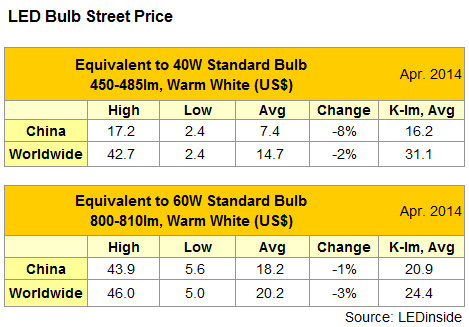

Global 40W equiv. LED bulb Average Selling Price (ASP) dipped slightly by 1.5% in April 2014 to US $14.7, with price decrease most evident in China, according to the latest LED bulb retail findings from LEDinside, a research subsidiary of TrendForce. Global 60W equiv. LED bulb ASP dropped 2.5% to US $20.2.

ASPs for 40W equiv. and 60W equiv. LED bulbs in China both fell last quarter, with price drops most evident for 40W equiv. bulbs, according to LEDinside. China’s 40W equiv. LED bulb ASP decreased 22.9 percent QoQ to US $7.4 in April 2014, making it the lowest globally. International brands are less price competitive, as Chinese manufacturers continue to dominate the low-mid priced LED bulb market”, said LEDinside Analyst Terri Wang.

Chinese lighting manufacturers have sped up investments in the LED market, most notably in bulb retrofit. Although overt market competition has caused unsatisfactory gross profits , it helps acquiring necessary market shares, and establishing a firm foundation to uphold Chinese manufacturers advantages in the domestic market. Additionally, most Chinese lighting manufacturers have a background in manufacturing, giving them an advantage in cost management and resource integration. Moreover, Chinese manufacturers are able to easily find suppliers in the local supply chain, offering them more vertical integration opportunities. In contrast, business opportunities from the LED replacement tide remains the main focus of large international manufacturers, such as Philips and Osram., consequently they are currently less interested in the Chinese market and have not responded to the raging price wars, thus providing Chinese manufacturers ample room for growth.

Chinese 40W equiv. bulb ASP plunges, while global 60W equiv. bulb ASP steadily declines

In China, 40W equiv. bulb ASP dipped 7.9% in April 2014, with existing products continued to show price decline. For instance, Foshan Lighting’s 7W bulb price further decreased from US $2.9 to US$2.4 in April after the drop in March. Price drops in the UK region were also evident in April, falling by 6.4%. Toshiba’s 7.7W, 470 lm LED bulb, for example plunged from US $25.6 to US $16.7 in April 2014.

In the 60W equiv. LED bulb sector, ASP in Japan declined 14.5% to US $16.4 last month. Similarly, bulb ASP in Germany was also down 6.9% during the same period, partly because of fluctuations in exchange rates.

CN

TW

EN

CN

TW

EN