Indonesia is situated in Southeast Asia and is located on the Equator. It is close to Papua New Guinea, East Timor and borders Malaysia. Geolocation wise the world’s largest archipelago is also an ocean across from Thailand, Singapore, Philippines and Australia. With a population of 240 million people scattered across 18,307 islands, Indonesia is the fourth most populated country in the world following China, India, and U.S. Annual economic growth rates peaked to 6.3% over the past few years indicating it is a country that holds great market potential.

According to Asian Development Bank’s new report “Asian Development Outlook 2015,” Indonesia’s economic growth is projected to reach 6.6% in 2014, setting a new record high for the past 15 years. Rich in natural resources, Indonesia is a major global raw material supplier, and its economic growth over the past five years reached an average of 5% to 6%. However, the country has very weak industrial infrastructures, and low-level technology. Hence, the country’s industrial products largely rely on imports.

Indonesia is increasing the penetration rate of the country’s electricity power, and increasing its exports. Energy deficiency is a huge problem in the country that has less than 60% energy penetration, and 40% of its 250 million population living in darkness. Blackouts and power rationing even occurs in the country’s main capital Jakarta.

The Indonesian government recently announced plans of becoming 100% energy self-sufficient within the next five years. Despite power shortages and blackouts in some rural areas, 84% of the areas now have access to steady power supplies. The Indonesian government aims to reach an energy self-sufficient rate of 75% by 2015, and supply solar-powered lighting equipment to rural areas. Other government promotions urge investors to increase investments in power related fields.

Following rising investments in power systems, and spreading global environmental awareness, the Indonesian government has encompassed the lighting industry as a method to move the country’s environmental energy saving policies on track. Besides promoting the usage of LED lights in public construction projects, the lights are also applied in commercial and transportation lighting applications.

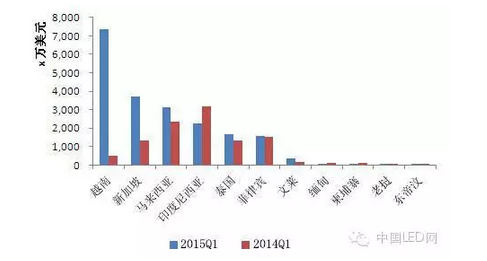

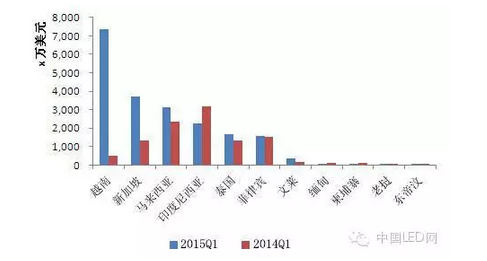

LED luminaire amounts for only 10% lighting industry sales in the country, according to statistics compiled by The Indonesian Electrical Lighting Industry Association (Aperlindo), and has great future market potential. Sales of CFL tubes and bulbs reached 320 million, but the country only manufactures 20% of these bulbs. About 80% of the country’s CFL products are imported. Chinese lighting products exported to Indonesia exceeded US $20 million during first quarter of 2015, according to statistics compiled by China’s customs.

|

|

Comparison of the value of Chinese lighting products exported to different Southeast Asian countries during first quarter of 2014 and 2015. The blue bars record values from first quarter of 2015, while the red indicates first quarter of 2014. All units in US $10,000 along the y-axis. From left to right: Vietnam, Singapore, Malaysia, Indonesia, Thailand, The Philippines, Brunei, Myanmar, Cambodia, Laos and East Timor. (Source: China Customs, Organized by LEDinside sister site CNLEDw.com) |

Market potentiasl from China's "One belt, one road" policies

“The one belt, one road” policy has raised the LED market outlook considerably, and impacted current traditional lighting replacement market. In 2010, Osram Semiconductors Golden Dragon Plus LED was chosen by PT Tricomm, and became the main light source in Solarens lighting solutions. Osram products was installed in a 9.7 km long high way in Jakarta.

This is just the tip of an iceberg. The transportation lighting market in Indonesia is huge. Only 4,816 kilometers (km) of the country’s 8,159 km long railway network are operating, while about 40% (3,343 km) of the tracks are in neglect. Indicating there is a huge market demand in the Indonesian lighting market, which is why LED manufacturers have upgraded products exported to this particular market, and are speeding the expansion of Indonesian lighting products.

In recent years, large retailers for instance Carrefour, Hypermart, Giant and Lotte Mart, hardware and furniture franchises including Ace Hardware and Index Furniture businesses have thrived in the Indonesian market. All of them expanding rapidly. The hot climate and air pollution in cities has kept the public from attending outdoor activities. Most family activities during weekends to be centered on air-conditioned shopping centers. Additionally, with the politics and economy stabilizing, foreign investors are financing large shopping mall construction projects. Large numbers of retail centers have opened up in cities with high population densities, such as Jakarta, Surabaya and Bandung. There are more than 30 large retail centers in Jakarta alone.

As for future developments in the Indonesian lighting market, the country will be constructing a 2,650 kilometer long high way, a 3,258 meter long railway, 24 large ports, 60 ferry piers, 15 modernized airports, 14 industrial parks, 49 dams, and 33 hydraulic power stations in the next five years, according to the country’s “2015-2019 Medium Term Development Plan”. Additionally, the country will be establishing a 1 million hectare irrigation system that will cost an estimated US $424.5 billion.

Indonesia’s “strategy to found a strong maritime country” is highly compatible with China’s “One belt, one road” market strategy. These markets have the future potential of becoming the major battle field for the LED lighting industry.

|

|

Indonesia's largest LED display wall. (Photo courtesy of Taman Anggrek Shopping Mall) |

LED industry developments backed by tariff incentives

Indonesia’s renewable energy policies gradually changed from energy management policies to cover both energy management and policy models, according to Asian Development Bank and International Energy Agency estimations. Rich in renewable energy resources, there is great market potential for the country’s resources, including geothermal, biofuel, hydroelectric power, solar energy and tidal wave energy. The country’s total electricity generation could reach 318 billion kWh by 2030. Electricity generated from coal power stations increased to 63%, natural gases amounted to about 20%, renewable energy about 12% electricity, hydroelectricity 4%, and energy from petroleum the remaining 1%.

By 2003, the Indonesian government established a series of energy related policies and regulations including national energy policies, renewable energy development policies, geothermal regulations, electricity regulations, electric consumption and supply regulations and others. In October, the Ministry of Energy announced another energy outlook “25/25 vision”, which aims to increase the usage of renewable energy through energy efficiency. By 2025, the country aims to raise renewable energy consumption to 25% of its total energy consumption.

The country’s Financial Minister Bambang Brodjonegoro announced the government’s plans of stimulating economic growth through investments. The country intends to launch a tariff free policy in the LED lighting industry.

In 2015, the country enacted the 18th government regulation, which outlined a series of tax preference policies to attract domestic and foreign investors. Under the regulations, investments in certain regions will become tariff free. Tax incentives will also be issued to LED, geothermal, natural gas processing, and harmless waste disposal technology, and other green industries. Lastly, the country’s President Joko Widodo has agreed to lower corporate tax rates from 25% to 17.5%, but has not released the time table for implementation.

The Indonesian government aims to use the above investment incentives to push its investment growth rate to above 8% this year, and reach the country’s long term GDP targets.

(Author: Skavy Chen, Editor, LEDinsidehttp:// Translator: Judy Lin, Chief Editor, LEDinside)