According to the latest report by TrendForce, titled "2024 Global LED Lighting Market Analysis - 2H24," the LED lighting industry did not see significantly positive changes and performance growth in 1H24. The revenue of leading companies shows a marked decline, reflecting overall market weakness. However, the demand for specialized LED in agricultural lighting has been driven by favorable factors, making it one of the few bright spots in the otherwise declining lighting market.

1 With Revenue Declines among Leading Companies, the LED General Lighting Industry Is Experiencing a “Consumption Downgrade”

Global lighting market leader Signify saw its LED lighting revenue decrease by 7.9% year-over-year in 2023, with a continued decline of 9.1% in 1H24, partly reflecting the global LED lighting industry’s struggles since 2023.

On one hand, consumers are inclined to reduce unnecessary expenses under economic pressure, suppressing the market demand for LED general lighting products, a relatively mature sector. On the other hand, consumers prefer cost-effective LED lighting products, leading manufacturers to compete for the limited market share through discounts. This indicates that the LED general lighting industry is undergoing a “consumption downgrade”.

The simultaneous decline in both output and price not only affects the growth expectations of the LED general lighting industry but also forces conventional lighting players to reassess their market strategies. Some businesses in unfavorable competitive positions have withdrawn from the LED general lighting market and turned to focus on more promising niche applications.

2 Demand for LED Agricultural Lighting Grows Against the Trend, Showing Multiple Favorable Aspects

According to TrendForce, the demand for LED lighting in greenhouses, primarily for fruit and vegetable cultivation, has recovered in 1H24. Additionally, investments in vertical farms, especially small to medium-sized ones, are driving demand, leading to a significant increase in order placements among horticultural LED lighting companies. TrendForce estimates the LED horticultural lighting market size to grow to USD 1.317 billion in 2024 (+6.8% YoY).

TrendForce believes that in the coming years, the demand for LED horticultural lighting will continue to grow, driven by multiple factors. One is the new wave of cannabis lighting replacements. The cannabis application market peaked in 2020-2021, and a new replacement peak is expected after 2025, stimulated by products featuring higher luminous efficacy and cost-effectiveness. Additionally, the legalization of cannabis crops in Europe is driving up the demand for LED lighting in greenhouses.

On the other hand, significant investments in emerging agricultural technologies globally to ensure local food security are facilitating the construction of vertical farms and the maturation of business models. The expected economic benefits will make growers more active in adopting LED lighting equipment, further boosting the demand for LED horticultural lighting.

In the medium to long term, bio-optical applications, with horticultural lighting as a typical example, are expected to open up new LED application scenarios beyond traditional lighting applications, such as beauty, fisheries, livestock, and microalgae, becoming the next focus market for the LED lighting industry.

