In 2022, as global market was stalked by a vicious economic downturn, most LED video wall manufacturers reported poor financial results. But as the saying goes, beyond the bitter end of winter lies the promise of radiant skies and thawing days. Following an economic upturn in 2023, the demand side, industry chain, and end market of LED video wall industry have regained vitality, empowering the total market size of LED video wall industry to further expand.

Overall LED Video Wall Market Picked up

On the demand side, while Chinese domestic market demand slowly warmed up, overseas markets enjoyed massive demands, especially in high-margin segments like outdoor rental and outdoor advertising LED video walls, benefited from the resumption of various activities in commerce, entertainment, and other sectors.

On the supply side, LED video wall manufacturers stayed vigorous in technological innovation and continually channelled efforts into research and development, further promoting the maturity of Micro/Mini LED technologies like COB and MIP, bringing down cost and boosting demand growth from the supply side.

On the application side, emerging markets such as cinema display and LED All-in-One maintained steady growth. Meanwhile, LED video wall has an increasingly larger footprint in markets including commerce, entertainment, sports, healthcare, and military, representing the diversification of applications and the increase of growth opportunities for LED video wall.

Against this backdrop, LED video wall manufacturers successfully reversed the situation of decline in business performance. According to five public companies’ annual financial reports for 2023, Unilumin, Absen, and Leyard achieved revenue growth. Unilumin, Absen and Ledman saw an increase in net profit, and Liantronics turned losses into profits.

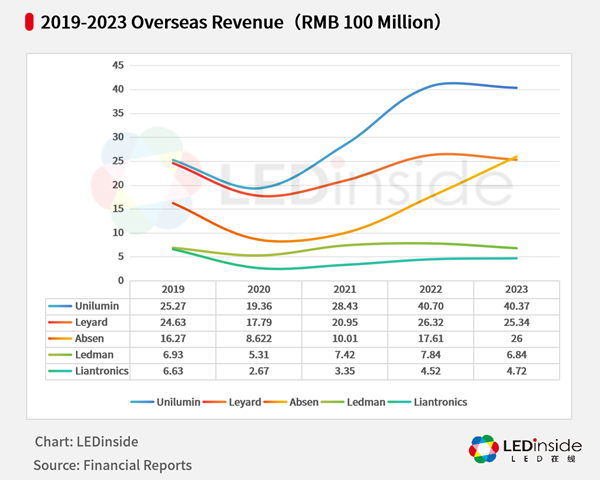

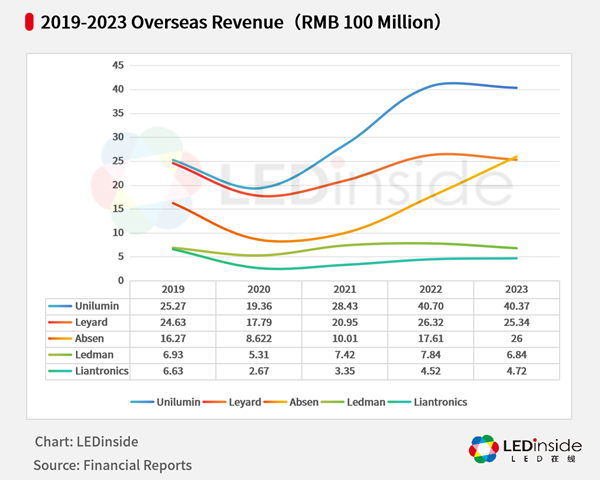

It is noteworthy that they delivered impressive results in overseas markets. For instance, Unilumin and Ledman further improved their gross margins for overseas business, with Unilumin achieving a gross margin of 37.55%. Overall, the LED video wall industry has showed positive signs.

Unilumin Topped the List by Revenue, Reshaping the Market Landscape of LED Video Wall Industry

In 2023, Unilumin recorded remarkable business performance. It achieved a revenue of RMB 7.41 billion (+4.73% YoY), and a net profit of RMB 144 million (+127.06% YoY). On profitability, with an improvement in the gross margins of both domestic and overseas business, Unilumin’s overall gross margin increased by 2% to 28.8%.

By product category, Unilumin's income was generated by four segments: intelligent display (LED video wall), smart lighting, cultural and creative lighting, and others. As the core business, intelligent display achieved a revenue of RMB 6.686 billion (+4.11% YoY), shipping LED video walls with a total area of up to 749,580.15 square meters (+16.61% YoY) in 2023. Benefited from the growth in sales volume and effective cost management, the gross margin of this business reached 28.91% (+1.38% YoY).

On a revenue scale basis (LED video wall business alone), Unilumin won the title. Currently, the top 3 companies are respectively Unilumin, Leyard and Absen, among LED video wall public companies.

Unilumin Steadily Takes the Lead in LED Video Wall Industry through Comprehensive Development

In retrospect, it's evident that Unilumin Group always has what it takes, and this is surely not its first time to hold the top position in LED video wall industry. For instance, regarding product shipment by LED video wall area, the company has consistently ranked first among public companies for 5 consecutive years since 2019, and so did its performance in overseas revenue.

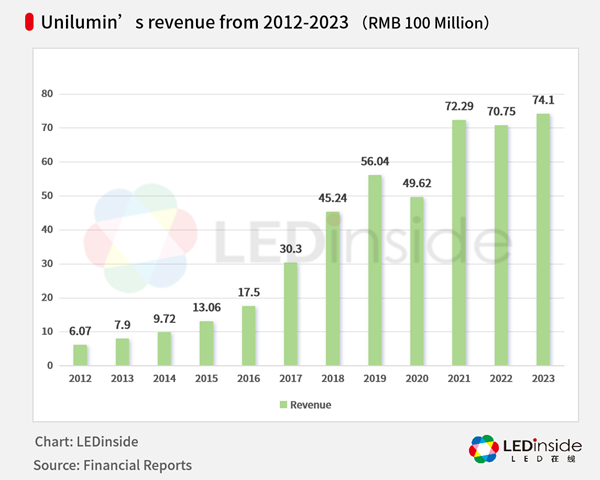

In regard to overall growth trajectory, Unilumin, listed in 2011, witnessed revenue scale to steadily and dramatically increase from RMB 600 million in 2012 to RMB 7.2 billion in 2021, which hit a new record high in 2023. Behind this accomplishment lie two competences: technology & scenarios development, brand & channel deployment.

Technology & Scenarios Development

Based on forward-looking planning and years of innovative investments, Unilumin has established an industry chain from package and module to video wall, achieving breakthroughs in COB (Chip-on-Board) and MIP (Mini/Micro LED Integrated Packaging) technologies. In addition, it has developed a full range of Mini/Micro LED products covering P0.3 to P1.8 and achieved mass production.

For COB, Unilumin completed the delivery of first COB All-in-One for outdoor advertising application in 2023, making a breakthrough in this emerging application. For MIP, Unilumin also pioneered the industry in breaking through 0202 (0.2mm*0.2mm) MIP packaging device technology; moreover, it already has the capability to produce MIP P0.4mm video wall, bracing itself for the commercialization of Micro LED technology.

As for the development of scenarios, Unilumin has diversified applications in various scenarios, including Metasight solutions, immersive virtual concerts, virtual production, LED cinema video wall, LED All-in-One, ushering in a new cycle of performance growth for the company.

Brand & Channel Deployment

With the development of COB & MIP, and the start of the Micro/Mini LED era, the business model of the LED video wall market has gradually changed. Amid the new market landscape, the importance of brand and channel continues to be highlighted, and Unilumin is also a forerunner in this regard.

Presently, Unilumin boasts three brands: ROE, Unilumin, and LAMPRO. Based on their unique market positioning and product characteristics, three brands have all penetrated various LED video wall segments.

With a global perspective in mind, Unilumin has deeply explored sales channels over the years. Its marketing network now spans over 160 countries, with more than 5,400 cooperating distributors and over 20 overseas subsidiaries and offices. Thanks to years of dedicated efforts, the scope, depth, and value of its sales and service network have been further enhanced, highlighting its market advantages. Apparently, Unilumin begins to bear fruit on the strength of comprehensive development.

Unilumin has the Potential to Continually Reign over the LED Video Wall Industry

Amidst an ever-changing market, despite a seemingly stable competitive landscape, chances are anyone can rewrite the market landscape, exemplified by Unilumin. However, in new arenas, opportunities for "overtaking" can arise at any time, and every manufacturer has the chance to snatch a victory out of defeat.

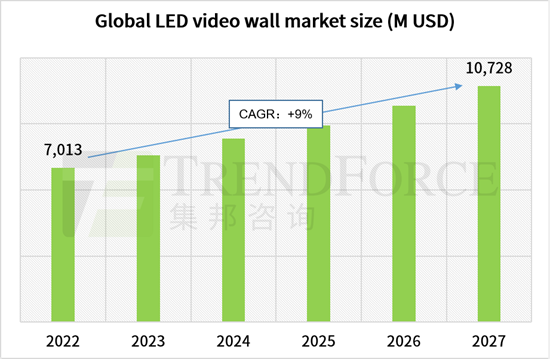

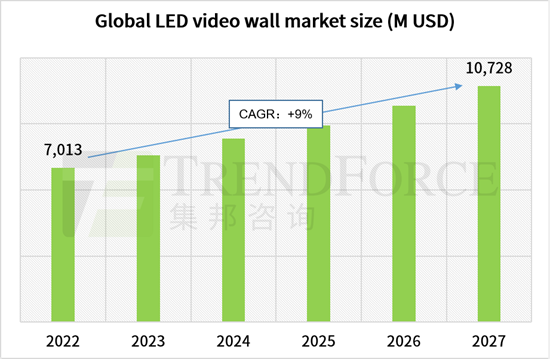

Currently, LED video wall is still in the early stages of development in many emerging application markets, presenting promising growth prospects. According to TrendForce's "2024 Global LED Video Wall Market Outlook and Price-Cost Analysis" report, driven by the development of LED fine pitch display and Mini LED display, the market size of global LED video wall is expected to maintain growth in 2024 and to reach USD 10.728 billion by 2027 at a CAGR of 9% from 2022-2027.

In face of new business opportunities, Unilumin has the potential to successfully hold its position given its keen insight and business acumen, which can find expression in the company’s overall strategic development, such as the Metasight digitalization, "LED+AI," and COG and silicon-based Micro LED technologies.

Unilumin was the first to propose “Metasight”concept in the industry, facilitating the integrated development of LED display and LED lighting. By combining software control, artistic design, IoT technology, and digital content, Unilumin has built a Metasight ecosystem to strengthen the added value of LED products, contributing to the successful creation of major projects like the Boulevard World spherical screen for Saudi Arabia Season and the world's largest LED immersive spherical theater, MSG Sphere.

Aside from Metasight ecosystem, Unilumin keenly embraced the AI-driven opportunities and developed a comprehensive solution covering LED hardware & digital assets & virtual systems & motion capture & AI in the digital broadcasting field, forming a closed-loop ecosystem vertically, laying foundation for future growth.

On advanced LED technologies, Unilumin has conducted R&D work on COG (Chip-on-Glass) and silicon-based Micro LED technologies, paving the way for its entry into the To C market.

As a whole, if Unilumin continues to hold all the trumps, it has the potential to keep reigning over LED video wall industry.(Author/Translator: Janice Chan, LEDinside/TrendForce)

TrendForce 2024 Global LED Video Wall Market Outlook and Price Cost Analysis

Release Date: 28 September 2023

Language: Traditional Chinese / English

Format: PDF

Page: 273

|

If you would like to know more details , please contact:

|

CN

TW

EN

CN

TW

EN