Weak TV and notebook demand leaves industry nursing a supply glut

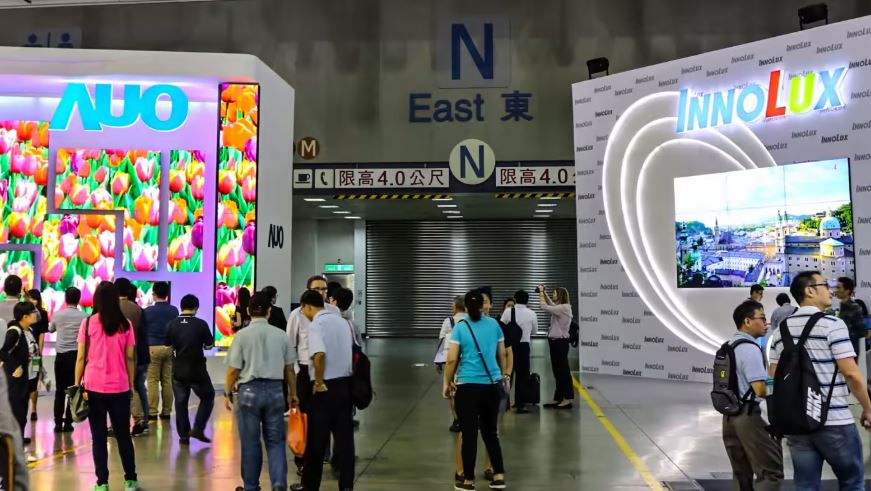

AUO and Innolux offer the latest pieces of evidence that the display industry has entered a period of capacity consolidation. (File photo by Kensaku Ihara)

TAIPEI -- Taiwan's two leading display makers are scaling back domestic capacity for consumer electronics amid an ongoing supply glut spurred by weak demand for TVs and notebooks.

Innolux on Wednesday said it is idling the production and employees at its 5.5-generation liquid crystal diode (LCD) display plant in Taiwan, while AUO is looking to repurpose a plant by shifting its notebook display production lines to another facility on the island.

The moves suggest the display industry has entered a period of capacity consolidation, as the demand fueled by working and studying from home during the pandemic fades. Samsung Display stopped producing LCDs last year to focus on more advanced displays, while LG Display is reportedly selling its LCD plant in the Chinese city of Guangzhou.

Displays, much like memory chips, are considered a commodity. Prices are extremely sensitive to consumer electronics demand, and the industry is vulnerable to supply gluts. Global PC shipments last year dropped 16.5% to 292.3 million units, compared with the 14.8% growth to 349 million units recorded the previous year, data from research agency IDC shows.

AUO has recorded three consecutive quarters of net losses, totaling 21.1 billion New Taiwan dollars ($690.8 million) for all of 2022, due to sharp declines in demand since the second quarter of last year. Innolux on Tuesday night booked its fourth straight quarter of net losses.

Innolux President James Yang and Chairman Jim Hung pose for photos at the Touch Taiwan display show on April 19. (Photo by Lauly Li)

Both of the affected plants were running at full capacity when the tech industry experienced an unprecedented shortage of chips and components due to surging demand during the pandemic.

"The market for consumer electronics has saturated, especially for those rather mature products like IT [notebooks]," Innolux chairman and CEO Jim Hung told reporters at the annual display show Touch Taiwan. "We are gradually idling the plant and lowering the production utilization rate and staff there. It might take six months to one year for the transition."

The facility cannot switch to making automotive displays, one of Innolux's business focuses in recent years, because the 5.5-gen display production lines cannot be adapted to the mainstream 5- and 6-gen display lines for automotive screens, the company explained.

One option Innolux is considering is to make glass-based antennas for on-the-ground receivers used with low-earth orbit satellites, but "no matter what niche products we do in the future, the utilization rate will not be as high as it used to be," Hung said.

AUO Chairman Paul Peng and CEO Frank Ko attend the annual Touch Taiwan display show on April 19. (Photo by Lauly Li)

AUO CEO Frank Ko said the company's plant in the Longtan District of the northern Taiwanese city of Taoyuan will slowly shift from making notebook displays to making advanced micro-LED displays, which are high-value and in line with AUO's pursuit of more advanced technologies.

Chairman Paul Peng said AUO has been investing in micro-LED technologies since early 2015 and has started a small-scale production of the displays for use in wearable devices and TVs. The company is also in talks with automakers to use the displays, he said.

Display makers have stepped up efforts to find more valuable applications following the economic downturn. Apart from automotive screens and medical applications, display makers like Innolux and China's BOE have allocated resources to researching advanced semiconductor packaging technologies in recent years.

2023 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 28 September 2022

Language: Traditional Chinese / English

Format: PDF

Page: 238

TrendForce 2022 Micro LED Self-Emissive Display Trends and Analysis on Supplier's Strategies

Release date: 31 May 2022 / 30 November 2022

Format: PDF

Languages: Tradional Chinese / English

Pages : 130–150 in total (subject to change)

If you would like to know more details , please contact:

CN

TW

EN

CN

TW

EN