Net profits improved for Dutch lighting giant Philips, mostly due to strong sales growth in its Healthcare and strong margin improvements in Consumer Lifestyle and Lighting businesses. However, performance in emerging markets including China, Russia and Latin America had declined.

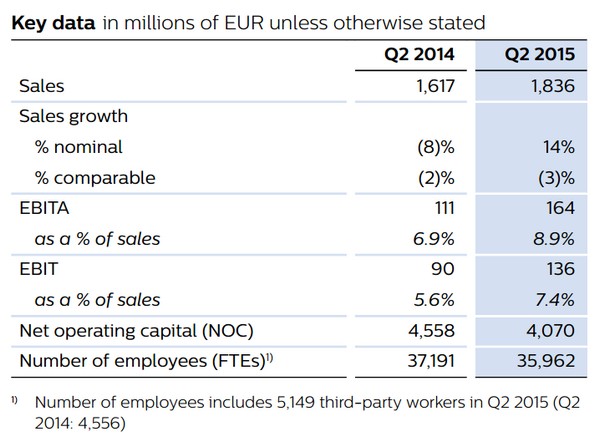

Lighting comparable sales declined 3% year-on-year.

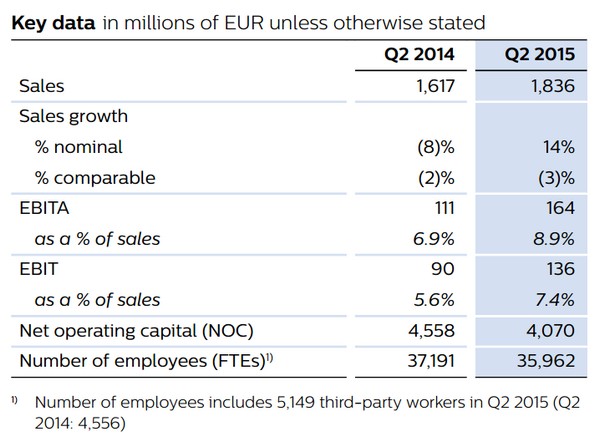

|

|

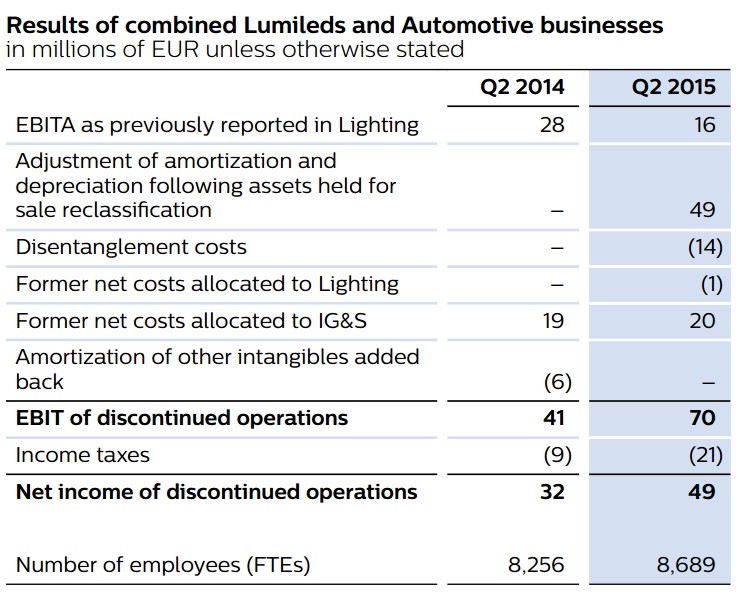

Philips lighting business performance for 2Q15. (Source: Philips) |

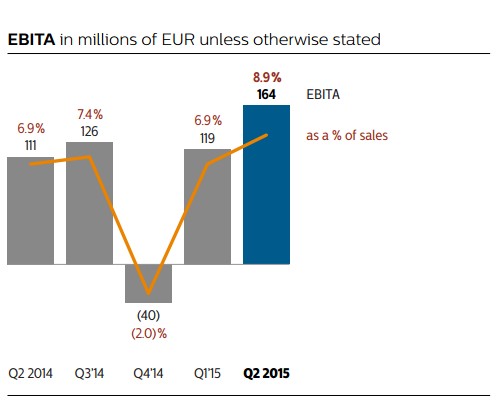

“We are pleased to have further improved our EBITA margin despite a sizable decline in comparable conventional lighting sales,”stated Frans van Houten, CEO of Philips. “We continue to take action to mitigate the impact of unfavorable end-market conditions in countries like China and underperformance in Professional Lighting Solutions North America.”

