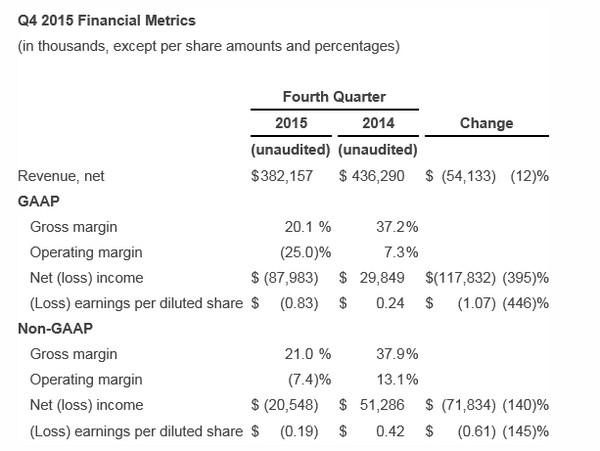

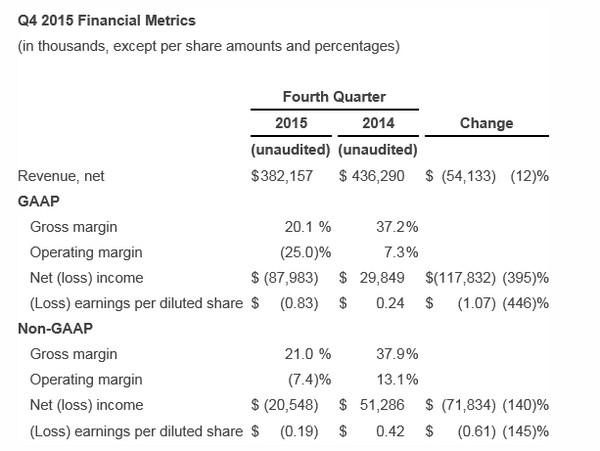

Cree, a market leader in LED lighting, announced revenue of US $382 million for its fourth quarter of fiscal 2015, ended June 28, 2015. This represents a 12% decrease compared to revenue of $436 million reported for the fourth quarter of fiscal 2014, and a 7% decrease compared to the third quarter of fiscal 2015. GAAP net loss for the fourth quarter was $88 million, or $0.83 per diluted share, compared to GAAP net income of $30 million, or $0.24 per diluted share, for the fourth quarter of fiscal 2014.

On a non-GAAP basis, net loss for the fourth quarter of fiscal 2015 was $21 million, or $0.19 per diluted share, compared to non-GAAP net income for the fourth quarter of fiscal 2014 of $51 million, or $0.42 per diluted share. During the fourth quarter of fiscal 2015, Cree recognized $84 million of costs related to the LED business restructuring that was announced on June 24, 2015.

The restructuring charges included $27 million of LED revenue reserves, $11 million of LED inventory reserves and $46 million of factory capacity and overhead cost reductions. The revenue and inventory reserves are included in both the GAAP and non-GAAP results, while the capacity and overhead charges are included in the GAAP results only.

“The actions we took in Q4 to restructure our LED business position us for solid revenue growth and margin expansion in fiscal 2016, driven by the strength of our commercial lighting business.”

For fiscal year 2015, Cree reported revenue of $1.63 billion, which represents a 1% decrease compared to revenue of $1.65 billion for fiscal 2014. GAAP net loss was $64 million, or $0.57 per diluted share, compared to $124 million of net income, or $1.01 per diluted share, for fiscal 2014. On a non-GAAP basis, net income for fiscal year 2015 was $72 million, or $0.64 per diluted share, compared to $203 million, or $1.65 per diluted share, for fiscal 2014.

"Fiscal 2015 was a year of good progress in our Lighting and Power and RF businesses, mixed with challenges in the LED industry," stated Chuck Swoboda, Cree Chairman and CEO. "The actions we took in Q4 to restructure our LED business position us for solid revenue growth and margin expansion in fiscal 2016, driven by the strength of our commercial lighting business.”

|

|

(Source: Cree) |

-

Cash and investments decreased by $69 million from Q3 of fiscal 2015 to $713 million.

-

Gross margin decreased from Q3 of fiscal 2015 to 20.1% on a GAAP basis, and decreased to 21.0% on a non-GAAP basis, primarily due to the restructuring charges.

-

Accounts receivable, net decreased by $30 million from Q3 of fiscal 2015 to $186 million, with days sales outstanding of 44.

-

Inventory decreased by $19 million from Q3 of fiscal 2015 to $281 million and represents 83 days of inventory.

-

Cash from operations was $88 million and free cash flow was $35 million for Q4 of fiscal 2015.

Recent Business Highlights:

-

Submitted a confidential draft registration statement to the U.S. Securities and Exchange Commission for a potential initial public offering of Cree’s Power and RF business;

-

Completed the previously announced $550 million share buyback program, and announced that Cree’s board of directors approved a $500 million stock buyback authorization for fiscal year 2016;

-

Entered into a global LED chip patent cross-license agreement with Epistar, under which Cree will receive a licensing fee and royalty payments from Epistar;

-

Acquired APEI (Arkansas Power Electronics International, Inc.), a global leader in power modules and power electronics applications. The acquisition enables Cree’s Power and RF business to extend its leadership position and help to accelerate the market for high-performance, best-in-class SiC power modules;

-

Introduced Cree® WaveMaxTM Technology, an optical breakthrough that enables next generation light experiences and delivers superior value, visual performance and energy-saving potential; and

-

Launched the new Cree XLamp® XHP35 family of LEDs with 50 percent more light output than Cree’s previous highest-performing single-die LED, enabling new designs with reduced size and lower system costs.

Business Outlook:

For its first quarter of fiscal 2016 ending September 27, 2015, Cree targets revenue in a range of $410 million to $430 million, with GAAP gross margin targeted to be 31.3%+/- and non-GAAP gross margin targeted to be 32.0%+/-. Our GAAP gross margin targets include stock-based compensation expense of approximately $3 million, while our non-GAAP targets do not. GAAP operating expenses are targeted to be approximately $142 million, and non-GAAP operating expenses are targeted to be approximately $107 million. The tax rate is targeted at 25.0% for the first quarter of fiscal 2016. GAAP net loss is targeted at $16 million to $22 million, or a loss of $0.16 to $0.21 per diluted share, due to the additional restructuring costs and the estimated fair value loss based on our Lextar investment current stock price. Non-GAAP net income is targeted in a range of $19 million to $24 million, or $0.18 to $0.23 per diluted share. The GAAP and non-GAAP per diluted share targets are based on an estimated 103 million diluted weighted average shares. Targeted non-GAAP earnings exclude $0.39 per diluted share of expenses related to stock-based compensation expense, the amortization or impairment of acquisition-related intangibles, net changes associated with our Lextar investment, and charges associated with the LED business restructuring.