As 2024 draws to a close, what were the major events in the LED industry this year?How might these events shape the future of LED development?

Here’s a roundup by TrendForce:

Meta and Google Unveil Micro LED AR Glasses Prototypes

In September and December 2024, Meta and Google released AR glasses prototypes, both featuring full-color Micro LED display technology.

Micro LED, with its higher brightness, faster response time, smaller size, and longer lifespan, is ideal for AR glasses' high display demands. Consequently, the adoption of Micro LED in AR glasses has grown annually.

The involvement of tech giants like Meta and Google has further boosted interest in Micro LED near-eye display technology. With continued brand promotion and rapid technical advancements, the commercialization of this technology is expected to accelerate, making it a major growth area for Micro LED applications.

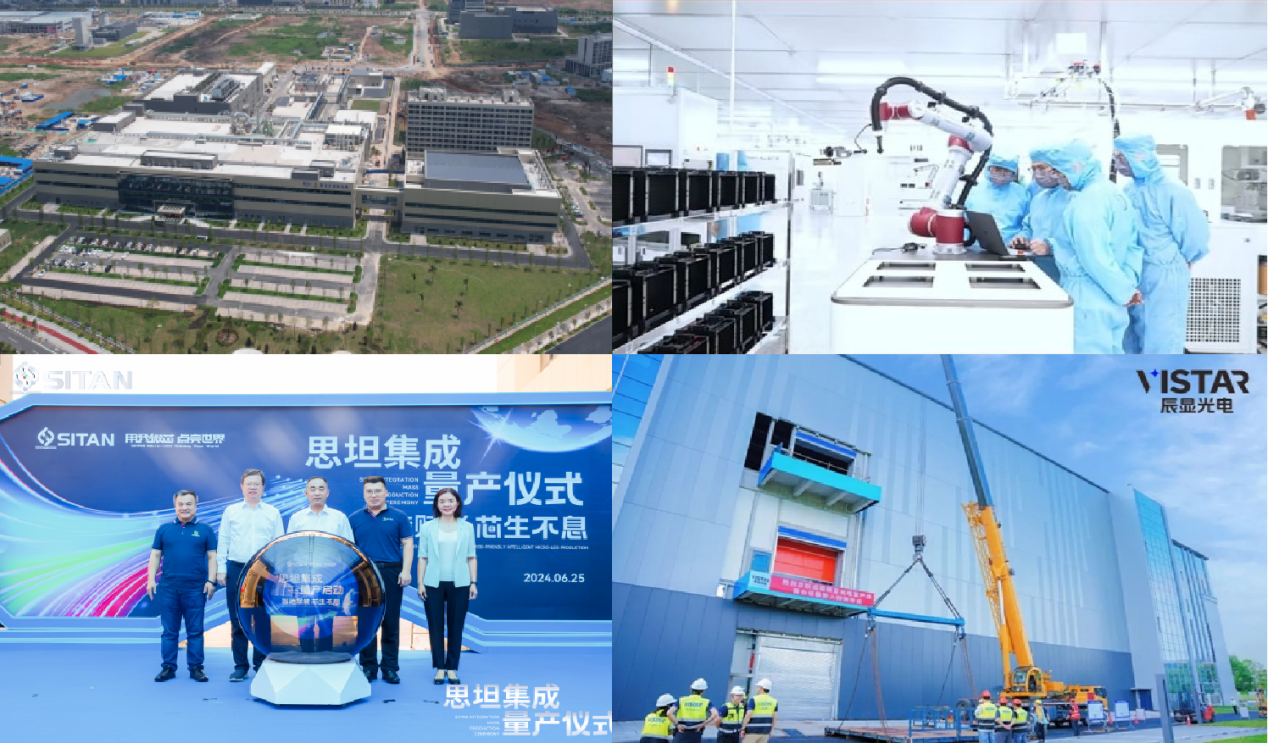

BOE, HC Semitek, Sitan Technology, Leyard, and VISTAR Launch Micro LED Production Lines

In 2024, the supply chain saw significant progress as Micro LED production lines began operations. BOE and HC Semitek launched a 6-inch production line in Zhuhai; Sitan Technology started its Xiamen Micro LED project; Leyard initiated the first phase of advanced MIP line in Wuxi; and VISTAR began producing TFT-based Micro LED in Chengdu.

With production capacity ramping up, Micro LED technology is expected to mature faster. By 2025 and beyond, it will expand into applications such as displays, AR/VR headsets, wearables, and automotive displays.

The Chinese Government Policies Drive LED Cinema Screens Boom

On May 24, six Chinese ministries issued a plan for upgrading cultural and tourism equipment, including promoting next-generation cinema systems. This policy supports widespread adoption of LED cinema screens and aims to strengthen domestic brands.

As a result, LED cinema screens became a hot topic in 2024, with the Chinese market experiencing rapid growth. By December 30, 42 new LED cinemas had opened, setting a record. Domestic companies are now looking to expand this technology into global markets.

"Black Myth: Wukong" and "Blossoms Shanghai" Highlight LED's Role in Gaming and Film

In 2024, Chinese gaming and film industries flourished. Popular projects like Black Myth: Wukong and Blossoms Shanghai spurred discussions.

Mini LED displays and LED+AI technologies have increasingly supported game development and applications.

Meanwhile, LED virtual production, as used in Blossoms Shanghai, shortened production cycles, enhanced immersive effects, and reduced post-production costs. China’s LED virtual production industry is thriving, with over 40 studios now operational.

Strategic Shifts by Lumileds, ams OSRAM, and Samsung

In 2024, several leading companies restructured their LED businesses:

-

Lumileds sold its traditional automotive lighting division for $238 million to enhance competitiveness.

