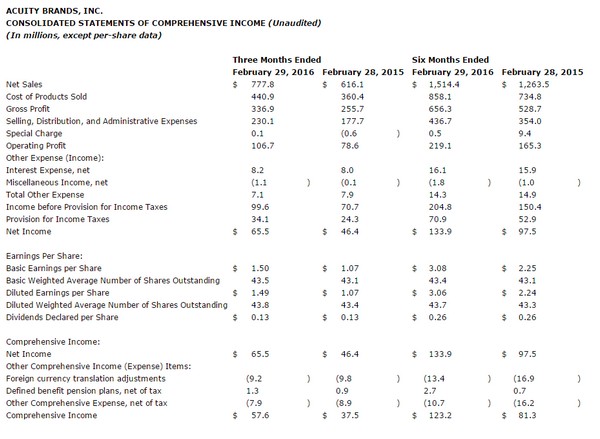

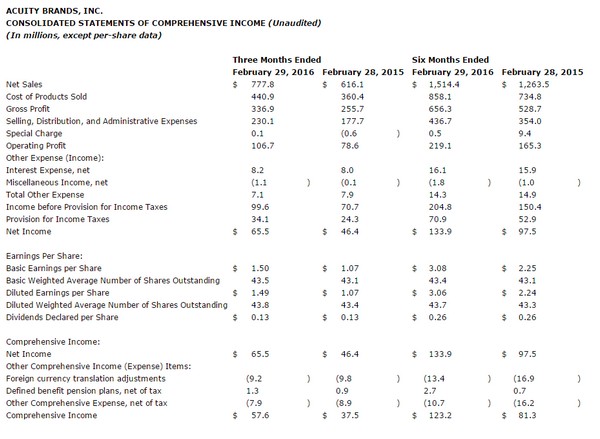

Acuity Brands announced record second quarter results for net sales, net income, and diluted earnings per share (“EPS”). Fiscal 2016 second quarter net sales of US $777.8 million increased $161.7 million, or 26%, compared with the year-ago period. Operating profit for the second quarter of fiscal 2016 was $106.7 million, an increase of $28.1 million, or 36%, over the year-ago period. Net income for the second quarter of fiscal 2016 was $65.5 million, an increase of 41% compared with the prior-year period. Fiscal 2016 second quarter diluted EPS of $1.49 increased 39% compared with $1.07 for the year-ago period.

Adjusted diluted EPS for the second quarter of fiscal 2016 increased 53% to $1.80 compared with adjusted diluted EPS of $1.18 for the year-ago period. Adjusted operating profit for the second quarter of fiscal 2016 increased $41.6 million, or 49%, to $127.4 million, or 16.4% of net sales, compared with the year-ago period adjusted operating profit of $85.8 million, or 13.9% of net sales. Adjusted results for both periods exclude the impact of amortization expense for acquired intangible assets, share-based compensation expense, acquisition-related items (including profit in inventory, professional fees, and certain contract termination costs), and special charges for streamlining activities. Management believes these items impacted the comparability of the Company's results and that adjusted financial measures enhance the reader’s overall understanding of the Company's current financial performance by making results comparable between periods. A reconciliation of adjusted financial measures to the most directly comparable U.S. GAAP measure is provided in the tables at the end of this release.

|

|

Acuity Brands financial statement for its second quarter of its fiscal year of 2016. (Acuity Brands/LEDinside) |

Vernon Nagel, Chairman, President, and Chief Executive Officer of Acuity Brands, commented, “We were extremely pleased with our achievement of record second quarter results. These results are even more impressive when one considers that we continued to invest in our strong sales growth and areas with significant future growth potential, including the expansion of our solid state luminaire and controls portfolio as well as our building management, software, and Internet of Things solutions. Adjusted gross profit margin was 43.5%, a quarterly record, and represented an increase of 200 basis points over prior year’s second quarter, while adjusted operating profit margin of 16.4% increased 250 basis points over last year’s second quarter. The integration of recent acquisitions, which include Distech Controls, Juno Lighting and Geometri, continues to go well. We believe our record second quarter results reflect our ability to provide customers with truly differentiated value from our industry-leading portfolio of innovative lighting and building automation solutions along with superior service.”

Second Quarter Results

The year-over-year growth in fiscal 2016 second quarter net sales was primarily due to a 17% increase in volume as well as an 11%increase from acquisitions, partially offset by 1% net unfavorable change in product prices and mix of products sold (“price/mix”) and 1% unfavorable impact from changes in foreign currency exchange rates. The increase in volume was broad-based across most product categories and key sales channels. Sales of LED-based products increased over 40% from the year-ago period and represented approximately 55% of fiscal 2016 second quarter total net sales.

Net cash provided by operating activities totaled $119.5 million for the first six months of fiscal 2016 compared with $75.5 million for the year-ago period. Cash and cash equivalents at the end of the second quarter of fiscal 2016 totaled $224.3 million, a decrease of $532.5 million since the beginning of the fiscal year. The Company used cash of $613.7 million for acquisitions.

Year-to-Date Results

Net sales for the first six months of fiscal 2016 increased 20% to $1,514.4 million compared with $1,263.5 million for the prior-year period. Fiscal 2016 first-half reported results include operating profit of $219.1 million, net income of $133.9 million, and diluted EPS of $3.06.

