Apr. 7, 2022 ---- According to TrendForce’s “Global LED Industry Data Base and LED Player Movement Quarterly Update” report, demand for high-standard LED products in the lighting market will enter a growth stage. Generally speaking, the price of lighting LED products is stable. However, due to the recent rise in global raw material prices, the unit price of products looks to trend higher. Coupled with high demand for energy conservation from governments around the world, the output value of the lighting LED market in 2022 is forecast to have an opportunity to reach US$8.11 billion, or 9.2% growth YoY. In the next few years, the scale of the lighting LED market will continue growing due to the promotion of human centric lighting (HCL), smart lighting, and other factors and is expected to reach US$11.1 billion by 2026, with a compound annual growth rate (CAGR) of 8.4% from 2021 to 2026.

TrendForce further states, despite the continuing impact of the pandemic in 2022, the pervasiveness of vaccines and the recovery of economic activities coupled with the rigid demand associated with the lighting market as a daily necessity, global "carbon neutrality," and the growing requirements of the energy conservation agenda, have moved numerous major powers to realize net-zero emissions through measures such as energy efficiency and low-carbon heating in recent years. However, lighting is a leading energy consumer in buildings, accounting for 20% to 30% of total building energy consumption. LED penetration will deepen, driven by the high demand for energy conservation and policies and regulations requiring the upgrade of aging equipment. In addition, smart lighting can also achieve the purpose of timely energy conservation. Therefore, there is strong demand for the introduction of LED lighting and smart lighting upgrades in commercial lighting, residential lighting, outdoor lighting, and industrial lighting, which further drives demand for high-standard LED products including high light efficiency, high color rendering and color saturation, low blue light HCL and smart lighting devices.

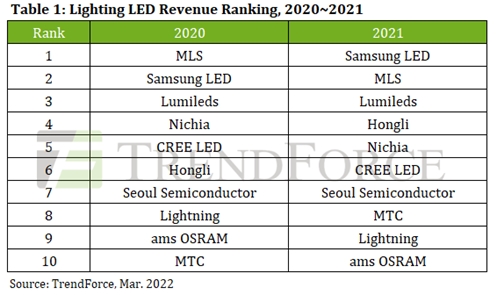

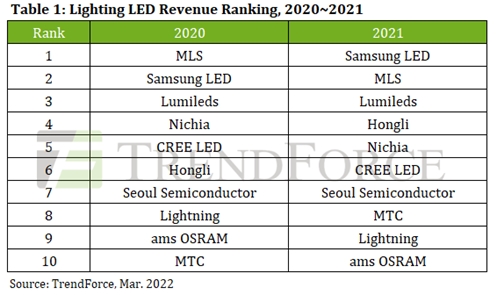

The gradual recovery of the lighting market is clearly reflected in the 2021 manufacturer revenue rankings. Lighting LED manufacturers including Samsung LED, ams OSRAM, CREE LED, Lumileds, Seoul Semiconductor, MLS, and Lightning have all posted revenue growth. Samsung LED surpassed MLS to rank first in revenue, with an annual revenue growth rate of 22% in 2021. Samsung Lighting LEDs are positioned in the high-end market. In high-end markets such as Europe and the United States, Samsung LED’s market share is gradually expanding due to its advantages in quality and patents. It is worth mentioning that Samsung LED's horticultural lighting orders also showed rapid growth, driving its whole lighting LED business revenue to rank first in the world. ams OSRAM, Lumileds, CREE LED, and Samsung LED primarily took advantage of orders for industrial, outdoor, and horticultural lighting last year, posting annual revenue growth of 26%, 18%, and 8%, respectively.

In terms of pricing, as demand in the lighting industry gradually recovered in 2021, facing demand for higher specification terminal application products and the impact of rising overall costs in raw materials and operations, LED packaging factories no longer adopted pricing strategies to capture additional market share, allowing lighting LED product pricing to stabilize and rebound in 2021. In terms of product categories, the average market price of medium and low-power lighting LED products (less than 1 watt, excluding 1 watt) such as 2835 LED, 3030 LED, and 5630 LED, posted an annual growth rate of 2.1~4.4%. For high-power lighting LED products (above 1 watt) such as ceramic substrate LEDs and 7070 LEDs, average annual market price growth was as much as 3.0~6.0%. TrendForce expects lighting LED pricing to further stabilize in 1H22.

Release Date: February 11, 2022

File Format: PDF / Excel

Language: Traditional Chinese / English

Page: 120

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN