-

The only Korean company to maintain revenue growth despite intensifying competition between Chinese

LED manufacturers

-

Reported second quarter revenues of KRW 267 billion and operating profit of KRW 24.1 billion increase 14.9% and 144.9% YoY respectively

-

Revenue guidance of KRW 260 to 280 billion provided for the upcoming third quarter which marks strongest quarter revenues since establishment

-

The company has revealed plans to increase dividends in the future to increase shareholder value

|

|

(Image: LEDinside) |

Seoul Semiconductor Co., Ltd., the noted Korean company in LED (light emitting diode) design and manufacturing, announced consolidated second-quarter revenues of KRW 267 billion. The rise in consolidated revenue came from strong sales in general lighting and strengths across all divisions within the company. The year over year rise in automotive lighting sales proved highly profitable for the company.

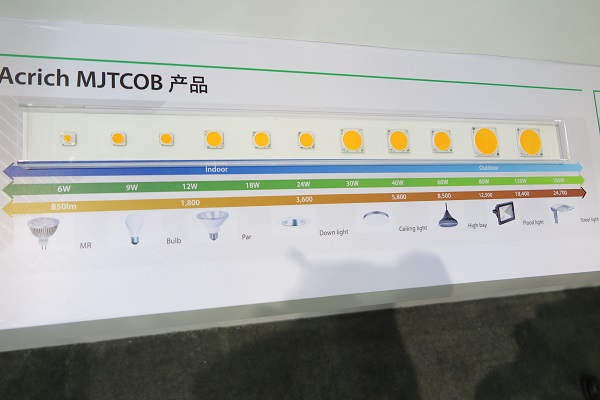

For the lighting division, while the differentiated product such as Wicop and Acrich increased in great proportion, automotive exterior lamps, e.g. daytime running lights and headlights continued their fast-paced growth. Automotive lighting is an area of high entry barriers due to high technology requirements and intellectual properties. Seoul expects to gain further market share with its differentiated Wicop technology. For the IT division, current customers expanding their product line-ups and new customer acquisitions were the main drivers for the rising sales figures.

|

|

(Image: LEDinside) |

To improve share price stability and increase shareholder value, Seoul announced plans to almost double its future dividends, based on the fact that its current level of pay-out is half the industry average and an increase up to the industry average is necessary. In addition, the company has sufficient cash generation capabilities since it has booked above 20% gains in EBITDA, leaving sufficient funds available for future investments. This was part of Seoul’s last quarter’s announcement to execute a KRW 10 billion share buyback program.

|

|

(Image: LEDinside) |

Company outlook

The company has provided revenue guidance of KRW 260 to 280 billion for the third quarter. The company plans to further strengthen its sales and marketing activities for its unique technologies including Acrich and Wicop and focus on acquiring more customers to reach new heights with respect to earnings.

The company’s Chief Financial Officer Sangbum Lee stated that SunLike, a new LED technology that produces light closely matching the spectrum of natural sunlight, unveiled at a press conference in Frankfurt, Germany in June, had been very well received with great interest from global customers. The company plans to launch additional new products during the remainder of the year and focus on protecting intellectual properties owned by the company.