3 Broad-based Lighting Companies under Performance Pressure, Whereas Specialized Firms Perform Well

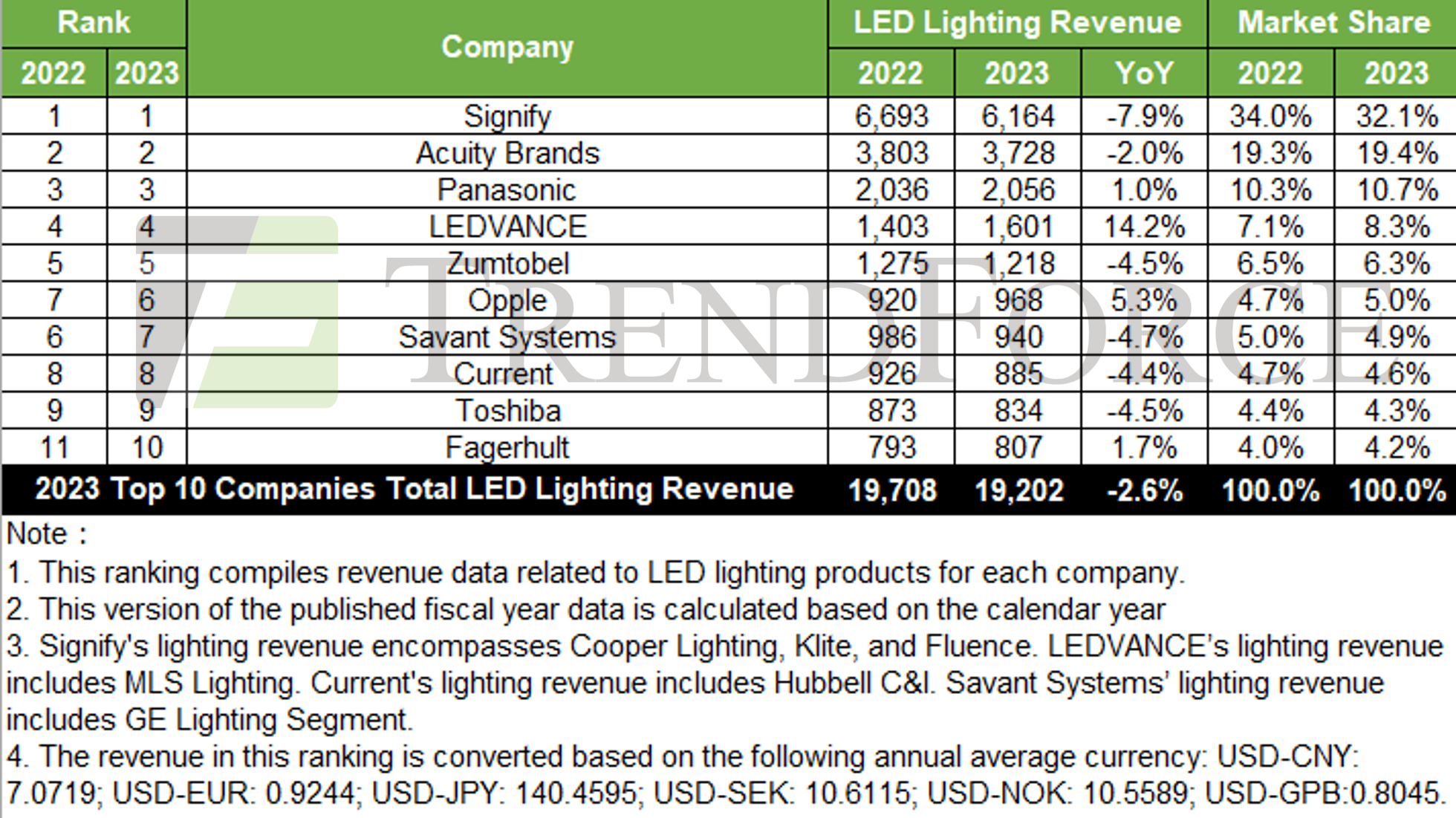

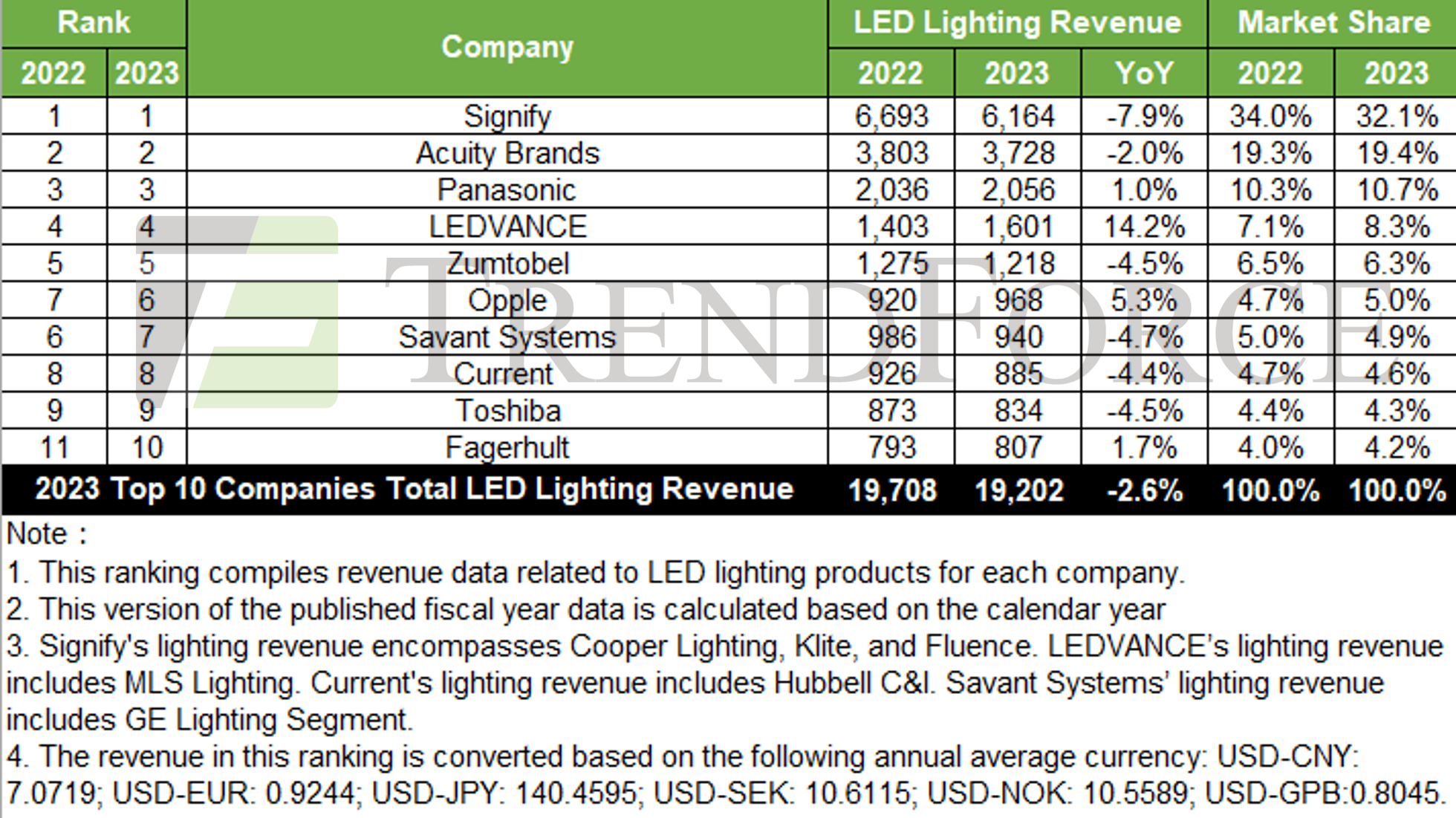

According to data compiled by TrendForce, the top five global lighting companies in terms of revenue for 2024 are Signify, Acuity Brands, Panasonic, LEDVANCE vs. MLS Lighting, and Zumtobel, with no changes from the 2023 rankings, revealing relatively stable positions of major players.

In 1H24, Chinese manufacturers’ revenue was poor, and European and American manufacturers also showed a downward trend, though the decline was more moderate. TrendForce estimates the overall revenue among the top 20 global manufacturers to decline by 4.4% year-on-year in 2024. Specialized firms are expected to outperform broad-based companies regarding revenue and profitability. For example, ENDO Lighting, focusing on the high-end commercial lighting market, has exhibited growth against the trend.

Leading manufacturers worldwide have been affected by regional or application-specific downturns, dragging down overall performance. In terms of new products, most manufacturers are centering on human-centric lighting, circadian lighting, and healthy lighting. Key product features include high luminous efficacy, anti-glare, flicker-free, high color rendering index, color saturation, and RG0 low blue light design.

Figure: 2023 Revenue Rankings of Global Top 10 LED Lighting Manufacturers (Unit: Million USD)

Source: TrendForce, August 2024

