-

Comparable sales growth stable, with sales in growth geographies up four percent

-

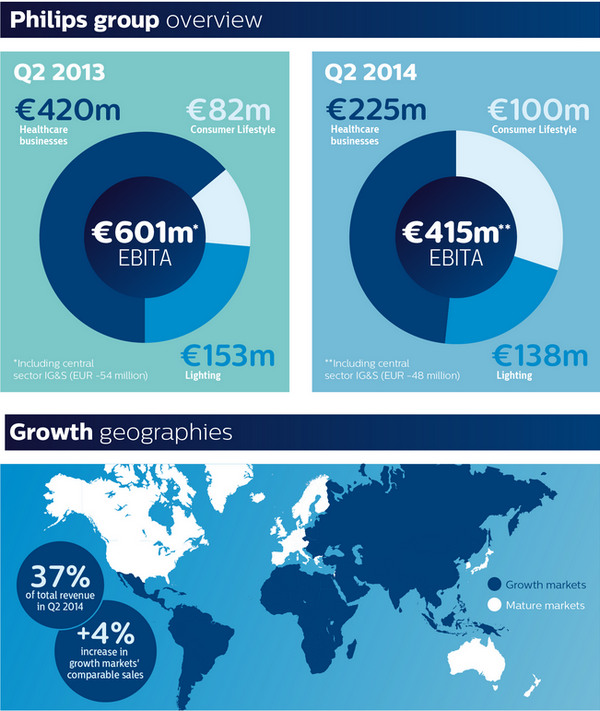

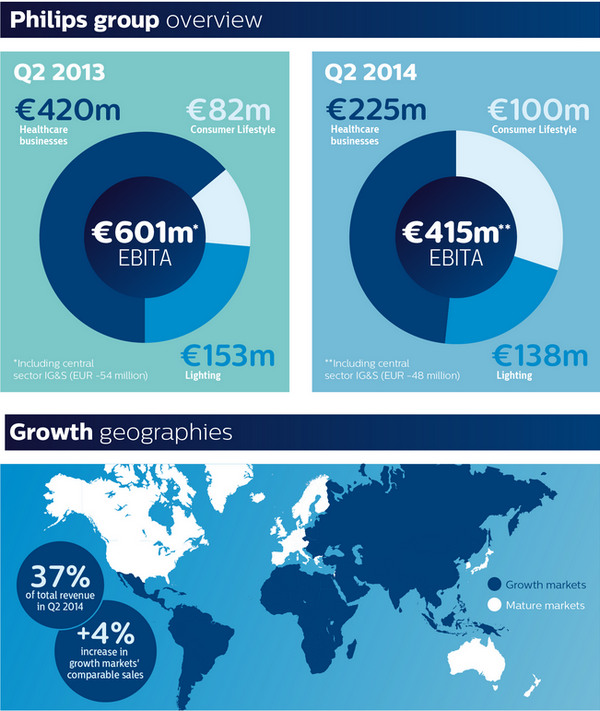

EBITA of EUR 415 million (US $ 561.20 million), compared to EUR 601 million in 2Q13

-

EBITA, excluding restructuring and acquisition-related charges and other items, amounted to EUR 449 million, or 8.5 percent of sales, compared to 9.4 percent in Q2 2013.

-

Currencies negatively impacted sales by 6 percent and EBITA by 0.8 percentage points of sales.

-

Net income amounted to EUR 243 million, supported by lower tax charges

-

Free cash flow of EUR 261 million, compared to free cash outflow of EUR 105 million in Q2 2013

|

|

Philips overall growth in 2Q14 and regions. (LEDinside/Philips) |

Frans van Houten, CEO:

“In the second quarter we continued to face headwinds, including ongoing softness in certain markets, unfavorable currency exchange rates and the voluntary suspension of production at our health care facility in Cleveland. At the same time, we are taking decisive action to accelerate value creation, improve performance and capitalize on higher growth opportunities in our businesses. This is demonstrated by our announcement to create a stand-alone company within Philips for the combined Lumileds (LED components) and Automotive lighting businesses and the implementation of the new management structure in Healthcare.

While 2014 is expected to be a challenging year overall, we anticipate EBITA for the Group, excluding restructuring and acquisition-related charges and other items, in the second half of the year to exceed the level of the same period last year. We continue to increase efficiency and drive profitable growth through the execution of our multi-year Accelerate! transformation and are firmly committed to reaching our 2016 targets.”

