China is currently the main global manufacturing base of LED lighting products, and OEMs/ODMs of brand vendors such as Philips Lighting, Osram Licht AG and IKEA are setting up factories there. The development surge in the LED lighting industry is driving the ongoing expansion of the Chinese market demand. Therefore, leading LED package manufacturers, such as Japan’s Nichia and Taiwan’s Everlight, are also proactively developing the country’s general lighting application market.

Consequently, the Chinese government has given strong support to the domestic LED industry. For the LED chip manufacturing in the upstream, the state has provided various subsidies. In the downstream market, major Chinese cities are driving the LED replacement demand and launching demonstration projects. In sum, state support in the upstream manufacturing and the increasing penetration of LED products in the downstream markets fuel the development of the Chinese LED package industry. Led by MLS and Honlitronic, China’s domestic LED package companies are experiencing a rapid rise and will continue to enlarge the scale of their enterprise as well as establishing a strong market position.

LEDinside 2015 Chinese LED Industry Market Report

Published Date: 25 June 2015

Language: English

Page: 351

Format: Electronics

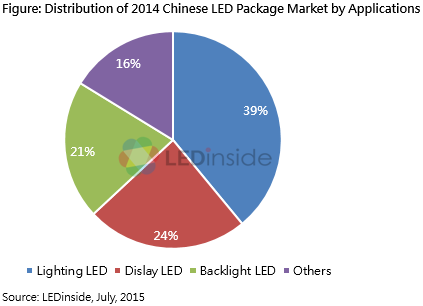

Chapter 3: LED market segments were added, covering the market scales on Chinese backlight LED, lighting LED and display LED fields. Also, Chinese LED package market scales in 2015-2019 by both manufacturer camps and power types are estimated. Furthermore, LED supply chain of backlight, lighting, and display markets are discussed.

Chapter 4: 18 Chinese LED package manufacturers business analysis are covered, covering business operation, financial performance, expansion and capacity, major clients, and LEDinside perspective.

Chapter 5: Total 18 International and Taiwanese LED manufacturers are discussed, including company revenue and profit, Chinese revenue performance, and major products and client in China.

Chapter 6: Adding market scale forecasts on chip, phosphor, and adhesive fields. In chip market sector, Chinese major five chip manufacturers business operation, and major clients in China are discussed. In phosphor market sector, major phosphor manufacturer product development is highlighted.

Market: Observed from market demand to see the opportunities and challenges of LED package industry.

Company: Talking the product, technology, scale, major client, and future development of major LED package manufacturers in China.

Strategy: Opportunities and Challenges for international and Taiwanese manufacturers.

Chapter I Industry Chain Overview

-

LED Industry History

-

LED Industry Chain

-

Definition of LED Packaging

-

Supporting Industries of LED Packaging

-

Lead Frame

-

Silicon

-

Phosphor

Chapter II China LED Industry Overview

The Upstream LED Chip Industry

-

New Expansion

-

Industry Polarization, and First-Tier Manufacturer is Bigger and Bigger

The Downstream Application Industry

-

Lighting Industry : Product Prices Fall, Driving Penetration Increased

-

Display Industry : Intense Competition, Entering into the Industry Reshuffle

-

Backlight Industry : Chinese Package Manufacturers Rise

Chapter III Chinese Package Industry Overview

3-1 LED Package Industry Trends in China

-

Chinese LED Package industry Overview

-

2014-2019 Chinese LED Package Market Scale

-

2014-2019 Chinese LED Package Market Scale- By Market Camps

-

2014-2019 Chinese LED package Market Value By Power Types

-

Prominent LED Manufacturers Market Position and Revenue Rankings

3-2 Chinese LED Industry Segments, Market Scale, Product Specifications and Supply Chain

-

Mid to large-Sized Backlight Market

-

Smartphone Backlight and Flash LED Markets

-

Lighting Market

-

Display Market

-

Decorative Lighting Market

Chapter IV Major Chinese LED Package Manufacturers Analysis

-

Nationstar

-

Honglitronic

-

Refond

-

Jufei

-

Mason

-

ChangFang Lighting

-

MLS

-

Ledman

-

Kinglight

-

Smalite

-

Hkled

-

Wenrun

-

Dongshan Precision

-

Lightning Opto

-

Runlite

-

Shineon

-

MTC

-

APT

Content

-

Revenue and Profit

-

Product Mix

-

Production Capacity Expansion Plan

-

Business Summary for 2014

-

Profitability Analysis

-

Operating Analysis (Days sales of inventory, Days of Sales Outstanding)

-

Debt Paying Ability Analysis (Debt Asset Ratio)

-

Product Specification

-

Overall Evaluation

-

Product

-

Technology

-

Scale

-

Main Customers

-

LEDinside’s Perspective

-

Note: Not specified currency in this chapter regarded as RMB

Chapter V International LED Manufacturers Business Operating Activities in China

-

European and U.S. LED Manufacturers Operating Activities in China

-

Lumileds, Osram Opto, Cree, Bridgelux, Luminus Devices

-

Japanese LED Manufacturers Operating Activities in China

-

Korean LED Manufacturers Operating Activities in China

-

Samsung LED, LG Innotek, Seoul Semiconductor

-

Taiwanese LED Manufacturers Operating Activities in China

-

Everlight, Lextar, Lite-on, Unity Opto, AOT, Harvatek, Edison Opto

-

Company Profile, Product and Business Strategy

-

Revenue and Gross Margin

-

Revenue from Chinese Market and Share

-

Major Clients in China

Chapter VI China’s LED Package Manufacturers Competitiveness

-

Chinese and International Manufacturers’ Competitiveness

-

China’s Domestic Manufacturers Competitiveness

-

Maturity in The Industry

-

Industry Concentration

-

Industry Integration Trend

-

Industry Growth Opportunities and Threats

Chapter VII Major Supporting Business in LED Package Industry

-

Section One:Equipment Industry

-

Die Bonder

-

Wire Bonder

-

Adhesive Dispensing Machine

-

Section Two:Major Materials

-

Chip

-

Phosphors

-

Lead Frame

-

Adhesive (Silicon, Epoxy)

-

Gold Wire

Chapter VIII New LED Packaging Technology and Hot Topics

-

COB Package

-

EMC Package

-

Flip Chip LED Package

-

Overview

-

Strengths

-

Market Trend

-

Conclusion

Chapter IX Conclusions and Suggestions

For further information please contact:

Joanne Wu (Taipei)

joannewu@trendforce.com

+886-2-7702-6888 ext. 972

CN

TW

EN

CN

TW

EN