AIXTRON: Further acceleration of growth in Power Electronics / Efficient power electronics based on GaN and SiC remain drivers of success / 2023 growth guidance confirmed

AIXTRON SE: Further acceleration of growth in Power Electronics

Efficient power electronics based on gallium nitride (GaN) and silicon carbide (SiC) remain drivers of success / 2023 growth guidance confirmed

Herzogenrath, Germany, April 27, 2023 – AIXTRON SE (FSE: AIXA, ISIN DE000A0WMPJ6), a leading provider of deposition equipment to the semiconductor industry, has seen continued strong demand for equipment from all areas of the addressed compound semiconductor industry. This in particular applies to systems for the production of efficient power electronics based on gallium nitride (GaN) and silicon carbide (SiC) which enjoy a further acceleration of growth. A number of large customers have chosen AIXTRON to set up their high-volume manufacturing facilities for GaN and SiC.

The order momentum for GaN continues to grow due to the increased adoption of this new material in power electronics. Orders from this area accounted for more than a third of equipment order intake in Q1/2023: One reason for this was that customers are using the material for new, additional applications e.g., in medium voltage or solar applications. In addition, several major customers are systematically proceeding to set up high-volume manufacturing capacities, relying here on AIXTRON as a core supplier.

From one of these leading manufacturers in the semiconductor industry, AIXTRON recently received their Supplier Excellence Award. This award acknowledged AIXTRON's close partnership in the development of their high volume manufacturing capacity on the one hand and the all new AIXTRON GaN deposition tool G10-GaN, which the customer is already using on the other hand. This system which offers an improved performance with significantly higher productivity, lower cost per wafer, and a completely new design with a considerably reduced clean room footprint, will be officially launched later this year.

SiC also continues its strong growth path, driven by the ongoing expansion of electromobility. Also here, several of AIXTRON's customers continue to build up their high volume manufacturing capacities based on AIXTRON equipment. The new G10-SiC system, which was introduced in Q3/2022, is proving to be very successful, also when integrated in already running operations at customer's sites. This is yet another proof point that this SiC tool will become the top-selling product in 2023. In addition, AIXTRON continues to win further customers with this new product.

Accordingly, AIXTRON again recorded high order intake in the first quarter of 2023 due to this strong momentum in power electronics. In addition, orders for Micro LED and Optoelectronics equipment as well as the after sales business contributed to the high overall demand.

