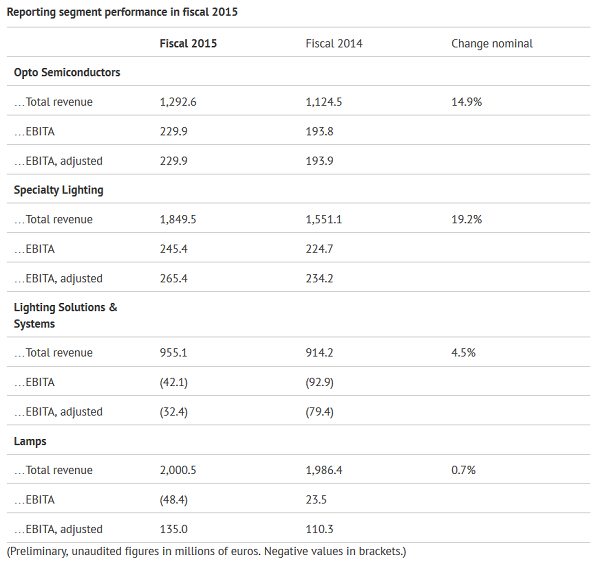

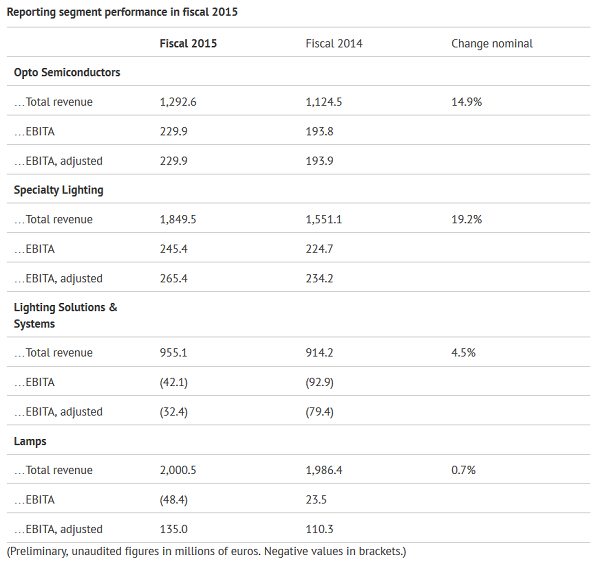

Osram managed the challenges of the changing lighting market very well in the fiscal year that ended in September 2015 and laid a strong foundation for future growth. EBITA1 excluding special items rose 26 percent on a year-on-year basis to €567 million, translating into a margin of 10.2 percent. Cost savings, positive currency effects as well as simplified corporate structures have contributed to this earnings increase. The reported EBITA margin reached 5.3 percent despite high transformation costs, while net income declined to €171 million. Revenue, on the other hand, rose eight percent to almost €5.6 billion. On a comparable basis, i.e., adjusted for portfolio and currency effects, revenue remained almost stable with a decline of around one percent. Based on the current corporate structure, the company expects comparable revenue in fiscal 2016 to be slightly below the prior year’s level. The adjusted EBITA margin is likely to be substantially below the level of fiscal 2015, among other things due to expenses attributable to the “Diamond” innovation and growth initiative. In contrast, net income is expected to increase sharply due to the anticipated book gain from the announced sale of the shares in Foshan Electrical & Lighting Co., Ltd. (Felco). Osram confirms that a dividend of €0.90 per share will be proposed for fiscal 2015 to the Annual General Meeting. For fiscal 2016, the company also intends to pay a dividend of at least €0.90 per share.

In a fast-changing market, Osram has continuously adapted its business, systematically implemented its realignment, and successfully put the company on a profitability track over the past years. One of the most far-reaching steps the company has taken in its history is the carve-out of the lamps business, which was initiated in fiscal 2015. It involves the separate organizational setup of a company with revenue of €2 billion, 18 plants, and approximately 11,000 employees. In addition, Osram has streamlined the decision-making processes and boosted efficiency and flexibility by rearranging its corporate functions and setting up a lean management holding. Within these decentralized management structures, the individual business segments are “global entrepreneurs”, with full responsibility extending from development through production and procurement to sales.

“The good earnings performance in fiscal 2015 shows that Osram has already been very successful in driving its realignment forward over the past years,” said Olaf Berlien, Chief Executive Officer of OSRAM Licht AG. “We are now switching the focus to growth. The ‘Diamond’ innovation and growth initiative we have launched for this purpose is aimed not only at securing and extending the company’s position as a trendsetter in the high-tech lighting business. We also want to significantly improve our position in the large general lighting LED market with this initiative.”

Osram Group in the fourth quarter

In the fourth quarter, Osram recorded a year-on-year revenue increase of seven percent to €1.43 billion. On a comparable basis, however, revenue was down two percent due to declines in the traditional lighting technology business. The adjusted EBITA margin increased by more than one percentage point to 9.5 percent, helped by productivity improvements, among other things. The revenue share of LED-based products and solutions reached 46 percent in the fourth quarter, after 39 percent in the prior-year period.

