Second highest order intake in company history / Continued strong demand for GaN and SiC power electronics / Double-digit growth for 2023 / High EU taxonomy aligned figures further increased

Herzogenrath, Germany, February 28, 2023 – AIXTRON SE (FWB: AIXA, ISIN DE000A0WMPJ6) continued to grow in 2022 fiscal year, and met the growth guidance for the full year 2022 in all areas. This was driven by the ongoing strong demand for efficient gallium nitride (GaN) and silicon carbide (SiC) based power electronics, particularly for ecologically sustainable applications. While in 2021 this area still accounted for around 45% of the order intake, the share has grown to well over half of incoming orders in the past twelve months. Also the demand for optoelectronics and laser equipment, as well as for LED and micro LED remains strong, enabling AIXTRON to expand its strong market position. From the third quarter onwards, AIXTRON's newly launched G10-SiC system for the production of energy-efficient SiC-based power devices had a strong impact on the overall growth.

Order situation: second largest order intake in the company's history

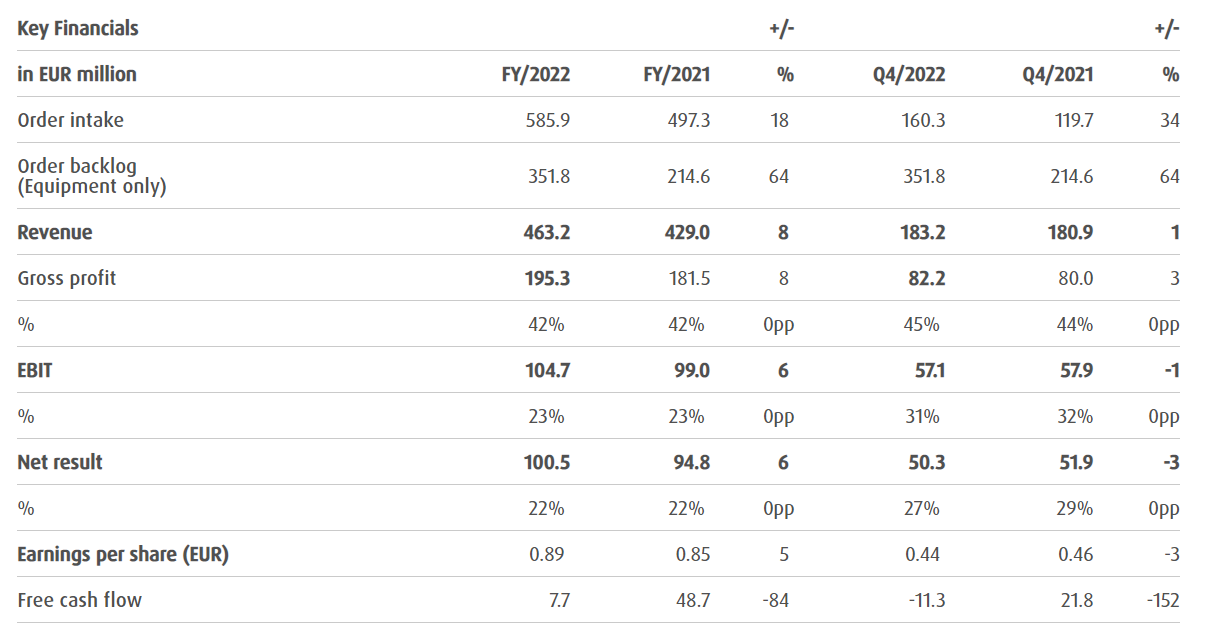

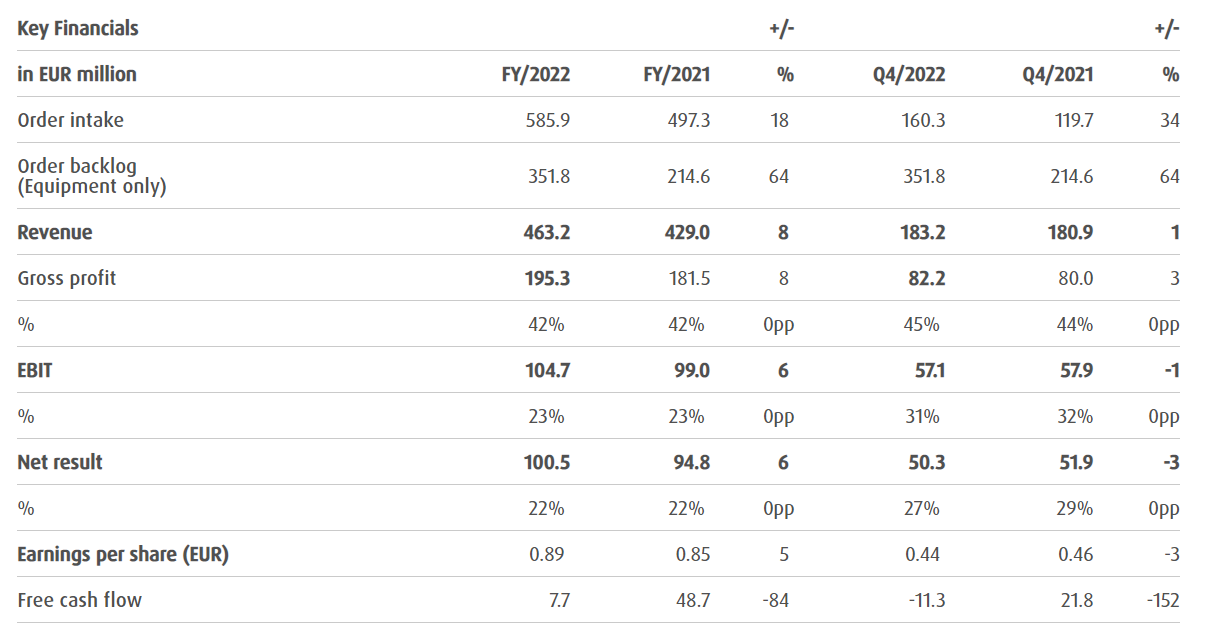

AIXTRON's order intake for the full year 2022 increased by 18% to EUR 585.9 million (2021: EUR 497.3 million). This was the Company's second best order intake in its almost forty-year history, after 2010.