4 LED Lighting Package Market Fluctuates at the Bottom, with International Brands Leading in Output Control and Price Stabilization

As a TrendForce market analysis suggests, the average price decline in the global LED lighting package market slowed down in 1H24, mainly due to international giants gradually abandoning low pricing strategies for the lighting LED market, leading to signs of bottoming out in overall lighting LED prices. Major LED package makers from Japan and South Korea, such as Samsung LED, Nichia, and Seoul Semiconductor, are responding to the trend of price competition in lighting LEDs with conservative strategies. They are controlling production output and stabilizing product prices, reducing the proportion of low-margin general lighting LEDs, and focusing on high-end markets and high-margin applications such as horticultural and automotive lighting to optimize revenue structure and enhance profitability.

Looking ahead to 2H24, due to the global economic weakness and a significant slowdown in real estate market investments, the demand for end-market LED general lighting will not recover as strongly as expected. The order visibility for LED package manufacturers remains unclear. The product structure of LED lighting is diversifying due to varying regional market demands, while emerging market demand will rise, benefiting the continuous increase in shipments of mid-to-low-end products and partially offsetting the negative impact of poor demand for conventional lighting regionally. TrendForce estimates the lighting LED market value to slightly decrease to USD 3.518 billion in 2024 (-1.3% YoY).

