The chances of Chinese investor Grand Chip Investment (GCI) acquiring Aixtron are looking rather slim, following U.S. President Barack Obama recent order that bans the business transaction, reported Bloomberg.

Aixtron stated that the order prohibits GCI from acquiring any of the company assets in the U.S., including patents and patent applications.

However, the order (which can be viewed here) does not prohibit GCI from acquiring Aixtron’s shares and ADSs.

|

|

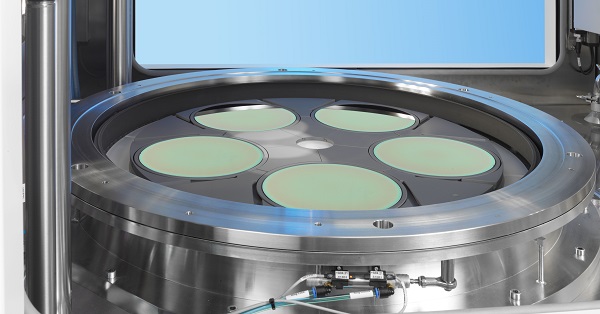

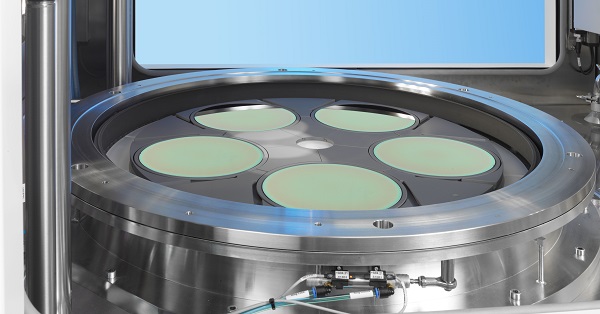

An Aixtron MOCVD equipment. (Aixtron/LEDinside) |

In the statement, GCI is weighing its options, evaluating how it will impact the acquisition.

Obama’s decision to block the EUR 670 million ($714 million) deal might lower the chances of GCI acquiring Aixtron, although a Reuters report has remained rather optimistic writing the deal could still be revived on the conditions of forgoing the German equipment manufacturers U.S. business.

"Chinese investors might be willing to take over Aixtron without its U.S. business including U.S. patents and patent applications," DZ Bank analyst Harald Schnitzer said in a client note. "That could be possible but we doubt that GCI (FGC) would be prepared to pay EUR 6 per Aixtron share in such a case."

The U.S. government pressured German Economic Ministry to call off the deal over national security concerns on Nov. 17, 2016.

At stake is Aixtron’s equipment can be used to grow GaN epiwafers that can be used in semiconductors, such as GaN drivers and others that are applied in U.S. weapon and missile systems.

Based on Reuters report, Aixtron’s technology is used to upgrade U.S. and foreign-owned Patriot missile defense systems, the Bloomberg report supply chain analyses pointed Northrop Grumman, a major U.S. defense contractor was one of Aixtron’s main customers.

The equipment manufacturer’s technology can be used to make LEDs, lasers, solar cells and military applications including satellite communications and radar.

About a third of Aixtron’s workforce of 700 employees are based in U.S., and its operations in Sunnyvale, California in the country is its third-largest site with manufacturing, sales, services, engineering as well as R&D.

During the first nine months of 2016, Aixtron’s U.S. business arm generated EUR 22 million revenue, about 20% of its total sales of EUR 107 million.

Analysts have painted a bleak outlook for Aixtron as a stand-alone company as it competes in an overcrowded market.

The German equipment maker needs to cut costs and jobs if the deal is completed, while some analysts speculated a white knight bidder such as U.S. chip equipment maker Applied Materials could emerge.

Another obstacle is the German Economy Ministry has withdrew approval for the Chinese acquisition in October and is still reviewing the transaction.

Aixtron has registered patents for 189 products as of 2015, according to its annual report. The company has patented 97 products, while the remaining 92 patent applications are still pending.

"Patent protection for inventions is usually applied for in those sales markets relevant for Aixtron, specifically in Europe, China, Japan, South Korea, Taiwan and the U.S.," the company said in the annual report.

The Chinese government has been angered by the U.S. decision to block the Aixtron deal, with the foreign ministry naming it “political obstruction.”

China’s foreign ministry spokesperson Lu Kang said China supports Chinese firms oversea investments on the foundation of market principles, international law, and local laws, adding that the Aixtron deal completely stems from commercial interests.

"China resolutely opposes the politicization of any normal commercial takeover or the wrong move of political obstruction," Lu said during a news briefing, adding that China hoped the U.S. would halt "groundless accusations" against Chinese firms and provide a fair environment for them.