In the fourth quarter 2022, the order intake reached EUR 160.3 million, up 34% compared to the same quarter last year (EUR 119.7 million), further demonstrating the strong demand and yet again another proof point for the lasting trend towards efficient GaN and SiC power electronics.

Order backlog and new record deliveries

Driven by this overall positive order development, AIXTRON's equipment order backlog increased by an impressive 64% to EUR 351.8 million in 2022, compared to EUR 214.6 million in the previous year.

Revenues continue at high levels driven by megatrends

In terms of shipments, AIXTRON in 2022 scored its best fourth quarter result since Q1/2011, recording revenues of EUR 183.2 million, a slight improvement compared to the strong revenues achieved in the same quarter in 2021 (Q4/2021: EUR 180.9 million). For the full year 2022, revenues increased by 8% to EUR 463.2 million (2021: EUR 429.0 million), driven by the ongoing global megatrends sustainability, electrification and digitalization. Systems for wide-band-gap power electronics (GaN and SiC) accounted for the largest share in terms of revenues (42%), followed by systems for optoelectronics (28%) and LEDs including Micro LEDs (27%). In the case of the latter, the growing demand for Micro LEDs led to higher revenues compared to the previous year.

Dynamic earnings growth

Overall, AIXTRON was able to continue the revenue and earnings growth of 2021: Gross profit in 2021 was EUR 181.5 million and grew further during 2022 to EUR 195.3 million, a plus of 8%. The final quarter was again particularly strong with a gross profit of EUR 82.2 million – up 3% compared to the same quarter of the previous year.

