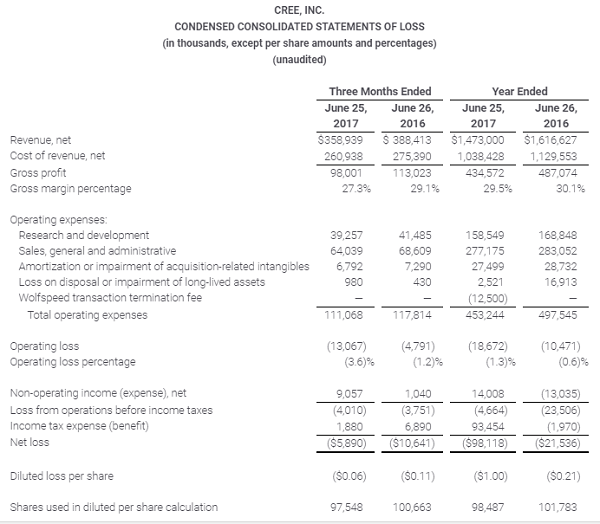

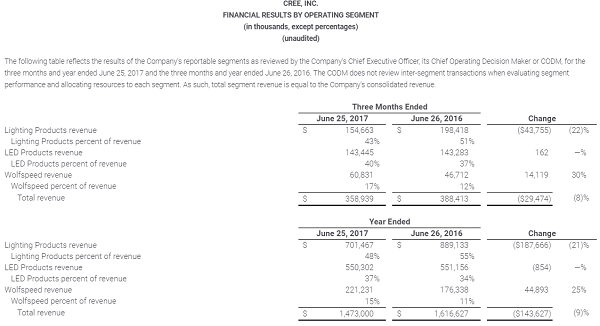

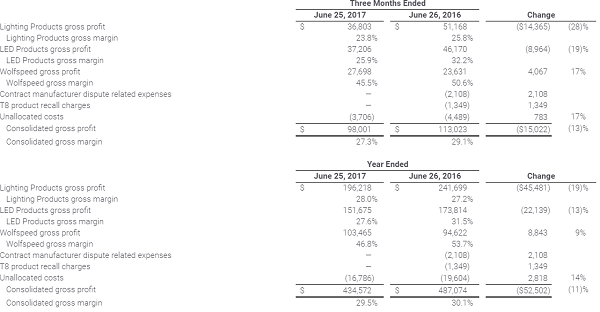

Cree, Inc. yesterday announced revenue of $359 million for its fourth quarter of fiscal 2017, ended June 25, 2017. This represents an 8% decrease compared to revenue of $388 million reported for the fourth quarter of fiscal 2016, and a 5% increase compared to the third quarter of fiscal 2017. GAAP net loss for the fourth quarter was $6 million, or $0.06 per diluted share, compared to GAAP net loss of $11 million, or $0.11 per diluted share, for the fourth quarter of fiscal 2016. On a non-GAAP basis, net income for the fourth quarter of fiscal 2017 was $4 million, or $0.04 per diluted share, compared to non-GAAP net income for the fourth quarter of fiscal 2016 of $19 million, or $0.19 per diluted share.

|

|

(Image: LEDinside) |

For fiscal year 2017, Cree reported revenue of $1.5 billion, which represents a 9% decrease compared to revenue of $1.6 billion for fiscal 2016. GAAP net loss was $98 million, or $1.00 per diluted share, compared to net loss of $22 million, or $0.21 per diluted share, for fiscal 2016. On a non-GAAP basis, net income for fiscal year 2017 was $50 million, or $0.50 per diluted share, compared to $88 million, or $0.86 per diluted share, for fiscal 2016.

"We made progress in Q4, with good results in each business and non-GAAP earnings per share that were in the middle of our target range," statedChuck Swoboda, Cree Chairman and CEO. "We built a solid foundation for growth in all three businesses over the last year. In the near term, we will have some incremental spending to expand capacity and are excited about the opportunity for Cree to grow revenue and profits in the year ahead."

Business Outlook:

For its first quarter of fiscal 2018 ending September 24, 2017, Cree targets revenue in a range of $353 million to $367 million. GAAP net loss is targeted at $20 million to $25 million, or $0.20 to $0.25 per diluted share. Non-GAAP net income is targeted in a range of $2 million to $6 million, or $0.02 to $0.06 per diluted share. Targeted non-GAAP income excludes $18 million of pre-tax expenses related to stock-based compensation expense and the amortization of acquisition-related intangibles. The GAAP and non-GAAP targets do not include any estimated change in the fair value of Cree's Lextar investment.

|

|

|

|

|

|

For more details about Cree's financial results, click here. (Image: Cree) |