LEDinside illustrated the global car sales situation in 2018 and explained how the US-China trade war has impacted the automobile market and indirectly influenced the automotive LED market in the past year. In the second part of the analysis, we will further discuss the application trends of automotive LED as well as the global industrial chain of automotive LED.

Mainstream automotive LED application trends

The automotive LEDs are adopted in various places in cars including interior and exterior lighting, dashboards and rear view mirrors.

Headlights as the most important part of automotive lighting have been moving toward to intelligent applications by combining LEDs and sensing technologies. Following the trends, automotive LED producers introduced matrix LED headlights which LEDs are placed in arrays and each LED can be individually controlled. In this way, the light source can be adjusted to fit different driving situations to enhance safety. Projection is another featured function of LED headlights which warnings, assisting path and other information can be projected on the roads.

For tail lights, individually controlled LEDs are adopted for delivering information to warn or communicate with other road users. The Volkswagen Group has presented vehicle lighting systems with these interactive and communicable functions.

Meanwhile, automotive dashboards integrated with LED lighting are a mainstream development. Automotive LED displays are believed to be the next step as they can show more detailed information required for alternative fuel vehicles and autonomous cars. Tesla, Audi TT and BMW i8 have adopted digital dashboards with LED backlights.

Display panels with driving assistance and navigation functions have been integrated into rear view mirrors as well. In 2016, panoramic display rear view mirrors were introduced. With four to seven automotive cameras installed, the back side situation of a car could be displayed. Panoramic display rear view mirrors will be more popular and common as the technology of automotive cameras and sensors become more mature and the price of these components decline.

Revenue of automotive LED increases for big brands

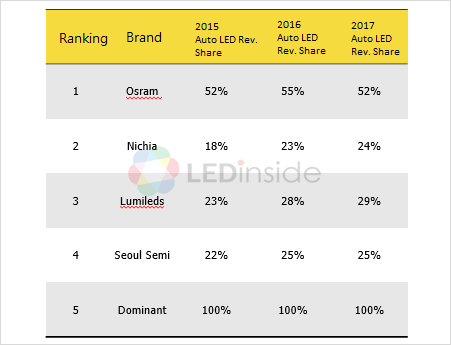

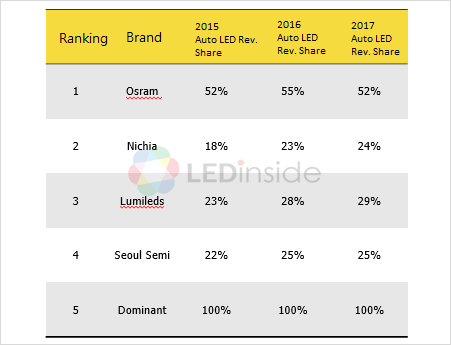

Stability is an essential requirement for automotive LEDs. As a result, leading big names have their advantages in the global automotive LED market, especially for original equipment. Osram, Nichia and Lumileds are the top three suppliers of automotive LED in the global market. These leading providers have shifted the focus to automotive and other niche LED applications from lighting and backlight since the formers are more profitable. Therefore, the revenue shares of automotive lighting for leading LED producers continue to rise.

At the same time, LED manufacturers from China and Taiwan are putting efforts to be involved in the supply chain of OEMs, aiming to increase their automotive LED market share. Everlight, for example, unveiled in 2018 that it has been engaged in the supply chain of a tier 1 manufacturer. The company also demonstrated a matrix headlamp and a multi array rear lamp at Electronica 2018. EOI, a Taiwan-based automotive LED lighting supplier, has provided its Flexible Uniflex rear lamp module for Tesla Model 3.

LEDinside 2018 Chinese Automotive Lighting Market Report - Passenger Car and Logistics Car Market Analysis

Release: 31 May 2018

Language: Chinese / English

Format: PDF

Page: 213

CN

TW

EN

CN

TW

EN