

Residential

-

Architectural

-

Hospitality

-

Shop

-

Industrial

-

Office

-

Outdoor

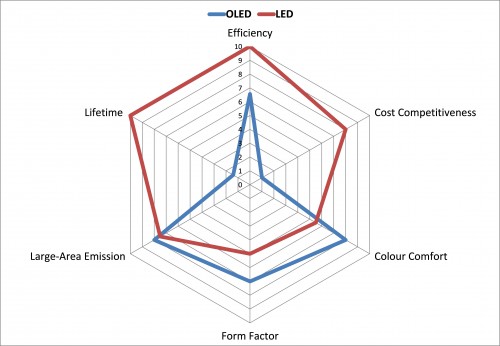

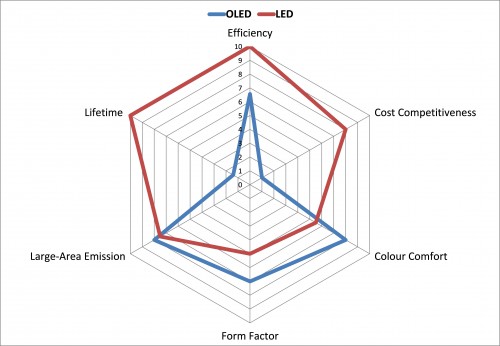

OLED and LED lighting are both solid-state technologies and offer overlapping value propositions per market segment. They will therefore compete directly in many instances. LED lighting has come a long way and offers a better performance than OLEDs, and that at a lower cost. OLED lighting will therefore only gain market success if it clearly defines its unique selling points and carves out initial market niches.

|

|

A radar chart comparing the current attributes of OLED and LED lighting. (Source: IDTechEx) |

This report is divided into two parts: (a) technology and (b) market assessment. The first offers a comprehensive yet detailed overview of both LED and OLED lighting, going through fabrication processes, material compositions, technology roadmaps, and key players. The device attributes of each technology are also critically assessed, examining parameters such as colour warmth and controllability, flexibility, efficiency, surface emission, lifetime, wafer size, and luminaire design.

The second section offers a blunt market assessment. Detailed cost projection roadmaps are developed, factoring in estimated cost evolution of the integrated substrates, encapsulation layers and materials. Changes in system configuration and material composition required to enable the cost roadmaps are outlined. We also factor in production costs including capital and labour. Values are expressed in units of $/unit and $/klm.

The value proposition of OLEDs for all market segments is critically analysed. For each assessment, IDTechEx Research examines parameters such as light quality, form factor, technology mix diversity, price sensitivity, light controllability, lifetime and light intensity. The report also rigorously compares the performance of OLED and LED devices using the above parameters.

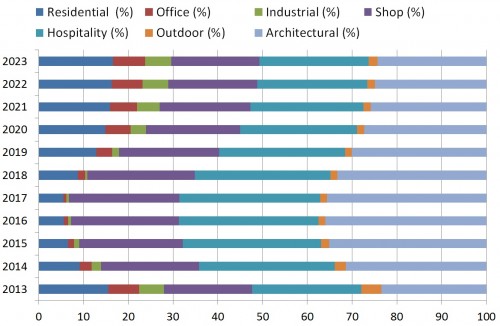

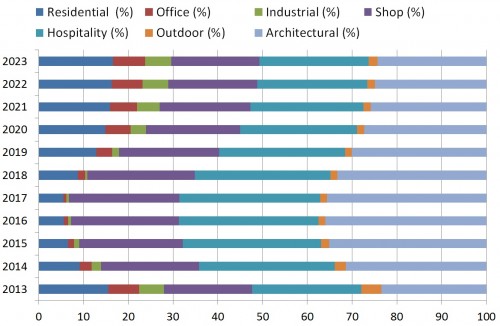

IDTechEx Research then develops detailed market forecasts. Here, we estimate the market share of OLEDs per lighting market segment, calculate the total lighting area per sector, estimate the lumen output per segment, and forecast the equivalent number of units sold per sector. Combining all our analysis, we forecast the monetary value of the market at module level per market segment.

|

|

The relative monetary contribution of each lighting market segment to the total OLED market between 2013 and 2023. Exact values are available upon request. (Source: IDTechEx) |

IDTechEx Research forecast the market will grow to US $1.3 billion in 2023 and initially grow at a rapid rate of 40-50% annually, although the initial market base in very small. The research organization contextualized its assessment by expressing market forecast in units of equivalent 60W incandescent bulbs. Implications of the market forecast was assessed for the global capital investment and production capacity. Comparison of LED market size (including automotive, backplane and residential) was based on a module level. Production capacities are compared too to further set out forecasts in prospective. The research methodology is clearly laid out in the report, as all underlying assumptions.

Read more at: http://www.idtechex.com/research/reports/oled-lighting-opportunities-2013-2023-forecasts-technologies-players-000339.asp?viewopt=showall