Lighting

“In Lighting, we are intensifying our focus on connected LED lighting systems and services, LED luminaires, and LED lamps for the professional and consumer markets. Our decision to combine the Lumileds and Automotive lighting businesses into a stand-alone company within Philips will allow it to extend its leading portfolio of digital lighting components and achieve robust growth, serving even more customers in the industry, as well as Philips Lighting. Lighting is taking advantage of the many opportunities in the growing LED space, driven by increased demand for energy efficiency and digital controls. We are also making good progress in Professional Lighting Solutions North America, and we anticipate improvement in Q3 and a return to profitability in the second half of the year.”

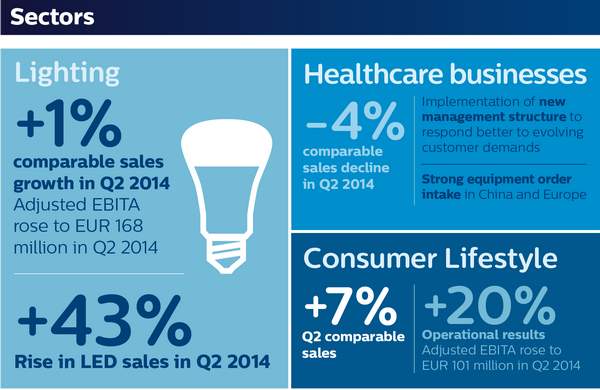

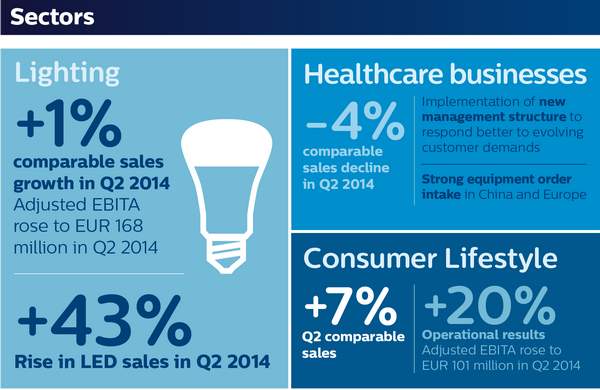

Lighting comparable sales increased 1 percent year-on-year. LED-based sales grew 43 percent and now represent 36 percent of total Lighting sales, compared to 25 percent in Q2 2013. The EBITA margin, excluding restructuring and acquisition related charges and other items, improved to 8.6 percent, an increase of 0.5 percentage points year-on-year.

|

|

Company earnings broken down into sectors. (LEDinside/Philips) |

Philips is taking actions to improve profitability in its Lighting business while also accelerating the drive to LED. The Company’s strong and continuous focus on optimizing its manufacturing footprint and the overall cost base has resulted in the 8th consecutive quarter of year-on-year improved operational profitability. The recovery in Consumer Luminaires in Europe is progressing, and the Company aims to make this business break-even for the full year.

In the second quarter, we continued to see strong momentum in LED-based sales, which grew 43 percent and now represent 36 percent of total Lighting sales. At the same time, we saw a 13 percent decline in our conventional lighting sales in the quarter. The Company is therefore accelerating actions to ensure the continued profitability of conventional lighting over the coming years and plans to pull forward the ongoing industrial footprint rationalization program for the Lighting sector, raising charges in the second half of 2014 from EUR 100 million to approximately EUR 170 million.

Innovation, Group & Services

“The favorable performance in IG&S, supported by increased royalties from intellectual property, is the result of our continued investments in industry-leading technology platforms and innovative research and development.”

Excluding restructuring charges and past-service pension cost gains, EBITA was a net cost of EUR 44 million, compared to a net cost of EUR 60 million in Q2 2013. The improvement was mainly due to lower costs in the IT Service Units and higher IP royalties, partly offset by higher investments by Group Innovation in emerging business areas.

Update on Accelerate! program:

We continue to execute on our multi-year transformation program Accelerate!, as we are strengthening our innovation pipeline through our focus on reducing time to market, increasing local relevance, improving quality, and better prioritization of investments. Moreover, the Company continued to make good progress on its three cost savings programs in the second quarter. The overhead cost savings were EUR 34 million for the quarter, bringing the cumulative annualized overhead cost savings in the first half of the year to EUR 190 million. The Design for Excellence (DfX) program generated EUR 44 million of incremental savings in the bill of material in the quarter, and the End-to-End productivity program generated EUR 5 million of savings. With these actions, we are continuing to deliver on our promise to improve operational and financial performance company-wide, as we transform Philips into a leading technology company in health and well-being.

As of June 30, 2014, Philips had completed 26 percent of the EUR 1.5 billion share buy-back program.