|

|

|

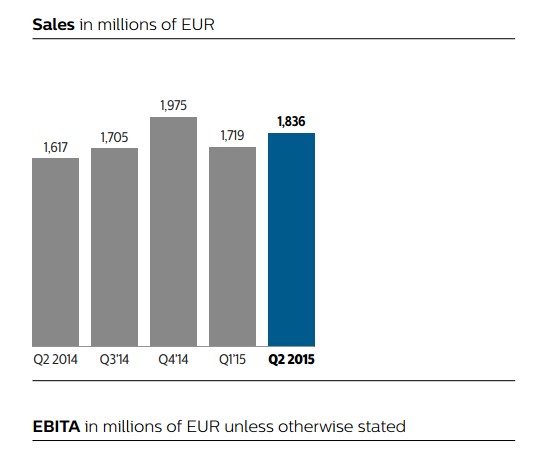

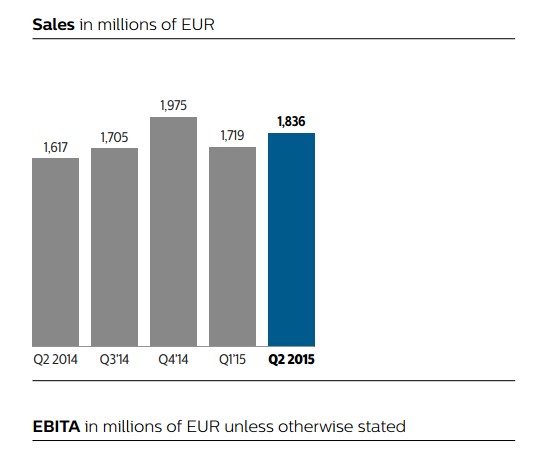

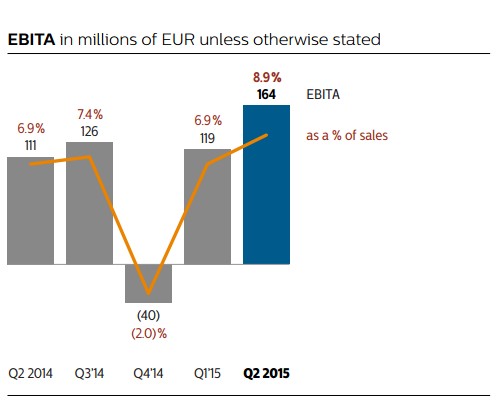

Top: Philips Lighting business sales revenue over the last four quarters. Bottom: Philips EBITA over the last four quarters. (Source: Philips) |

Growth in LED lighting sales of 21% was offset by a decline in overall conventional lighting sales of 16%. LED sales now represent 40% of total Lighting sales, compared to 34% in Q2 2014.

