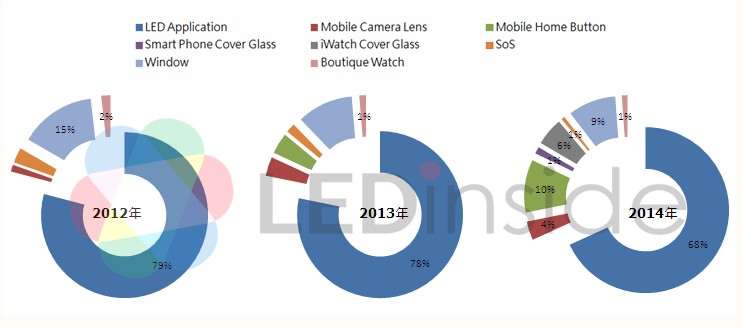

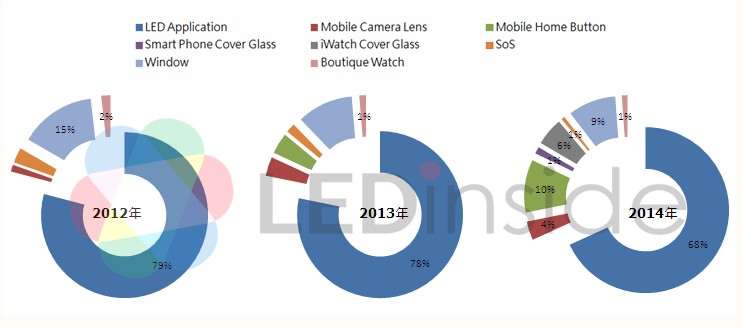

Out of sapphire substrate non-LED applications, mobile devices have shown strongest demands, according to “2014 Global Sapphire Substrate Market Report” by LEDinside, a research division of TrendForce. Sapphire substrate non-LED application is projected to reach 32% this year, with mobile device applications taking a 21% share, said LEDinside.

Figure 1:Sapphire substrate market application demand share analysis

|

|

Source: LEDinside |

Sapphire substrate applications gradually diversifying

In 2012, Apple changed the iPhone 5 camera lens from plastic to sapphire. The material was even introduced into fingerprint recognition button for the iPhone 5S released a year later. Sapphire substrate was chosen for fingerprint recognition applications mainly because it is very hard and highly scratch resistant which can prevent fingerprint sensors from scratching. Compared to glass, sapphire substrate has a wetting angle of 85 degrees, which prevents fingerprints from sticking to the home button and reduces misreadings. Apple’s promotion of the material triggered a new sapphire substrate craze on the market.

Many signs point to diversifying sapphire substrate applications in new products as Apple’s next goal. Future application possibilities include the upcoming iWatch cover, and even iPhone cover glass. Regardless of the type of application, all these point to diversification of sapphire substrate applications.

Apple iPhone faces challenges in making sapphire smartphone cover glass

Although, Apple has great interest in sapphire cover glass for smartphone, there are still many obstacles for the tech giant to overcome, according to LEDinside observations. These include whether current sapphire production capacity can meet large smartphone demands? Huge cost differences between sapphire cover glass and tempered glass also continue to exist, making lowering sapphire manufacturing costs a crucial future factor.

Still the Cupertino company actions seem to indicate it is working towards the goal of materializing sapphire cover glass. Apple is optimizing its supply chain management, and it has solidified relations with upstream manufacturers to prevent potential raw material shortages on the market. The company's partnership with GTAT for instance, not only guarantees a steady supply of upstream sapphire ingots,Apple is also actively vertically integrating suppliers. This can be seen in GTAT’s acquisition of upstream raw material manufacturers to ensure aluminum oxide raw material supply. In addition, Apple and Chinese glass processing supplier Biel Crystal has formed a partnership with sapphire manufacturer Roshow Technology, which further secures sapphire ingot supply. Apple has continued its tradition of managing its supply chain with an iron grip.

Realization of sapphire smartphone glass cover dependent on sapphire price and supply volume

An increasing number of manufacturers are willing to introduce sapphire substrates into camera lens covers, but when it comes to sapphire cover glass most manufacturers shy away. The majority of manufacturers believe sapphire substrate prices must fall to about the same level as tempered glass before sapphire smartphone glass covers demand can take off. Another factor is whether the sapphire industry supply is large enough to meet client demands. Since there are high volume smartphone demands, any phone component that incorporates sapphire could create shortages in the sapphire substrate industry.

English

May 15, 2014

E-file

Sapphire applications for mobile and wearable devices. (LEDinside)

1.1 Technology Development History of Sapphire Substrate Industry

Chapter II Discussion on Advanced technology of Sapphire Substrate Industry

2.1 Mainstream Sapphire Ingot Technology

2.3 Mainstream Pattern Sapphire Substrate Technology

Chapter III Discussion on Global Supply Chain Related to Sapphire Substrate

3.1 Sapphire Substrate Materials Overview

Chapter IV Supply-side Analysis of Global Sapphire Substrate Industry

4.1 Sapphire Substrate Industry Supply Chain Trend

4.3 Sapphire Substrate Manufacturer Capacity Overview

4.5 Major Manufacturer’s Business Performance and Market Development

4.7 Sapphire Substrate Industry Sufficiency- Supply and Demand

Preview

5.2 Sapphire Industry Long-term Price Forecast- Ingot

Major LED chip manufacturers across different regions. (LEDinside)

6.1 LED Market Value and Volume Forecast

6.3 2013~2018 Global LED Market Demand (Total Sapphire Volume and By Region) and Wafer Size Trend

6.5 LED Chip Manufacturer Revenue Ranking and Capacity Estimates

6.7 Chip House PSS Introduction Rate and in-house PSS Production Rate

6.9 LED Chip Price Trend

6.11 Sufficiency of Sapphire Substrate in LED Industry- Supply and Demand

6.13 Alternative Materials of Sapphire Substrate in LED Application Market

Preview

Sapphire Substrate in SOS Market Overview

· Sapphire Substrate Market in SOS Application

· Compared with Traditional CMOS, UltraCMOS® Has Better Performance

· Sapphire Substrate in Windows Film Market Overview

· 7.2 Sapphire in Handset Device Market Outlook and Supply Chain Development

· Camera Lens: Sapphire Camera Lens in Smartphone

· Other Manufacturers Ramping

· Sapphire Cover Glass in Smartphone

· Apple Will Apply Sapphire to Protect Screens!

· Challenges Apple Needs to Overcome for Sapphire Glass Covers

· Increase Capacity: GTAT’s ASF is Helpful Sapphire Cover Glass in Phones

· Reduce Cost: Cutting Technology and Lamination Patent Allows Sapphire Cover Glass to Be Achieved in Short Time

· Manage Supply Chain: Analysis on Apple Aggressively Secure Sapphire Supply Chain

· Estimated Apple Shipment Schedule

· Probability Analysis of Applying Sapphire Cover Glass in Apple iPhone

Sapphire Substrates Market Value for Non-LED Applications:

· Sapphire in Mobile Device Market has Growth Potential

· Analysis of Apple iWatch’s Sapphire Screen

· Handset Device Has Most Growth Potential

Taipei

Tel: +886-2-7702-6888 ext. 972

E-mail: joannewu@ledinside.com