Veeco Instruments (NASDAQ: VECO)

Third Quarter 2016 Results Summary:

-

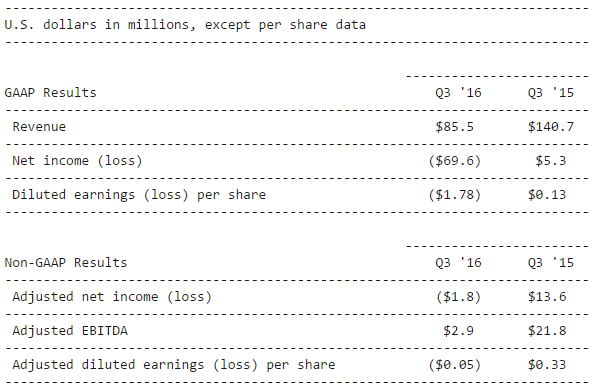

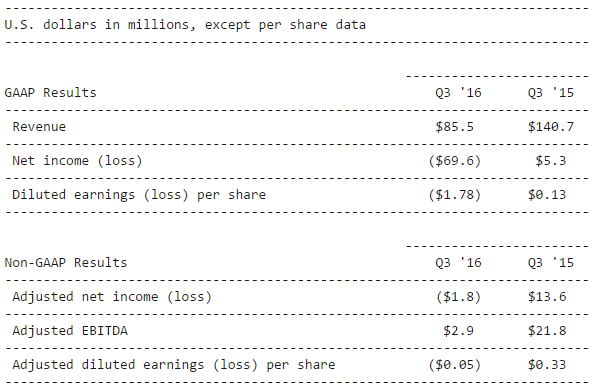

Recognized revenue of US $85.5 million

-

GAAP net loss per share of $1.78, includes pre-tax restructuring and asset impairment charges of $57.8 million

-

Narrowed non-GAAP net loss per share to $0.05

-

Achieved positive non-GAAP adjusted EBITDA of $2.9 million

-

Generated $7 million in cash from operations

Veeco Instruments announced financial results for its third fiscal quarter ended Sept. 30, 2016. Results are reported in accordance with U.S. generally accepted accounting principles ("GAAP") and are also reported adjusting for certain items ("Non-GAAP"). A reconciliation between GAAP and Non-GAAP operating results is provided at the end of this press release.

|

|

Veeco Instruments financial results for 3Q16. (Veeco Instruments/LEDinsides) |

"Veeco executed well in the third quarter, delivering revenue above the top end of our guidance range and generating positive adjusted EBITDA and cash flows from operations," commented John Peeler, Chairman and Chief Executive Officer. "We are seeing a clear improvement in LED industry conditions and solid demand for our MOCVD products. We continue to win LED lighting and display opportunities with our TurboDisc® EPIK™700 Metal Organic Chemical Vapor Deposition ("MOCVD") system and expand our positions in red, orange and yellow LEDs with our TurboDisc® K475i™ Arsenic Phosphide ("As/P") system.

"We remain focused on improving the Company's through-cycle profitability. We are executing against our cost reduction initiatives, including our recently announced plans to significantly reduce investments in Atomic Layer Deposition ("ALD") technology development. These actions are expected to lower our quarterly adjusted EBITDA breakeven level to approximately $75 million in revenue, starting in the first quarter of 2017. Overall, I'm pleased with our ongoing execution and the positive momentum of our business looking ahead," Mr. Peeler concluded.

In the third quarter, the company recorded total asset impairment and restructuring charges of $57.8 million. Of these charges, the vast majority were non-cash relating to an intangible ALD asset impairment and $1.8 million were restructuring charges requiring cash.

Page 2/Q3 2016 Earnings Results Press Release

Guidance and Outlook

The following guidance is provided for Veeco's fourth quarter 2016:

-

Revenue is expected to be in the range of $85 million to $100 million

-

GAAP Gross Margin is expected to be in the range of 37% to 39% and non-GAAP Gross Margin is expected to be in the range of 38% to 40%

-

GAAP Net Income (loss) is expected to be in the range of ($13) million to ($7) million and non-GAAP Net Income (loss) is expected to be in the range of ($3) million to $3 million

-

GAAP earnings (loss) per share is expected to be in the range of ($0.34) to ($0.19) and non-GAAP earnings (loss) per share is expected to be in the range of ($0.07) to $0.07

-

Adjusted EBITDA is expected to be between $0 and $6 million

Please refer to the tables at the end of this press release for further details.

Conference Call Information

A conference call reviewing these results has been scheduled for today, November 1, 2016 starting at 5:00pm ET. To join the call, dial 1-888-430-8709 (toll free) or 1-719-325-2448 and use passcode 6493222. The call will also be webcast live on the Veeco website at ir.veeco.com. A replay of the webcast will be made available on the Veeco website beginning at 8:00pm ET this evening. We will post an accompanying slide presentation to our website prior to the beginning of the call.

CN

TW

EN

CN

TW

EN