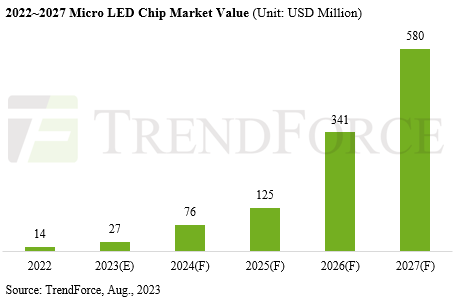

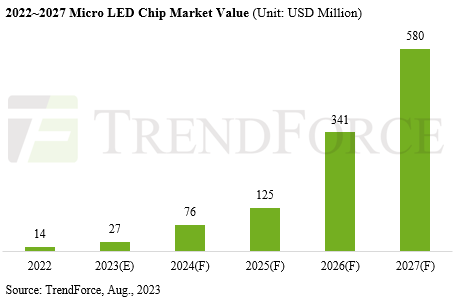

Aug. 10, 2023 ---- Mass production of large displays and wearable devices is propelling the Micro LED market. TrendForce predicts that the market value of Micro LED chips will reach $27 million in 2023, indicating a YoY growth of 92%. With the scaling of existing application shipments and the introduction of new applications, it’s projected that the market value of Micro LED chips will approach $580 million in 2027, representing a CAGR of approximately 136% from 2022 to 2027. Alongside the consistent growth in chip values, ancillary industries—such as transfer and testing equipment, glass and CMOS backplanes, and both active and passive matrix drive ICs—are poised for synchronous expansion.

This year, Samsung has unveiled an 89-inch 4K display and plans to further take advantage of Micro LED’s seamless splicing by introducing 101-inch and 114-inch models. LG Electronics, a South Korean brand, is set to commence mass production of its 136-inch 4K model, utilizing a larger 22.3-inch backplane and cost-effective 16x27µm chips, by the end of 2023.

Leading panel manufacturer BOE has charged a similar trajectory, with launches aimed at bolstering the overall industry’s growth. The company has successfully launched its P0.9 active matrix display in the 2Q23 and is planning to release the P0.51 active matrix display in the fourth quarter. Additionally, BOE intends to introduce a turnkey solution in 2024. For brands interested in Micro LED, this not only diversified production acquisition channels but also contributes to the accelerated development of the overall industry.

Wearables are a key application for Micro LED this year. AUO, pivoting from its traditional LCD operations, has successfully produced the world’s inaugural 1.39-inch Micro LED watch panel. In addition to initially providing it to European luxury watch manufacturer Tag Heuer, other major companies specializing in sports wearables and Japanese watch brands are all potential adopters of Micro LED wearable devices in the future.

Apple’s rollout of a 2.12-inch Micro LED for the Apple Watch has been deferred from 2025 to 2026 due to supply chain adjustments. However, production operations for the Micro LED variant are already in motion, signifying possible integration into Apple’s broader product range, including headsets, smartphones, and automotive applications.

Booming development in recent years has provided growth opportunities for innovative automotive displays like Micro LED. However, owing to the prolonged verification processes inherent to the auto sector, tangible mass production of Micro LED displays for vehicles might only materialize post-2026. TrendForce believes that instrument displays with high demands for reliability and brightness, technologically advanced head-up displays (HUD), and transparent displays with numerous connections to autonomous driving technology are all primary avenues for Micro LED displays to enter the automotive sector. Automakers from Europe, the US, and Japan are demonstrating considerable enthusiasm toward adopting Micro LED tech.

Micro LED continues to compete with technologies like LCOS, Micro OLED, and LBS when it comes to AR headsets. Industry leaders like Meta, Google, and MIT continue to assess and assist in the R&D of Micro LED for micro-projection displays, attracted by its balanced performance in terms of brightness, energy consumption, pixel density, and light engine size.

TrendForce is set to host the “Micro LED Forum 2023”on Tuesday, September 5th, from 9:30 to 17:00 at the NTUH International Convention Center. The forum has invited TrendForce’s Senior Research Vice President, Eric Chiou, alongside industry representatives from Mojo Vision, ITRI, Lumus, Unikorn Semiconductor, Porotech, Nitride Semiconductor, Tohoku University, Coherent, InZiv, AUO, and Tianma to share developments in Micro LED technology and its manifold applications.

TrendForce 2023 Micro LED Market Trend and Technology Cost Analysis

Release Date: 31 May / 30 November 2023

Language: Traditional Chinese / English

Format: PDF

Page: 160 / Year

If you would like to know more details , please contact: