"Gold+ Member: Global LED Market Demand and Supply Database and LED Industry Quarterly Update" released by TrendForce in March 2024

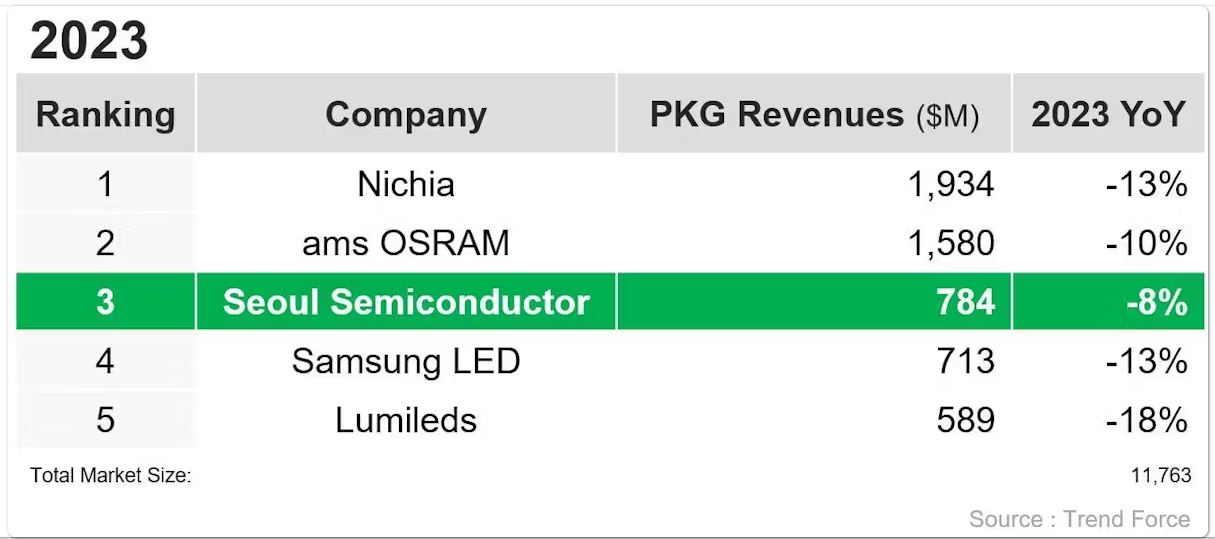

SEOUL, South Korea--Seoul Semiconductor (KOSDAQ:046890), a global optical semiconductor company, ranked third in the category of visible light for the second consecutive year and first in the category of UV LED for the fifth consecutive year in the 2023 global rankings released by market research firm TrendForce. This is significant in that Seoul Semiconductor is the only one among the top 5 companies that has achieved organic growth relying solely on its best-in-industry optical semiconductor technologies.

Behind this achievement lies the entrepreneurial spirit of Seoul Semiconductor, which has been committed to earning customer trust. Seoul Semiconductor incurred a huge loss as it maintained a safety stock worth USD 50 million, even during the COVID-19 pandemic, to deliver on its promises to customers. Nevertheless, it has not failed to supply 100% of committed orders to customers. Seoul Semiconductor's consistent and responsible behavior has earned the trust of its customers. As a result, in 2023, even under the deteriorating economic conditions, Seoul Semiconductor was able to limit its growth decline to negative 8%, whereas other major companies in the industry were hit harder, experiencing a reversal to negative 13% on average. This is the result of Seoul Semiconductor's perseverance in prioritizing customer trust above all else.

Under the vision of “Make the World Clean, Healthy and Beautiful with Light", Seoul Semiconductor is running innovation centers in six countries and production bases in four countries to ensure stability in product supply to customers.

* Organic growth refers to the growth that a company achieves by enhancing its own competitiveness, such as technology development, without relying on external drivers, such as mergers and acquisitions (M&As).

Gold+ Member Report

Gold+ Member Report

|

Report Title

|

Content

|

Format

|

Publication

|

|

LED Industry Demand

and Supply Database

|

Demand Market Analysis:

|

PDF / Excel

|

1Q (Mid Mar.)

3Q (Early Sep.)

|

|

2024-2028 Demand Market Forecast

|

|

(Backlight and Flash LED / General Lighting / Agricultural Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / UV LED / IR LED / Micro LED / Mini LED)

|

|

Supply Market Analysis:

|

|

1. LED Chip Market Value (External Sales, Total Sales)

|

|

2. WW New / Accumulated GaN LED and AS/P LED MOCVD Chamber Installations

|

|

3. GaN LED and AS/P LED Wafer Market Demand (By Region / By Wafer Size)

|

|

4. GaN LED and AS/P LED Wafer Market Demand and Supply Analysis

|

|

LED Player Revenue

and Capacity

|

LED Chip Market Analysis:

|

PDF / Excel

|

2Q (Early Jun.)

4Q (Early Dec.)

|

|

Top 10 LED Chip Manufacturers by Revenue and Wafer Capacity

|

|

LED Package Market Analysis:

|

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis

|

|

Top 10 LED Package Players by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED

|

|

LED Industry Price Survey

|

Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED,

IR LED, VCSEL)

|

Excel

|

1Q (Mid Mar.)

2Q (Early Jun.)

3Q (Early Sep.)

4Q (Early Dec.)

|

|

LED Industry

Quarterly Update

|

Major Players Quarterly Update:

|

PDF

|

1Q (Mid Mar.)

2Q (Early Jun.)

3Q (Early Sep.)

4Q (Early Dec.)

|

|

EU / U.S.- Lumileds, ams OSRAM, Cree LED

(Smart Global Holdings)

|

|

JP- Nichia, Citizen, Stanley, ROHM

|

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys

|

|

ML- Dominant

|

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride

|

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS

|

|

Micro/Mini LED

Exhibit Report

|

CES 2024 / Touch Taiwan 2024

|

PDF

|

Aperiodically;

<20 Pages

|

|

If you would like to know more details , please contact:

|