This is an evolution story of a long-running business. With a history of almost a century in general lighting, Munich-based conglomerate Osram went through several fierce competitions in the industry in the LED era and finally in 2016 decided to divest its historic light sources business, selling it to a Chinese consortium. The company is now announcing its determination to transform into a high-tech company along with the establishment of a new advanced LED factory that it plans to put in a total investment of EUR 1 billion.

Osram’s new LED fab in Kulim, Malaysia was inaugurated on November 23. It is by far the most modern 6-inch LED fab. LEDinside joined the press tour and had an exclusive interview with Aldo Kamper, CEO of Osram Opto Semiconductors, to get first-hand information about the company’s evolution.

|

|

Aldo Kamper, CEO of Osram Opto Semiconductors (Image: Osram/LEDinside) |

LEDinside: Congratulations for the Kulim plant establishment. Can you brief us on how the current operation in Osram is going and the plans and design capacity for the new plant?

OSRAM Opto.

So far, according to Osram’s business map, the base in Regensburg, Germany is responsible for the R&D and chip production for LED, infrared LED and lasers - and is driving innovations like Micro ASF applications. The Penang plant in Malaysia also has a chip fab and is, together with the Wuxi plant in China, a center for the LED packaging business.

The Kulim plant will be mainly producing blue LED chips. We plan to manufacture mid-power LED chips for general lighting at first, and later expand the line-up with high-power LED chips also for general lighting and other automotive lighting lines in 2018. In particular, we expect to put those automotive lighting products into mass production slightly later in 2018-2019 because it would take longer for our customers to verify and validate them.

|

|

(Image: Osram/LEDinside) |

LEDinisde: So, the production will be focusing on general lighting. In that case, it’s inevitable that Osram will face threats from Chinese LED makers with very competitive cost structures. How will Osram harness the Kulim plant to change the situation?

OSRAM Opto.

We have been in the leading position in the industry, but our revenue in LED lighting solution does not make up much of our consolidated revenue. Therefore, Osram Opto Semiconductors decided to increase the invest in this area to gain more market share in the LED lighting market, which we believe the Kulim plant can help us to achieve that and change the dynamic in the market.

It is also our first time to duplicate specific process steps of our technology in Germany and deploy it in Asia. The design and construction of the plant follow those of the German headquarters. For example, the purity of its cleanrooms reaches 99.9% and the production of LED epi-wafers features high-level automation.

Of course, it depends on several factors to make the cost structure competitive. Osram has a few edges: state-of-the-art technologies, high reliability, comprehensive IP portfolio, and, most important of all, high volume manufacturing capability. The volume of 6-inch LED wafers the new plant produce is about 125% more than that of traditional 4-inch ones. The Kulim plant is anticipated to reach a weekly capacity of 13,000 wafers at full utilization rate at the end of 2019. The number can grow 5 times more after the completion of the third-phase construction. In addition, the capacity of our plant in Wuxi will also double, we just had the groundbreaking for phase 2. All that builds up economies of scale that makes Osram very competitive in the general lighting market.

|

|

One-stop manufacturing in the Kulim plant covers from production of LED chips to that of finished products. (Image: Osram/LEDinside) |

LEDinside: Has Osram ever thought about that the plant’s massive capacity would cause already heavy oversupply to increase even more?

OSRAM Opto.

The dynamic in the market is pretty clear now. Without enough capacity, a company will fail to rival others. That means the market will see a phase out of LED companies with insufficient capacity and their exit will free up some space in the market for new capacity. However, that also means only a few large companies will remain after the phase-out and it will heap more pressure on them.

LEDinside: Infrared sensing is gaining popularity and VCSEL will become the mainstream application for 3D facial recognition. Does OSRAM consider to tap into this field? Do you see any possible impacts on Osram’s IR LED business with the rise of VCSEL?

OSRAM Opto.

Ok. So, when we talk about infrared sensing, there are a few solutions—IR LED, VCSEL, and edge laser. Each of them is used for different applications. IR LED is more suitable to be used for iris and 2D facial recognition. VCSEL, of course, is for 3D facial recognition. As for edge laser with higher power, it is a better pick for LiDAR in automotive self-driving system. Osram now has IR LED and edge laser product lines. VCSEL may be in our future plans, but still, we have to consider what kind of IR products are suitable for these end-applications.

Is VCSEL going to affect our IR LED business? In fact, I won’t worry too much. Because the reliability of iris recognition is higher. It is more suitable for biometrics for financial security. Perhaps future smartphones will sport both IR LED and VCSEL for iris recognition and 3D facial sensing.