|

|

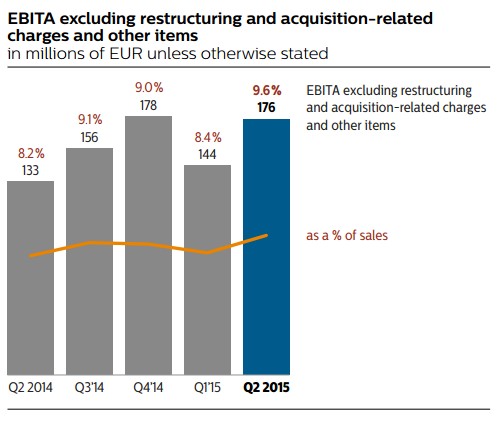

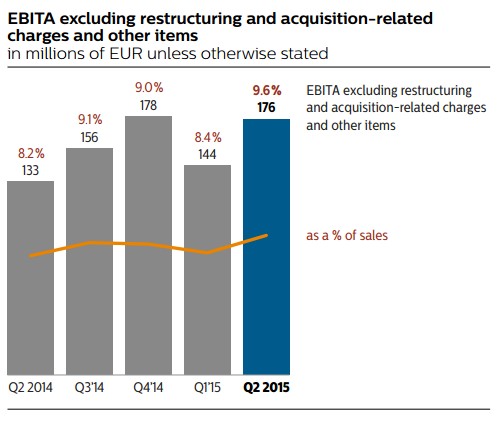

EBITA margin excluding restructuring and acquistion and related items for the last four qurters. (Source: Philips) |

EBITA margin, excluding restructuring and acquisition-related charges and other items, improved by 140 basis points to 9.6% year-on-year, despite a significant negative currency impact on the margin. This increase was driven by the continued improvement in LED lighting margins, and continued cost management.

Net operating capital, excluding a currency translation effect of EUR 576 million, decreased by EUR 1,064 million YoY. The decrease was mainly due to the reclassification of the combined businesses of Lumileds and Automotive as assets held for sale in 4Q14.

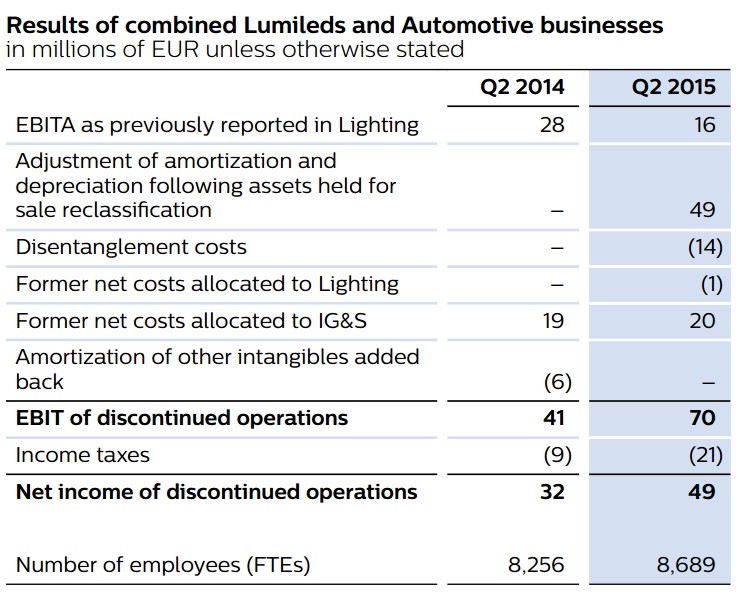

Lighting financial results this quarter, marks the first time Lumileds and automotive lighting sector revenue is excluded from Philips Lighting financial results. Chinese investor Go Scale Capital acquired Lumileds on March 31, 2015, and the transaction is still being finalized.

|

|

Philips Lumileds and automotive lighting revenue for 2Q15 and other separation costs. (Source: Philips) |

Philips expects to finalize the transition of the Lighting business into its own legal structure within the Philips Group by February 2016, and is aiming to complete the separation by first half of 2016. The company lowered the estimated separation costs from EUR 300-400 million in 2015 to EUR 200-300 million in 2016.

The company also announced it is reviewing all strategic options for the lighting business, including initial public offering and a private sale.

Some of the important lighting cases Philips acquired this year include the company’s acquisition of 15 million 7W LED lamps from Energy Efficiency Services Limited, as part of the Indian government's initiative to promote energy saving lighting for households and help reduce electricity consumption at peak periods. In Lille, France, Carrefour will install 2.5 kilometers of Philips LED-based lighting positioning solution to provide location-based services.

For further information:

Quarterly Report

· Q2 2015 - Quarterly Report

Presentation

· Q2 2015 - Quarterly Results Presentation

CN

TW

EN

CN

TW

EN