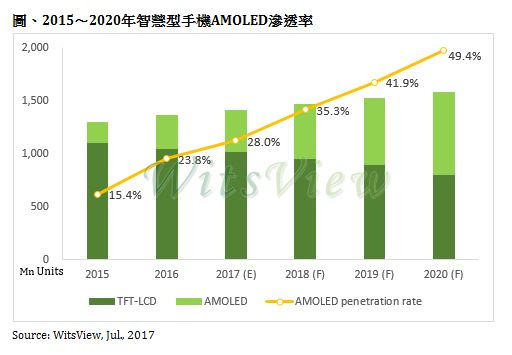

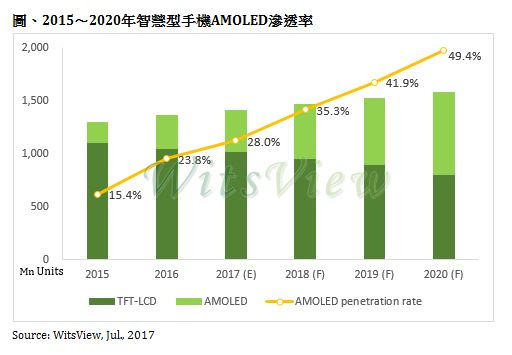

The confirmation of Samsung Display (SDC) being Apple’s AMOLED panel supplier for the upcoming iPhone devices has spurred other smartphone brands and panel makers to aggressively invest in this display technology. The latest display market forecast by WitsView, a division of TrendForce, finds that AMOLED is set to become mainstream in the global smartphone market in the near future with the penetration rate reaching to almost 50% by 2020.

|

|

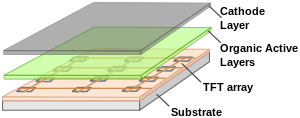

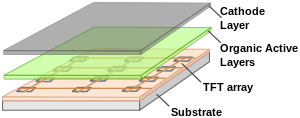

(Image: Wikipedia) |

SDC’s initiative and Apple’s adoption has trigger the current surge in AMOLED demand

SDC since 2015 has been actively finding other sources of demand besides Samsung to expand its presence in the AMOLED market and consume its growing production capacity. However, this year is a breakthrough for SDC as the company has for the first time entered the iPhone display chain with its AMOLED offering. As 2017 marks the 10th anniversary of the iPhone’s launch, Apple has made major upgrades to this year’s iPhone refresh in order to dramatically raise the sales of these devices.

“Apple’s move has been closely watched by its competitors,” said Boyce Fan, research director of WitsView. “The reveal of the next iPhone’s specifications has accelerated the deployment of AMOLED displays for other smartphone brands. Panel makers, especially those from China, are hastily building up their AMOLED manufacturing capacity as well.”

Chinese panel makers EverDisplay (EDO) and Visionox entered the AMOLED market early on during the 2013 to 2014 period. Later in 2016, the much larger Chinese panel suppliers BOE Technology (BOE) and Tianma also made the switch from focusing on the production of LTPS LCD panels to the ramping up of their AMOLED capacity. BOE and Tianma even altered their fab plans, turning newly built facilities initially reserved for LTPS panel production into AMOLED panel fabs. Once the two major panel suppliers finish installing equipment at their respective AMOLED fabs, they will begin trial production sometimes in the second half of this year.

Limited supply of processing equipment and technological hurdles are challenges that later market entrants have to overcome

Chinese panel makers will likely build more AMOLED panel fabs in the near term. Costs will not be a significant issue for them because the domestic market has plenty of capital and the government supports the development of new display technologies. On the other hand, AMOLED manufacturing has several difficult technological barriers. In addition to having perfected the backplane production, prospective suppliers have to improve other highly complicated manufacturing processes such as the deposition of the organic layer and encapsulation.

The evaporation equipment, for example, is still mainly provided by Japanese and South Korean companies. Currently, the Gen-6 half-cut machine made by Canon’s subsidiary Tokki is the most in-demand evaporation system on the market. However, Tokki’s equipment is also very limited in terms of market supply because Tokki’s priority customer is SDC and by extension Apple.

Over the past two to three years, SDC has practically monopolized the market for small-size AMOLED displays. Nonetheless, some smartphone makers are wary of being locked into a single supplier for this type of technology and are encouraging competing panel manufacturers to catch up. Besides the activities of Chinese panel companies, South Korea’s LG Display (LGD) will also begin mass production of flexible AMOLED panels from a Gen-6 fab in the second half of this year. This is an important milestone according to WitsView’s because the market will become more competitive with LGD’s entry and eventually open up to other suppliers. The initial shipments of AMOLED smartphone panels from LGD are expected to be for non-Apple customers.

|

|

2015-2020 AMOLED penetration in the smartphone market (Image: TrendForce) |