2024 Global LED Lighting Market Analysis-2H24

Release Date: 2024 / 07 / 31

Languages: Traditional Chinese / English

Format: PDF / EXCEL

Page:110-120

Content

Chapter 1. Global Lighting Market Trend

-

TrendForce LED Lighting Market Scale- Methodology

-

TrendForce LED Lighting Market- Product Definition

-

TrendForce LED Lighting Market Product Definition- Lamps

-

TrendForce LED Lighting Market Product Definition- Luminaires

-

2024-2028 Global LED Lighting Market Scale- Penetration

-

2024-2028 Global LED Lighting Market Scale- Installed Market

-

2024-2028 Global LED Lighting Market Scale- by Product

-

2024 Projected Growth Rates of LED Lighting Market Value- by Region

-

2024-2028 Global LED Lighting Market Volume Forecast- by Product

-

2024-2028 Global LED Lighting Market Forecast- by Application

-

Outlook on LED Lighting Market Trends in Europe

-

Outlook on LED Lighting Market Trends in Northern America

-

Outlook on LED Lighting Market Trends in the Middle East and Africa

-

Outlook on LED Lighting Market Trends in Latin America

-

Outlook on LED Lighting Market Trends in Asia Pacific

-

Outlook on LED Lighting Market Trends in China

-

Outlook on LED Lighting Market Trends in Japan

Chapter 2. Horticultural Lighting and LED Market Trend

2.1 LED Horticultural Lighting Market Trend

-

Drivers of Growth in the LED Horticultural Lighting Market

-

2024-2028 LED Horticultural Lighting Market Scale- LED Luminaires

-

2024-2028 LED Horticultural Lighting Market Scale by Application

-

2024-2028 LED Horticultural Lighting Market Scale by Region

2.2 LED Horticultural Lighting Market: By Crop Type

-

LED Horticultural Lighting Market- Cannabis

-

LED Horticultural Lighting Market- Micro-algae

-

LED Horticultural Lighting Market- Rose

-

LED Horticultural Lighting Market- Chinese Herbology

2.3 LED Horticultural Lighting Products Specification

-

Horticultural Lighting Products Specification Analysis- Greenhouse/Indoor Farm

-

Horticultural Lighting Products Specification Analysis- Vertical Framing

-

Horticultural Lighting Products Specification Analysis- Consumer Grow Light

2.4 Agricultural Lighting LED Trend

-

2024-2028 Agricultural Lighting LED Market Scale- LED Package

-

2024-2028 Agricultural Lighting LED Market Scale- by Power

-

2023-2024 Mainstream Horticultural Lighting LED Products Analysis

Chapter 3. Lighting Player Revenue Ranking and Strategies

-

Global Major Lighting Manufacturer List

-

2022-2024(E) Top 20 Lighting Player Revenue Ranking: Total Lighting

-

2022-2024(E) Top 20 Lighting Player Revenue Ranking: LED Lighting

-

Lighting Player Revenue and Product Strategies

。Signify

。Zumtobel

。Fagerhult

。Acuity Brands

。Current Lighting Solutions

。Panasonic

。Endo Lighting

-

Chinese Lighting Player Revenue and Product Strategies

。LEDVANCE/MLS

。Opple Lighting

。NVC Lighting

。Leedarson

。Foshan Lighting

。Yankon Group

Chapter 4. Lighting LED Market Scale

-

2024-2028 General Lighting LED Market Value- by Application

-

2024-2028 General Lighting LED Market Value - by Package Type

-

2024-2024 General Lighting LED Market Scale- by Power

-

2022-2023 Lighting LED Player Revenue Ranking

-

2022-2023 Lighting LED Player Market Share

Appendix. Lighting Market Regulations and Standards

-

Policies and Regulations on the General Lighting Market- Abstract

-

Global Wireless Transmission Standards for Smart Lighting

-

Global Wired Transmission Standards for Smart Lighting

-

2024 Major Communication Methods of Control Systems in China

-

Healthy Lighting Environment- DIN SPEC 67600

-

Healthy Lighting Environment- WELL Building Standard TM

-

Healthy Lighting Environment- Underwriters Laboratories (UL)

-

Emission Reduction and Energy Saving- Northern America

-

Emission Reduction and Energy Saving- Europe

-

Emission Reduction and Energy Saving- Africa

-

Emission Reduction and Energy Saving- Asia Pacific

-

Emission Reduction and Energy Saving- Latin America and The Caribbean

-

Emission Reduction and Energy Saving- International Bodies

|

If you would like to know more details , please contact:

|