LEDinside: As a leading company in the market of automotive lighting and sensing, how does Osram see future development of automotive technology? Also, since this market is a blue ocean to the LED industry, how would Osram differentiate itself from its rivals, especially competitors here in Asia?

OSRAM Opto.

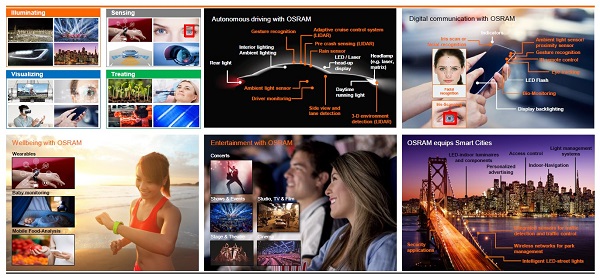

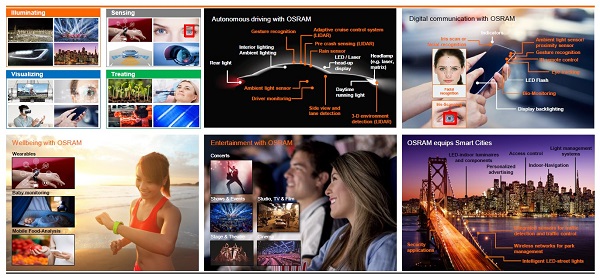

Automotive sensing will be one of our future highlights. A future high-end autonomous driving system has lane/road detection, blind spot detection, and driver fatigue monitoring to enhance road security. Osram’s sensing components play a big part in it, especially laser diodes for LiDAR systems. Many LiDAR technology startups choose our edge lasers as light sources of their LiDAR products. Also, in terms of in-vehicle sensing, Osram’s IR LEDs can go with a myriad of sensors or cameras to monitor a driver’s movement—to see if he’s dozing, for example. Through eye-tracking and other recognition technologies, those systems provide decent security precaution.

Automotive lighting wise, Osram is devoted to offering more affordable solutions. Particularly, we continue to enhance the performance of our LED components each year to lower the cost and eventually get them widely deployed in almost every type of vehicles.

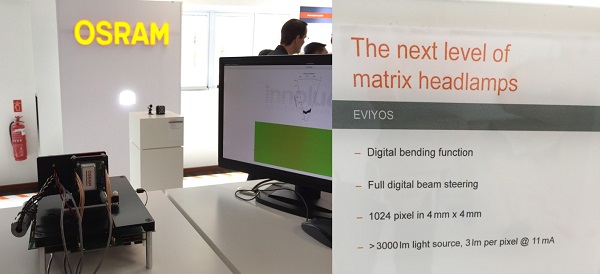

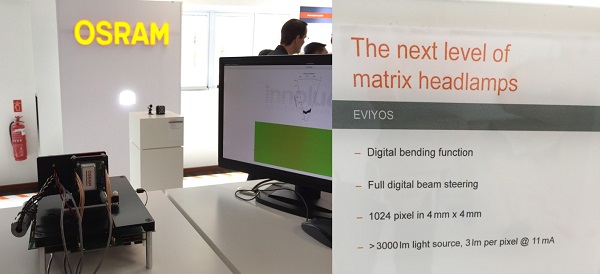

We attempt to stand out in this area by combining our automotive sensing and lighting technologies. The new matrix LED headlamp, though still under development, is a good example. It detects road/lane conditions with signals received by the embedded IR laser and sensor. It also features high-resolution matrix lighting solutions that are highly adaptive. For instance, the light sources will dim to avoid blinding cars coming from the opposite direction or project light on objects that catch drivers’ attention. This product is likely to hit the market and be seen on high-grade vehicles.

Apart from developing our own products, we have also started working with various partners. In July, we bought 25.1% of LeddarTech shares for a mid double-digit million euros. This month, we also announced a joint venture with automotive manufacturing company Continental. We will provide the light sources and they will provide their proprietary controlling systems. Via the partnership, we aim to create a new form of light sources that take in knowledge and technologies of opto-semiconductors, advanced electronics, and software.

|

|

Osram demonstrated its innovative light source—the next level of matrix headlamps integrated with automotive sensing capabilities. (Image: Osram/LEDinside) |

Our core value is very specific; that is, Osram will transform into a high-technology company. The establishment of our Kulim plant represents our innovation, passion, and competitiveness. We offer our comprehensive technology portfolio to meet as a wide range of requests as we can.

|

|

(Image: Osram/LEDinside) |