Second quarter 2023¹

-

Signify's installed base of connected light points increased from 117 million in Q1 23 to 119 million in Q2 23

-

On track for all Brighter Lives, Better World 2025 sustainability program commitments

-

Sales of EUR 1,644 million; nominal sales decline of -10.5% and CSG of -8.6%

-

LED-based sales represented 84% of total sales (Q2 22: 84%)

-

Adj. EBITA margin of 8.3% (Q2 22: 9.5%)

-

Net income of EUR 45 million (Q2 22: EUR 248 million)

-

Free cash flow of EUR 88 million (Q2 22: EUR 135 million)

Eindhoven, the Netherlands – Signify (Euronext: LIGHT), the world leader in lighting, today announced the company’s second quarter 2023 results.

“In the second quarter, we saw continued softness in the consumer, indoor professional and OEM channels and a slower than anticipated recovery of the Chinese market. Against this backdrop, our actions to improve gross margin are paying off, although fixed costs reduction plans are not yet fully compensating for the volume decline. While our Digital Solutions and Conventional Products divisions demonstrated resilience in their bottom line, our Digital Products division was more exposed to these challenges,” said Eric Rondolat, CEO of Signify.

“The continued economic softness has led us to apply caution in our outlook for the full year and adjust our Adjusted EBITA margin guidance to 9.5-10.5%. On the other hand, our free cash flow generation has and will continue to benefit from supply chain lead time improvements and effective working capital measures. We therefore expect our free cash flow generation to be at the higher end of the 6-8% range. To optimize our global operations, we have begun implementing structural measures to adapt our cost structure to the market environment. These measures will enable enhanced performance and a stronger focus on growth opportunities.”

Brighter Lives, Better World 2025

In the second quarter of the year, Signify remained on track to deliver on its Brighter Lives, Better World 2025 sustainability program commitments:

Double the pace of the Paris Agreement

Signify is on track to reduce emissions across the entire value chain by 40% against the 2019 baseline - double the pace required by the Paris Agreement. This is driven by Signify’s leadership in energy efficient and connected LED lighting solutions, which significantly reduce emissions during the use phase.

Double Circular revenues

Circular revenues remained stable at 29%, on track to reach the 2025 target of 32%. The main contribution is from serviceable and upgradeable luminaires, including the first serviceable Horticulture product family.

Double Brighter lives revenues

Brighter lives revenues increased to 28%, on track to reach the 2025 target of 32%. This was driven by the performance of Cooper’s tunable products supporting the consumer well-being portfolio and continued strength of the safety & security portfolio.

Double the percentage of women in leadership

The percentage of women in leadership positions continued to improve to 30%, on track to reach the 2025 target of 34%. This was mainly due to the acceleration of hiring practices for diversity across all levels.

Outlook

The continued economic softness has led us to apply caution in our outlook for the full year and adjust our Adjusted EBITA margin guidance to 9.5-10.5%. On the other hand, our free cash flow generation has and will continue to benefit from supply chain lead time improvements and effective working capital measures. We therefore expect our free cash flow generation to be at the higher end of the 6-8% range.

Financial review

Second quarter

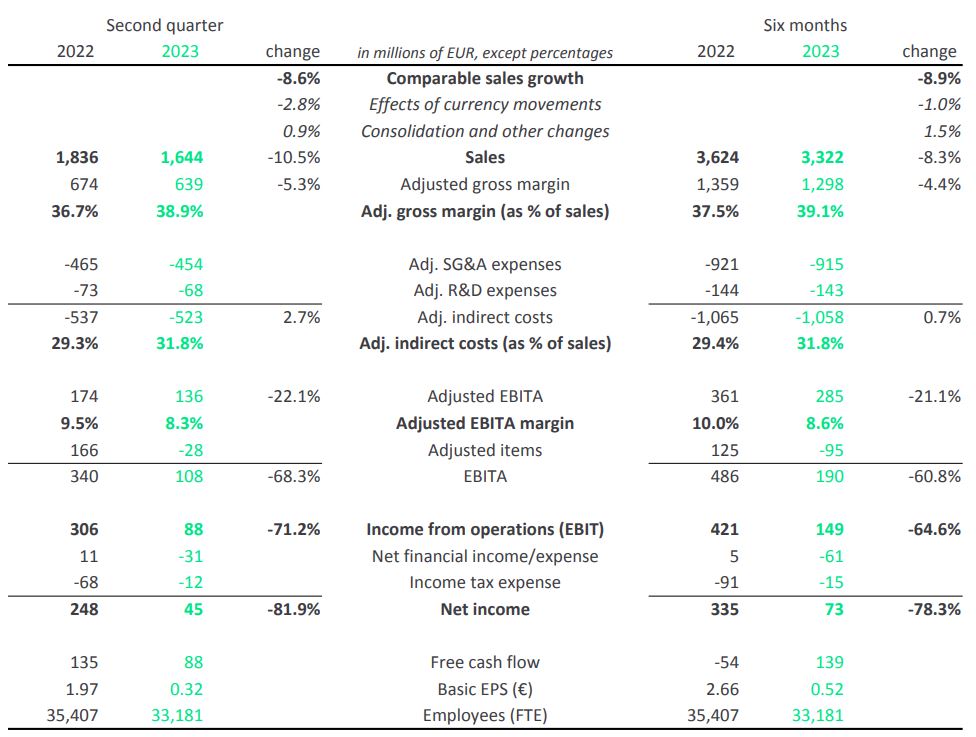

Nominal sales decreased by 10.5% to EUR 1,644 million, including a negative currency effect of 2.8%, mainly from CNY depreciation, and a positive effect of 0.9% from the consolidation of Fluence, Pierlite and Intelligent Lighting Controls (ILC). Comparable sales declined by 8.6%, as the indoor professional business, the consumer segment and the OEM channel continued to be weak.

The Adjusted gross margin increased by 220 bps to 38.9% driven by effective COGS management and price discipline. Adjusted indirect costs as a percentage of sales increased by 250 bps to 31.8%, as indirect costs did not keep pace with lower sales.

Adjusted EBITA was EUR 136 million. The Adjusted EBITA margin decreased by 120 bps to 8.3%, mainly due to under-absorption of fixed costs. Digital Products was mainly impacted, while Digital Solutions and Conventional Products both achieved Adjusted EBITA margin gains.

Restructuring costs were EUR 9 million, acquisition-related charges were EUR 3 million and incidental items had a negative impact of EUR 16 million.

Net income decreased to EUR 45 million, mainly due to lower income from operations and higher financial expenses, partly offset by lower income tax expense due to lower taxable income. In Q2 2022, income from operations included a EUR 184 million gain from the disposal of non-strategic real estate, while financial income included a benefit from a non-cash fair value adjustment of the Virtual Power Purchase Agreements.

The number of employees (FTE) decreased from 35,407 at the end of Q2 22 to 33,181 at the end of Q2 23. The year-on-year decrease is mostly related to a reduction of factory personnel due to lower production volumes. In general, the number of FTEs is affected by fluctuations in volume and seasonality.

TrendForce 2023 Global LED Lighting Market Analysis-1H23

Publication dates: February 10, 2023; July 31, 2023

Language: Traditional Chinese/English

File format: PDF and EXCEL

Number of pages: 100 (in each publication)

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN