The LED industry survived the economic downturn, and has started to rebound in 3Q15. Their financial results will reveal whether manufacturers are in the lead with a overflowing treasury, passing, or in the red zone.

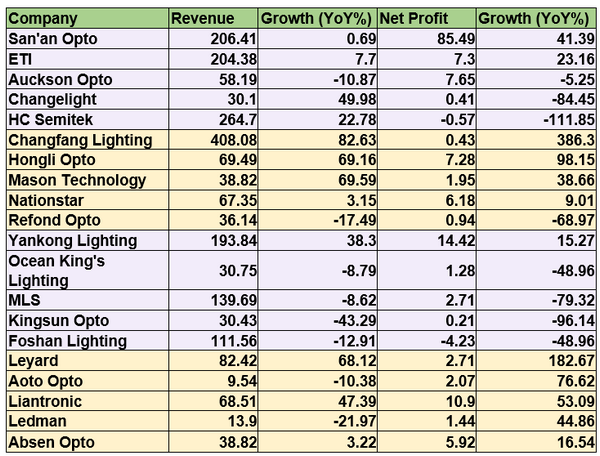

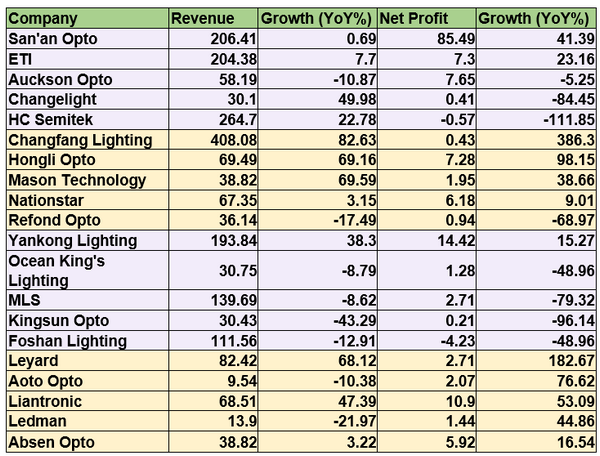

LEDinside editor team has compiled 20 listed Chinese LED companies 3Q15 revenue data, which showed 12 manufacturers net profits increased. Judging from these results, it can be observed manufacturers polarized financial performances.

Note: All data compiled are from listed Chinese LED manufacturers revenue results in 3Q15. The above table indicates manufacturers’ 3Q15 revenue.

|

|

All figures in US$ millions. (Source: LEDinside) |

More than half of manufacturers in the upstream LED sector report plunging revenues

In the past, LED chip industry’s large production capacity expansion led to plunging prices. In addition, LED package industry’s oversupply situation caused easing LED chip demands. The quagmire of high revenues, but low profits is especially evident in the LED chip industry.

Even though Chinese LED manufacturer Auckson Opto announced it reached 100% utilization rates in August 2015, and its LED business contributed for 50.64% of its net profits, its performance slid in third quarter. The company’s revenue was down 10.87% YoY to reach RMB 369 million, and its net profits dropped 5.25% to RMB 48.55 million.

Another Chinese manufacturer that was unable to avoid the “plummeting net profit curse” was Changelight, which saw its revenue tumble. Despite receiving a handsome subsidy of RMB 10.78 million from the Chinese government, and revenues rise 49.98% in 3Q15, Changelight’s net profits plunged 84.45% YoY in 3Q15 to RMB 2.57 million.

HC Semitek also joins the list of manufacturers struggling with uptick in revenues, but declining profits. Even though the company’s subsidiary in Suzhou, China released its production capacity, intense market competition in the LED industry spurred irrational price wars that cancelled out all benefits from manufacturing at economics of scale. HC Semitek’s revenue rose 22.78% to reach RMB 265 million during 3Q15, but its net loss widened 111.85% compared to the year before to reach RMB 30.68 million.

ETI’s revenue and net profit in 3Q15 climbed up 7.70% and 23.16% respectively. However, after reducing non-recurring profits and losses, the company’s net profits slumped 514.89%. All these indicate manufacturers are under more stress following the LED industry’s intensified market competition and sliding prices.

The only exception has been China’s leading LED chip manufacturer San’an Opto, which continued to acquire government subsidies and expand its production capacity. The company’s 3Q15 revenue and net profits both increased. The company reported its 3Q15 revenue increased incrementally by 0.69% to RMB 1.31 billion, while its net profits soared 41.39% to RMB 543 million. Worth noting is San’an Opto’s net profits for the first three quarters reached RMB 1.45 billion, nearing RMB 1.46 billion in 2015. All these explain why the company’s Chairman Xiucheng Lin has repeatedly topped China’s billionaire list.

Most manufacturers in the midstream LED sector report uptick in revenues

Although, lighting market demand growth occurred much slower than projected it still contributed to the oversupply situation in the LED package industry. However, in the LED chip industry 3Q15 performance was better than expected, and not as pessimistic.

Four LED package manufacturers were able to raise their revenue and profits, the exception was Refond Opto that was affected by sliding mid to large sized LED backlight source market demands. The company reported a revenue decline of 17.49%, while net profits plunged 68.97%.

Additionally, Changfang Lighting delivered stellar performance. In 3Q15, the company revenue was up 82.63% YoY, while net profits soared 386.3% to reach RMB 27.77 million. A strong contrast from the company’s first quarter performance, where net profits slid in 2Q15 to generate only moderate growth. Changfang Lighting has been able to rebound in 3Q15 and deliver a strong performance.

Steadying growing business and income from subsidiaries Hongliopto led to revenue and net profit growth of respectively 69.16% and 98.15%, pushing the company towards high growth.

Even though Mason Technology’s revenue soared 69.58% to reach RMB 246 million, but net profit growth lagged behind its revenue growth. The company benefited from its rising LED and epiwafer revenue, resulting in increase in both revenue and net profit growth in 3Q15.

Downstream lighting manufacturers net profits slide, display companies post net profit growth

In the downstream sector, lighting and display manufacturers performance was very polarized in 3Q15, with one camp showing positive growth and the other reduction.

Of the four lighting manufacturers surveyed, three manufacturers revenues and net profits slid, and only Yankong Lighting revenue and pofits increased.

Ocean King Lighting was impacted the most by the general macroeconomic performance and price wars in the industry. Its financial statements showed revenues downed 8.79%, while net profits were reduced by 48.96%.

Intensity of industry competition the greater the impact of “price wars,” MLS 3Q15 revenue report reflected the influence of price wars. Since product retail prices were slashed, MLS revenue dipped 8.62% in 3Q15 to RMB 887 million, while its net profits plunged 79.32% to RMB 17.19 million.

In terms of pricing, LEDinside analysts also offered their perspective. For most LED manufacturers, 2015 will be an especially difficult year, said Roger Chu, Research Director, LEDinside. LED lighting demands have climbed up, and replaced traditional lighting applications in very large volumes, but oversupply has triggered LED price falls of 30% to 40%.

During first half of the year, Kingsun Opto’s net profits plummeted due to intense market competition. The situation did not improve in 3Q15, with revenues and net profits plummeting 43.29% and 96.14% respectively.

Foshan Lighting announced declining prices and other factors, caused plummeting revenue and net profits during first half of 2015. Compensations required to cover lawsuits from misleading financial statements also decimated its net profits. During third quarter, the company also provided more detailed statistics and explanations. Foshan Lighting’s 3Q15 revenue declined 12.91% YoY to RMB 708 million, and its net loss declined 123.99% YoY to RMB 26.82 million.

Even though the LED industry is entering a transition phase from traditional lighting to LEDs, Yankong lighting’s 3Q15 revenue was also unexpectedly bright. The company’s lighting revenue increased 38.3% YoY to RMB 1.23 billion, while its net profits were up 15.27% YoY to RMB 91.52 million.

Five LED display manufacturers revenues also climbed up in 3Q15, which also indicated the price wars were not as intense as previous models.

Restructure and contribution from former subsidiary has led to Leyard’s positive results. The company’s revenue soared 68.12% in 3Q15 to reach NT $523 million (US$16.13 million), while its net profits soared 182.67% to RMB 103 million.

Even though Aoto Opto and Ledman revenues slid down by various degrees, both reported growing net profits. Aoto Opto’s 3Q15 net profit rose 76.62% to RMB 13.11 million. Ledman Opto’s 3Q15 net profit also climbed up 44.86% to RMB 9.12 million in 3Q15.

Additionally, Liantronics benefited from the company’s in house epiwafer manufacturing, and acquisition development strategies. The company’s revenues increased 48.39% to reach RMB 435 million, while its net profits rose 53.09% to RMB 69.18 million.

Absen Opto’s revenue and net profits in 3Q15 reached RMB 246 million and RMB 37.60 million respectively, but its investments poured into developing small pitch display products and R&D reduced revenue growth rate to an incremental 3.22% YoY and 16.54% YoY uptick in net profits.

(Author: Lurena Liu, Editor, China, LEDinsidehttp:// Translator: Judy Lin, Chief Editor, LEDinside)