-

ams OSRAM ended its Micro LED watch collaboration with Apple but focused on AR and automotive displays.

-

Samsung announced plans to exit the lighting LED business by 2H 2025, shifting toward higher-margin products.

These moves will impact emerging LED technologies and reshape the competitive landscape.

Nationstar and Leyard Sign Major Base Projects

Nationstar invested ¥2 billion in its new production base to manufacture RGB small-pitch, Mini/Micro LED, and other advanced products. Leyard signed a ¥1 billion project in Changsha to focus on smart displays, urban lighting, virtual reality, and cultural applications.

These investments lay the groundwork for the diversified application of LEDs in 2025 and beyond.

Chinese Companies Expand into Southeast Asia and the Middle East

In 2024, Chinese LED companies accelerated overseas expansion, focusing on high-growth regions like Southeast Asia and the Middle East.

MTC announced a Vietnam base and a Singapore subsidiary; Leyard established a Dubai subsidiary; AOTO Electronics invested in a Thailand subsidiary etc........

These moves capitalize on growth opportunities in emerging markets.

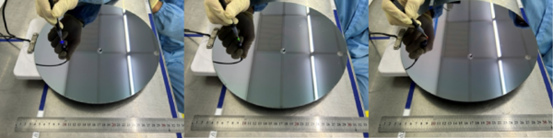

Chip Innovations Backed by LatticePower's Silicon Substrate Technology

Micro LED breakthroughs in 2024 were fueled by LatticePower's silicon substrate materials. Achievements included:

-

Ultra-high brightness (400,000 nits) and resolution (3300 PPI) Micro LED displays.

-

A 10-million-nit green Micro LED module.

-

High-performance silicon-based InGaN red Micro LEDs.

Large-size silicon substrate GaN-based Micro LED epitaxy technology boasts superior characteristics, including high substrate removal yield, high CMOS bonding yield, large size, low cost, and low warpage. In the future, silicon substrate epitaxy technology is expected to become a key driver for the commercialization of Micro LED displays.

LED Industry Leaders Celebrate 20 Years

In 2024, companies like Unilumin, Qiangli, Hongli Zhihui, and Leyard celebrated their 20th anniversaries. These firms have been instrumental in shaping China’s LED industry, symbolizing its growth from follower to leader on the global stage.

NovaStar and APT Electronics Go Public

NovaStar and Jinko Electronics successfully listed on the Shenzhen and Hong Kong stock exchanges in 2024, receiving strong market responses: NovaStar shares surged 230% on the first day; APT Electronics Ltd.set a record for oversubscription in tech IPOs, with shares up 45.43% on debut.

This reflects capital market optimism about the LED industry's prospects, likely encouraging more companies to pursue IPOs and drive technological innovation.

Gold+ Member Report

Gold+ Member Report

|

Report Title

|

Content

|

Format

|

Publication

|

|

LED Industry Demand

and Supply Database

|

Demand Market Analysis:

|

PDF / Excel

|

1Q (Mid Mar.)

3Q (Early Sep.)

|

|

2024-2028 Demand Market Forecast

|

|

(Backlight and Flash LED / General Lighting / Agricultural Lighting / Architectural Lighting / Automotive- Passenger Car & Box Truck & Scooter / Video Wall / UV LED / IR LED / Micro LED / Mini LED)

|

|

Supply Market Analysis:

|

|

1. LED Chip Market Value (External Sales, Total Sales)

|

|

2. WW New / Accumulated GaN LED and AS/P LED MOCVD Chamber Installations

|

|

3. GaN LED and AS/P LED Wafer Market Demand (By Region / By Wafer Size)

|

|

4. GaN LED and AS/P LED Wafer Market Demand and Supply Analysis

|

|

LED Player Revenue

and Capacity

|

LED Chip Market Analysis:

|

PDF / Excel

|

2Q (Early Jun.)

4Q (Early Dec.)

|

|

Top 10 LED Chip Manufacturers by Revenue and Wafer Capacity

|

|

LED Package Market Analysis:

|

|

LED Package Manufacturers: Total Revenue, LED Revenue, and Capacity Analysis

|

|

Top 10 LED Package Players by Revenues in Backlight and Flash LED, Lighting, Automotive, Video Wall, UV LED

|

|

LED Industry Price Survey

|

Sapphire / Chip / Package (Backlight, General Lighting, Agricultural Lighting, Automotive, Video Wall, UV LED,

IR LED, VCSEL)

|

Excel

|

1Q (Mid Mar.)

2Q (Early Jun.)

3Q (Early Sep.)

4Q (Early Dec.)

|

|

LED Industry

Quarterly Update

|

Major Players Quarterly Update:

|

PDF

|

1Q (Mid Mar)

2Q (Early Jun)

3Q (Early Sep)

4Q (Early Dec)

|

|

EU / U.S.- Lumileds, ams OSRAM, Cree LED

(Smart Global Holdings)

|

|

JP- Nichia, Citizen, Stanley, ROHM

|

|

KR- Samsung, Seoul Semiconductor, Seoul Viosys

|

|

ML- Dominant

|

|

TW- Ennostar, Everlight, LITEON, AOT, Harvatek, PlayNitride

|

|

CN- San’an, Changelight, HC SemiTek, Aucksun, Focus Lightings, Nationstar, Hongli, Refond, Jufei, MTC, MLS

|

|

Micro/Mini LED

Exhibit Report

|

CES 2024 / Touch Taiwan 2024 / Display Week 2024

|

PDF

|

Aperiodically;

<20 Pages

|