Strong order intake

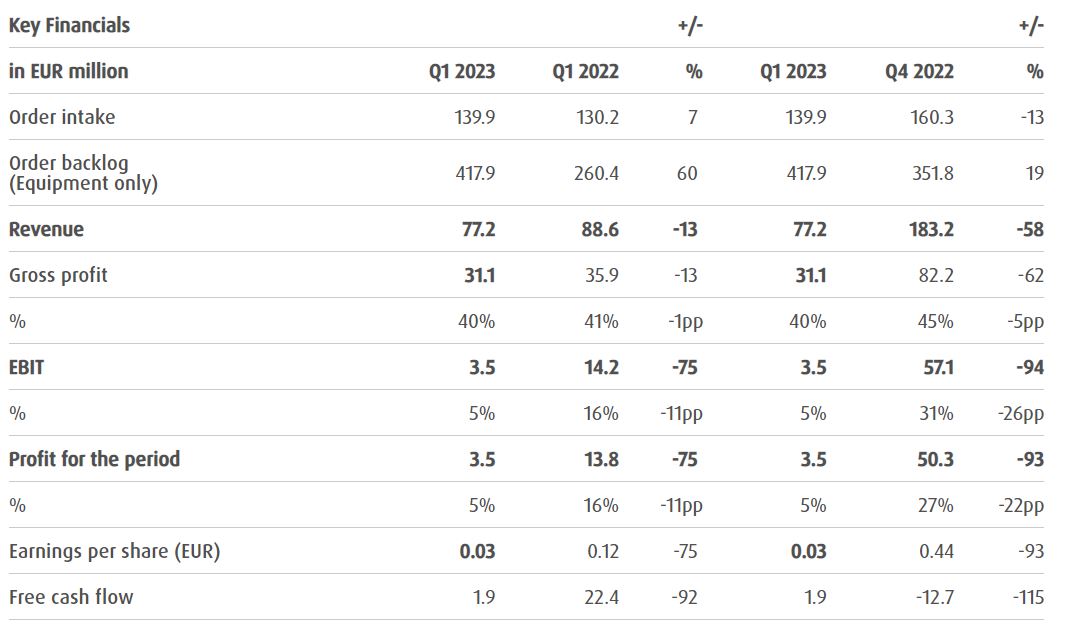

In the first quarter of 2023, the company's order intake increased by 7% to EUR 139.9 million (Q1/2022: EUR 130.2 million). Driven by this positive order development, AIXTRON's equipment order backlog in the quarter increased accordingly, reaching EUR 417.9 million as of March 31, 2023, which is an increase year-on-year by 60% (Q1/2022: EUR 260.4 million).

Revenues

In the first three months of 2023, revenues reached EUR 77.2 million, and were 13% lower than in same quarter of the previous year (EUR 88.6 million). This is mainly due to the fact that export licenses for tools ready for delivery in Q1/2023 were not yet issued as of the reporting date.

Full-year growth guidance confirmed

Due to the continued strong demand and stable supply chains, the Executive Board continues to expect an increased growth with rising order intake and margins for the full year. The full-year guidance given in February 2023 is therefore confirmed.

In line with the revenues, gross profit in the first quarter of 2023 was at EUR 31.1 million (Q1/2022: EUR 35.9 million) and gross margin was at 40% (Q1/2022: 41%).

In the first three months of 2023, operating expenses reached EUR 27.6 million and were slightly higher than in the same period 2022 (Q1/2022: EUR 21.7 million). This was mainly due to higher expenses in the area of research and development. With an operating result (EBIT) of EUR 3.5 million and an EBIT margin of 5% (Q1/2022: EUR 14.2 million, 16%), the profit for the period in Q1/2023 was EUR 3.5 million (Q1/2022: EUR 13.8 million).

Financial position

In the first quarter 2023, AIXTRON's free cash flow was EUR 1.9 million (Q1/2022: EUR 22.4 million). The difference year-on-year is mainly due to the quarter's lower profit for the period and a further increase in inventories.

As of March 31, 2023, AIXTRON reported cash and cash equivalents including other financial assets of EUR 327.5 million (Dec. 31, 2022: EUR 325.2 million). The deviation compared to December 31, 2022, was mainly due to the current result, inflows from customer receivables and advance payments which were almost fully offset by the increase in inventories. The equity ratio as of March 31, 2023 was 72% (Dec. 31, 2022: 73%).

Reflecting the strongly growing core business, the number of employees (full-time equivalent employees as of the reporting date) in the group continued to grow. As of March 31, 2023, 974 employees worked for AIXTRON (Dec. 31, 2022: 895).

2023 full-year growth guidance confirmed

For the year 2023, the Executive Board expects the high demand for MOCVD systems to further increase and has therefore confirms the 2023 full-year growth guidance that was given in February 2023.

Accordingly, Management expects the total order intake in the Group to range between EUR 600 million and EUR 680 million for the full year 2023. At revenues between EUR 580 million and EUR 640 million, the Executive Board expects to achieve a gross margin of around 45% and an EBIT margin of around 25'%.

"SiC and GaN for efficient power electronics offer an enormous growth potential which is further driven by the overall trend towards energy efficiency in general and specifically by the acceleration of the e-mobility expansion. For AIXTRON, this is reinforced by the fact that several major customers are moving into volume production and are relying on AIXTRON's innovative technology solutions and systems for this important and necessary step. This is yet another evidence for the success of our strategy and our development from a niche supplier to a reliable partner enabling industrial scale production in the semiconductor industry," says Dr. Felix Grawert, CEO and President of AIXTRON SE.

"AIXTRON's technology is paving the way to a more sustainable, electrified and connected world. In doing so, we are serving current megatrends while already working on tomorrow's innovations. With our cutting-edge technology and the expertise of our employees, we are creating industrial solutions that are unique on the market. Our customers response is the best proof that we are on the right track," says Dr. Christian Danninger, CFO of AIXTRON SE.

CN

TW

EN

CN

TW

EN