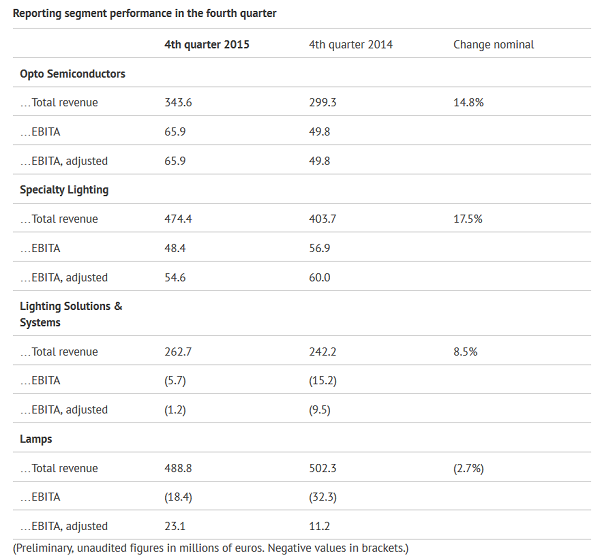

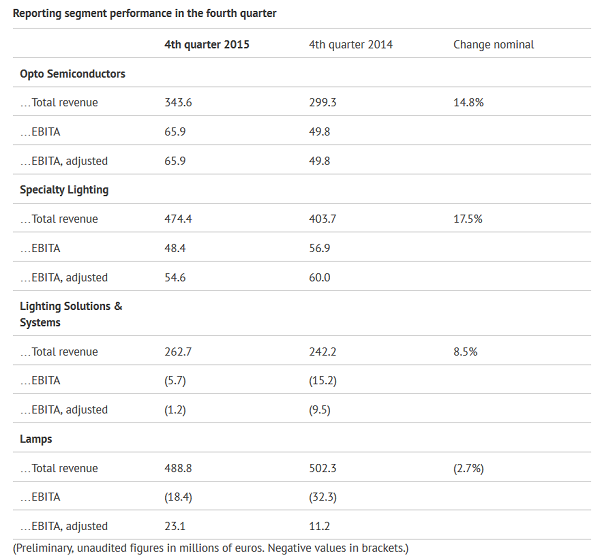

Osram reporting segments in the fourth quarter2

Osram’s Opto Semiconductors (OS) reporting segment posted a comparable revenue increase of five percent in the fourth quarter from a year earlier, again supported by allreporting regions. Main growth drivers were the automotive and industrial businesses. At 19.2 percent, the EBITA margin again reached a very good level.

Specialty Lighting (SP), with its Automotive Lighting and Display/Optics units, also recorded revenue growth of five percent on a comparable basis, thanks to continuing strong demand for LED-based products. In contrast, the EBITA margin, excluding special items, declined to 11.5 percent. This development was driven in particular by ramp-up costs for the broad-based market launch of new technologies in the automotive business and a higher revenue share of LED-based products than in the prior-year period.

The Lighting Solutions & Systems (LSS) reporting segment comprises the business with components such as LED modules and LED drivers as well as with luminaires, solutions and services. Thanks to growth in Digital Systems, the segment’s revenue rose two percent on a comparable basis in the fourth quarter. The adjusted EBITA margin improved to minus 0.4 percent.

The Lamps reporting segment comprises the general lighting lamps business. Due to the continuing decline in demand for traditional lamps, the segment recorded a comparable revenue decrease of eight percent in the fourth quarter. The segment’s adjusted EBITA margin was 4.7 percent. With €63 million, free cash flow even topped the very good figure of the third quarter.

Outlook for fiscal 2016

The following outlook refers to the company’s current structure and therefore also includes the general lighting lamps business. For fiscal 2016, the managing board expects revenue on a comparable basis to be slightly below the prior-year level. The EBITA margin, excluding special items, is expected to be substantially below the level of fiscal 2015, primarily due to the “Diamond” innovation and growth initiative as well as due to structural factors associated with the carve-out of the general lighting lamps business and the continuing transformation. In contrast, the managing board expects net income and return on capital employed (ROCE) to rise sharply due to the anticipated book gain from the announced sale of the Felco shares. Due to a strong increase in capital expenditure as well as special items such as the intended special funding of pension plans, free cash flow is expected to amount to a low to medium negative triple-digit million-euro figure. The managing board is confident about Osram’s positive midterm prospects and therefore intends to pay a dividend of at least €0.90 per share also for fiscal 2016.

|

|

|

|

|

|

1Earnings before interest, taxes and amortization

2Due to the carve-out, the general lighting lamps business is now shown as the Lamps reporting segment. At the same time, the remaining activities of the former Classic Lamps & Ballasts and LED Lamps & Systems units have been bundled in the new Digital Systems unit. This unit therefore comprises the business activities with traditional ballasts as well as with LED modules, drivers and light management systems. Digital Systems has been assigned to the new Lighting Solutions & Systems reporting segment, which also includes the luminaires, solutions and services business

Osram's Share Buyback

At its regular meeting on Tuesday, the supervisory board of OSRAM Licht AG approved the managing board’s proposal to implement a comprehensive share buyback. The buyback will probably start in the first quarter of CY2016 and shall be executed within twelve to 18 months. Up to 9.81 percent of the capital stock is to be repurchased, subject to a maximum spend on shares totaling €500 million. The managing board is keeping all options open as to the use of the acquired shares. The action complements the proposed dividend of €0.90 per share, which is to be submitted to the Annual General Meeting in February 2016. “Following the announcement of our pension plan funding, which considers the interests of our employees, the share buyback combined with the dividend is a strong commitment to Osram’s policy of ensuring shareholder value,” said Chief Financial Officer Klaus Patzak.

CN

TW

EN

CN

TW

EN