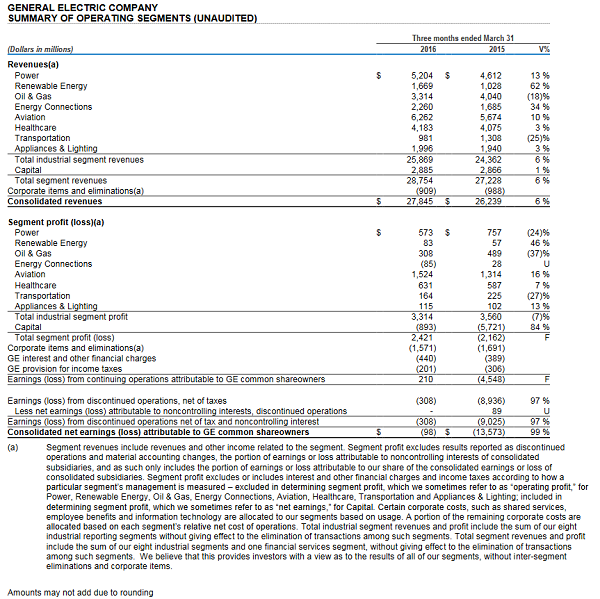

GE released first-quarter results last week, with industrial operating plus verticals earnings reaching $0.21 per share, up 5 percent compared to last year. The company said it remained on track to earn between $1.45 and $1.55 per share and return $26 billion to shareholders in 2016.

GE reported total industrial margins at 12.8 percent, up 30 basis points from the first quarter of last year, excluding operations it acquired from Alstom last fall. The company also returned $8.3 billion to shareholders, including $6.1 billion through a share buyback in the first quarter. GE’s backlog of orders grew to a record $316 billion, up 18 percent since the first quarter of last year.

GE CEO Jeff Immelt pointed to the challenging environment facing the oil and gas industry, but said this wasn’t the first the company drew strength from its businesses ranging from GE Aviation and GE Power to GE Healthcare. “The value of GE is that we are able to offset this with better performance across the portfolio,” he said.

After the September 11 attacks, for example, GE Aviation engine shipments were down 20 percent. The business has tripled its earnings and grown market share since. GE Power’s gas turbine shipments declined by 65 percent during the power generation bubble more than a decade ago. Today, the business helps supply one-third of the world’s electricity needs. “Like past cycles, the strength throughout GE is being transferred to our Oil & Gas business,” Immelt wrote in a letter to shareowners earlier this year. “We are able to invest more in R&D, something our competitors can’t do. We are providing lower-cost solutions to our customers that allow them to sustain at current resource market pricing. And we can invest in new assets based on favorable economics.”

GE Oil & Gas reported an 18 percent decline in revenues this quarter compared to last year.

Last year GE launched GE Digital, a new unit that developed Predix – a cloud-based software platform that allows GE businesses and their customers to connect locomotives, medical scanners and entire “brilliant factories” to the Industrial Internet and make them run more efficiently. GE Digital orders grew to $1.2 billion for the quarter, up 29 percent from last year. The company opened Predix to outside developers in the first quarter and currently has more than 7,500 developers registered to use the platform. Customers like Pitney Bowes are already using the platform to optimize their operations.

GE Digital also signed deals and partnerships with industry leaders like Oracle and Intel to combine data analytics with GE’s industrial domain expertise.

The push into the digital domain runs parallel to GE’s exit from the lending business. To date, GE Capital has signed deals to sell assets valued at $166 billion. From that total, it has closed transaction valued at $146 billion – ahead of its original plan. “In less than a year since we announced our plan to divest the majority of GE Capital assets, we have made significant progress toward our goals,” said Keith Sherin, GE Capital chairman and CEO. The company expects the deal total to reach $200 billion by the end of the year.

Since 2012, GE Capital has reduced its assets from $549 billion to less than half of this size. In March, GE formally submitted a request with the Financial Stability Oversight Council to release it from its supervision as a Systematically Important Financial Institution (SIFI). “A transformed GE is well positioned to deliver for shareholders. Today our portfolio is simpler and stronger,” said Jeff Immelt, GE chairman and CEO.

Software and data is also helping GE redefine how companies make things. In March it opened the first Center for Additive Technology Advancement (CATA) designed to help GE businesses ranging from Oil & Gas to Healthcare to bring additive manufacturing to the mainstream.