Adjusted operating profit for the first half of fiscal 2016 increased $63.8 million, or 34%, to $253.3 million, or 16.7% of net sales, compared with prior year’s adjusted operating profit of $189.5 million, or 15.0% of net sales. Adjusted net income for the first half of fiscal 2016 was $156.6 million compared with $113.2 million for the prior-year period, an increase of 38%. Adjusted diluted EPS for the first half of fiscal 2016 increased $0.98, or 38%, to $3.58 compared with adjusted diluted EPS of $2.60 for the year-ago period. Adjusted results for the first six months of fiscal 2016 and 2015 exclude amortization expense for acquired intangible assets, share-based compensation expense, acquisition-related items (including profit in inventory, professional fees, and certain contract termination costs), and special charges for streamlining activities. The total impact of these items on diluted EPS for the first six months of fiscal 2016 and 2015 was $0.52 and $0.36 respectively. A reconciliation of adjusted financial measures to the most directly comparable U.S. GAAP measure is provided in the tables at the end of this release.

Outlook

Nagel commented, “We remain bullish about our prospects for continued future profitable growth. Third-party forecasts as well as key leading indicators suggest that the growth rate for the North American lighting market, which includes renovation and retrofit activity, will be in the mid-to-upper single digit range for fiscal 2016 with expectations that overall demand in our end markets will continue to experience solid growth over the next several years. Our order rates through the month of March reflect this favorable trend. We expect to continue to outperform the growth rates of the markets we serve by executing our strategies focused on growth opportunities for new construction and renovation projects, expansion into underpenetrated geographies and channels, and growth from the continued introduction of new products and lighting solutions as part of our integrated, tiered solutions strategy.”

Nagel concluded, “We believe the lighting and lighting-related industry as well as building automation systems will experience solid growth over the next decade, particularly as energy and environmental concerns come to the forefront along with emerging opportunities for digital lighting to play a key role in the Internet of Things. We believe we are uniquely positioned to fully participate in this exciting industry.”

Non-GAAP Financial Measures

This news release contains non-GAAP financial measures such as “adjusted gross profit”, “adjusted selling, distribution, and administrative expenses” (“adjusted SD&A expenses”), “adjusted operating profit”, “adjusted operating profit margin”, “adjusted net income”, and “adjusted diluted EPS”. These measures are provided to enhance the reader's overall understanding of the Company's current financial performance and prospects for the future. However, the Company’s non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies, have limitations as an analytical tool and should not be considered in isolation or as a substitute for GAAP financial measures.

A reconciliation of each measure to the most directly comparable GAAP measure is available in this news release. In addition, the Current Report on Form 8-K furnished to the SEC concurrent with the issuance of this press release includes a more detailed description of each of these non-GAAP financial measures, together with a discussion of the usefulness and purpose of such measures.

Conference Call

As previously announced, the Company will host a conference call to discuss second quarter results today, April 6, 2016, at 10:00 a.m. ET. Interested parties may listen to this call live today or hear a replay at the Company's Web site: www.acuitybrands.com.

About Acuity Brands

Acuity Brands, Inc., with fiscal year 2015 net sales of $2.7 billion, is a North American market leader and one of the world’s leading providers of indoor and outdoor lighting and energy management solutions. Acuity Brands, headquartered in Atlanta, Georgia has operations throughout North America, and inEurope and Asia, and employs approximately 9,000 associates. The Company’s products and solutions are sold under various brands, including Lithonia Lighting®, Holophane®, Peerless®, Gotham®, Mark Architectural Lighting™, Winona® Lighting, Healthcare Lighting®, Hydrel®, American Electric Lighting®, Carandini®, Antique Street Lamps™, Juno®, Indy™, AccuLite®, Aculux™, DanaLite, NaviLite®, Sunoptics®, RELOC® Wiring Solutions, eldoLED®, Distech Controls®, and Acuity Controls™.

Forward Looking Information

This release contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that may be considered forward-looking include statements incorporating terms such as "expects," "believes," "intends," “estimates”, “forecasts,” "anticipates," “may,” “should”, “suggests”, “remain”, and similar terms that relate to future events, performance, or results of the Company and specifically include statements made in this press release regarding: prospects for future profitable growth; third-party forecasts of a mid-to-upper single digit growth rate for the North American lighting market for fiscal 2016 and expectations that demand in the Company’s end markets will continue to experience solid growth over the next several years; expectation that the Company will outperform the growth rates of the markets it serves and that the Company will execute strategies related to such growth opportunities; and expectation of solid growth over the next decade for the lighting and lighting-related industry as well as building automation systems and the Company’s position to fully participate. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the historical experience of Acuity Brands and management's present expectations or projections. These risks and uncertainties include, but are not limited to, customer and supplier relationships and prices; competition; ability to realize anticipated benefits from initiatives taken and timing of benefits; market demand; litigation and other contingent liabilities; and economic, political, governmental, and technological factors affecting the Company. Please see the other risk factors more fully described in the Company’s SEC filings including risks discussed in Part I, “Item 1a. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended August 31, 2015. The discussion of those risks is specifically incorporated herein by reference. Management believes these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations. Further, forward-looking statements speak only as of the date they are made, and management undertakes no obligation to update publicly any of them in light of new information or future events.