"We had a solid first quarter. Despite the significant headwind from currency effects, we managed to generate further growth while maintaining high margins. From the current perspective, we expect to gain momentum in the second half of the fiscal year," said Olaf Berlien, CEO of OSRAM Licht AG. "The strong and sustained level of demand for our products shows that our expansion of capacity and investment in new technologies was absolutely the right decision because it is enabling us to improve opportunities for long-term growth."

|

|

Osram 1Q18 Review (Source: Osram) |

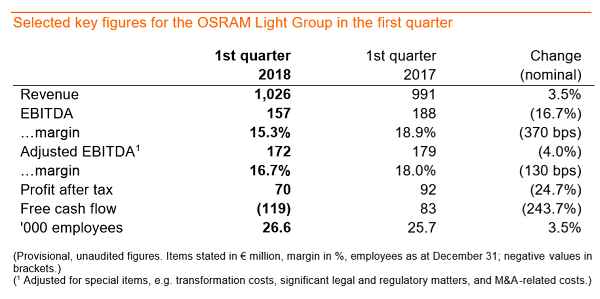

In the first quarter of fiscal year 2018, Osram continued to grow while increasing capital expenditure. Demand for high-tech products, particularly opto-semiconductors, remained strong. At €1.03 billion, the group's revenue on a comparable basis was up by 5 percent relative to the prior-year quarter. EBITDA adjusted for special items amounted to €172 million, which was nearly the same level as a year earlier. The adjusted EBITDA-margin reached 16.7 percent. Due to the strong growth of its operations, the company was able to almost fully offset the negative impact from currency effects, continued increase in spending on research and development, and temporary increase in capital expenditures due to production expansions, such as the new facility in Kulim, Malaysia. Research and development expenses now equate to 9.4 percent of revenue. Osram remains on track with the implementation of its growth strategy.

|

|

(Source: Osram) |

As previously announced, fiscal year 2018 will be influenced by capital expenditure and impacts from currency effects. The recent exchange rate movements negatively impacted consolidated revenue by more than €60 million in the first quarter alone. To lay the foundation for sustained profitable growth, Osram is continuing to invest in its production and future technologies. Products based on novel LED-related technology already account for two-thirds of actual revenue.

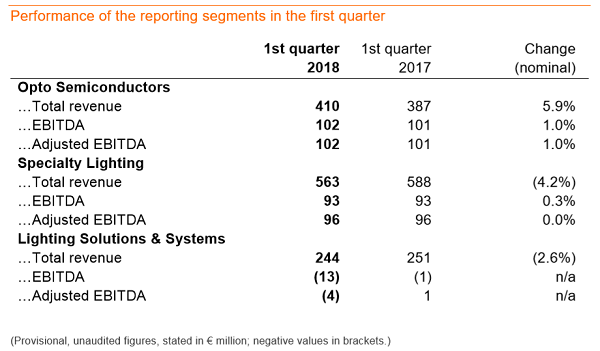

On a segment basis, the first quarter confirmed that the growth trends and operational strength of Osram Opto Semiconductors (OS) are fully intact. In the first quarter, rampup costs for new capacity softened margins, as had been anticipated.

To meet the high demand for LEDs, particularly those used in general lighting, Osram opened its new plant in Kulim, Malaysia, in November 2017. Production ramp-up is going according to plan, and productivity is very encouraging. It is expected that additional capacity of this Phase 1 investment will be realized by the end of the fiscal year.

|

|

(Source: Osram) |

Revenue in the largest segment, Specialty Lighting (SP) also was burdened by exchange rate effects. Looking at global car production, we see a mixed picture. Our view on the automotive market has not changed since Q4, and we anticipate continued growth, though at a lower level than FY2017.

However, the trend of increasing penetration of LED lighting continues, particularly in the automotive industry. LEDs will increasingly replace traditional technologies in new vehicles, supporting our strategy with this business.

When looking at the Lighting Solutions & Systems (LSS) segment, we saw no fundamental improvement in the business environment. Construction activity for new industrial and office buildings continued to be sluggish, especially in the North American market. As a result, demand for luminaires, electronic ballasts, and services remains weak in this segment. The Board has taken corrective actions and is exploring all options in the Lighting Solutions (LS) business unit. A decision will be made this fiscal year.

In fiscal year 2018, Osram will continue to build on its foundations for the future. The company budgets a revenue increase of between 5.5 and 7.5 percent. The EBITDA adjusted for special items is likely to be around €700 million and will be influenced by factors such as currency effects, ramp-up costs for Kulim and increased capital expenditure on research and development, which adds up to a three digit million Euro amount. For the current fiscal year, Osram expects earnings per share to be between €2.40 and €2.60. We are expecting a free cash flow between minus €50 million and minus €150 million. The Managing Board is confident about Osram's positive mediumterm prospects and is therefore aiming for a dividend of at least €1.11 per share again in fiscal year 2018.

During the past three months, the exchange rate of the Euro gained significantly especially against the U.S. dollar. This development weighs on the key figures of Osram. The forecast for the current fiscal year from November was based on an exchange rate of $1.18 to the Euro at that time.