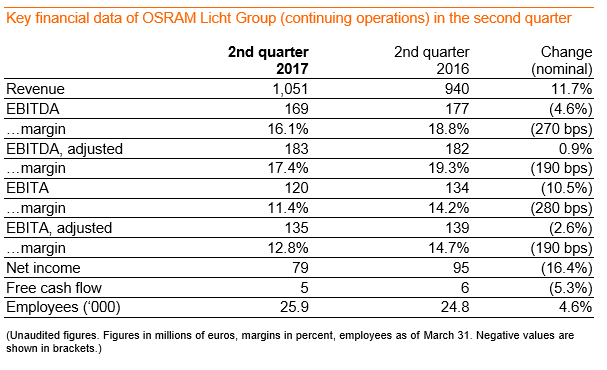

- Revenue up by about 10 percent1 in the second quarter on a comparable basis

- Adjusted EBITDA margin at 17.4 percent

- Expansion of global LED production capacities well on track

|

|

|

(Image: Osram) |

“We nearly doubled our growth rate in the second quarter. We saw the strongest growth materialize in our high-tech businesses Opto Semiconductors and Specialty Lighting, which are currently benefiting from the momentum in attractive growth markets. Our strategy is working and Osram is on track to achieve its ambitious targets for 2020, successfully addressing an ever-changing market,” said Olaf Berlien, Chief Executive Officer of OSRAM Licht AG.

In the second quarter of fiscal 2017, Osram saw a significant lift in its growth rate. On a comparable basis, i.e. adjusted for portfolio and currency effects, revenue generated in the period January to March rose by around 10 percent year on year to reach €1.05 billion. Comparable growth in the prior-year quarter was approximately 6 percent. This growth was driven by sustained levels of high demand for opto semiconductors and continued strong demand from the automotive sector. In nominal terms, revenue grew by nearly 12 percent. Even with ongoing investments into new products and growth initiatives, EBITDA2 adjusted for special items remained solid at €183 (prior year: 182) million, translating into a strong profit margin of 17.4 (prior year: 19.3) percent. Profit after tax from continuing operations was €79 million in the second quarter, compared with €95 million in the same period a year ago, when the company benefited from one-time effects. In view of the performance of the business in the first half of the current fiscal year and its current market outlook, Osram raised the business outlook for the fiscal year 2017 as a whole.

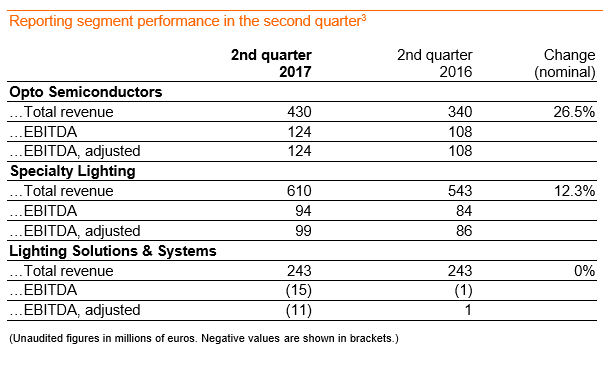

Osram reporting segments in the second quarter

The LED business (Opto Semiconductors, OS) reported strong growth in all its business segments in the second quarter and posted substantial year-on-year revenue growth of 24 percent on a comparable basis. Revenue grew exceptionally strong in the business with infrared products. These products are used for iris scans or in fitness wristbands and smart watches. At 29.0 (prior year: 31.7) percent, the EBITDA margin was again at a very high level. In response to strong market demand across various market segments, the expansion of production capacities is on its way. In Regensburg, construction started in March to increase existing production square footage. Work on expanding the back-end capacity in Wuxi, China, will begin in August and the new LED chip factory in Kulim, Malaysia, will start commissioning equipment in May as planned, with production scheduled to start in November of this year.

In the second quarter, the Specialty Lighting (SP) reporting segment, which includes the Automotive Lighting and Professional & Industrial Applications (PIA) units, benefited from continued strong demand from the automotive sector and delivered revenue growth of more than 8 percent on a comparable basis. Adjusted for special items, the EBITDA margin increased year on year to reach 16.2 (prior year: 15.8) percent. In May, products from the PIA unit will once again be showcased for the stage lighting at the Eurovision Song Contest (ESC). As in previous years, Osram is the event’s official lighting partner.

In the Lighting Solutions & Systems (LSS) reporting segment, revenue growth was negatively impacted by a weaker US market, resulting in a flat revenue level on a comparable basis year over year. The adjusted EBITDA margin of LLS was negative at minus 4.4 (prior year: plus 0.4) percent. Improving the cost position in the luminaires business is still a key focus. Numerous cost reduction measures are already ongoing to bring this business to competitive profitability levels, in combination with growing the revenue base.

Discontinued operations in the second quarter

With the sale of Ledvance now completed, the general lighting lamps business is no longer being consolidated within the financial statements of Osram effective March 3, 2017. In line with our communication back at the signing of the sale agreement in July 2016, the final part of the resulting book loss amounting to nearly €40 million was accounted for in discontinued operations as a consequence of the change of control. Combined with the operational results of Ledvance, taxes, and other disposal effects this resulted in a net loss of €56 million in discontinued operations.

Compared to the Q1 2017, Osram’s net liquidity in Q2 increased by approximately €300 million to about €570 million, mainly due to the cash proceeds from the sale of Ledvance.

Outlook for fiscal 2017

As announced the previous day, the managing board now expects comparable revenue growth to be between 7 to 9 percent for fiscal 2017, compared to earlier guidance of between 5 to 7 percent. The company’s adjusted EBITDA margin is expected to be in the range of 16.5 to 17.5 percent, compared to earlier guidance of delivering at least 16 percent. Diluted earnings per share is now expected to be in the range of €2.70 to €2.90, up compared to the initial guidance of €2.35 to €2.65. Free cash flow still continues to be targeted at break-even.

Osram’s medium-term planning (5-1-5) for fiscal 2020 targets revenue of between €5 billion and €5.5 billion, with EBITDA of €0.9 billion to €1 billion and earnings per share of approximately €5.