In anticipation of a further increase in the demand for the tools and future technologies of the Company, investments were not only made to strengthen the Company structures. Significant investments were also made in research and development (R&D): With EUR 57.7 million, the already high level of investments in R&D from the previous year was not only maintained, but even slightly increased (2021: EUR 56.8 million).

Also, AIXTRON's operating result (EBIT) once again exceeded the very strong figures from the previous year: in fiscal year 2022, it increased by 6% reaching EUR 104.7 million (2021: EUR 99.0 million). The fourth quarter was again very strong – these last three months of the year accounted for EUR 57.1 million, comparable to the performance in Q4 of 2021 (EUR 57.9 million), in which the results of 2020 were more than doubled (Q4/2020: EUR 24.5 million).

Consolidated net profit for the year 2022 grew by 6% year-on-year to EUR 100.5 Mio. (2021: EUR 94.8 million). Earnings per share improved to EUR 0.89 from EUR 0.85 in the previous year.

The Company was again able to achieve the same high gross margin level as in 2021, i.e. 42%. The EBIT margin was in line with the guidance, again reaching a strong 23% which is yet another proof point for AIXTRON's continuous high profitability.

Build-up of inventories and financial position

Free cash flow in the 2022 fiscal year was EUR 7.7 million (2021: EUR 48.7 million). The difference compared to the previous year is mainly the result of a build-up of inventories to EUR 223.6 million compared to EUR 120.6 million in the previous year. On the one hand, inventories were created due to delayed deliveries of some equipment at the end of the year, and on the other hand, significant quantities of materials were deliberately procured at an early stage in order to meet a continued strong increase in demand. With this strategy, AIXTRON succeeded in 2021 as well as in 2022 and despite ongoing tight supply chains and material bottlenecks was able to successfully address customer requests on time and to significantly increase the Company's revenues. Higher investments in property, especially in laboratory equipment and extensions compared to the previous year, also had a related impact on the development of the 2022 free cash flow (2022: EUR 27.4 million; 2021: EUR 16.4 million).

As of December 31, 2022, cash and cash equivalents including financial assets amounted to EUR 325.2 million (2021: EUR 352.5 million).

The equity ratio of 73% (as of December 31, 2022; previous year 80%) was lower than in 2021 which was mainly due to the significantly higher customer prepayments compared to the previous year and the correspondingly higher balance sheet total. This high value underlines the financial strength of AIXTRON.

In view of the very positive business development in the past fiscal year, AIXTRON plans to pay out a dividend again. The Executive Board and Supervisory Board will therefore propose to the Annual General Meeting on May 17, 2023 to pay a dividend of EUR 0.31 per share (2021: EUR 0.30 per share).

Given the strongly growing core business, the number of employees in the group increased in 2022 by 25% to a total of 895 compared to the 718 employees at the end of 2021. As in previous years, the majority of the employees are based in Europe.

High taxonomy-aligned figures according to the EU Taxonomy Regulation again

Since the financial year 2021, AIXTRON has been voluntarily reporting taxonomy aligned figures in accordance with the EU Taxonomy Regulation. In the 2022 fiscal year, taxonomy aligned revenues increased again amounting EUR 270.9 million or 58% (2021: EUR 243.2 million, 57%). Operating expenses (OpEx) increased to EUR 44.7 million or 73% (2021: EUR 43.0 million, 72%). The taxonomy-aligned capital expenditures (CapEx) rose to EUR 13.6 million or 38% (2021: EUR 7.6 million, 39%). These high results very impressively point to the future viability of AIXTRON's business activities.

Guidance 2023: Double-digit growth expected

For the year 2023, the Executive Board expects the high demand for MOCVD systems to further increase, which should be reflected in a double-digit growth in revenues. Based on the assessment of the order situation, the current corporate structure and the budget exchange rate of 1.15 USD/EUR (2022: 1.20 USD/EUR), Management expects an order intake for the full year 2023 to range between EUR 600 million and EUR 680 million and revenues of EUR 580 million to EUR 640 million. Furthermore, the Executive Board expects a gross margin of around 45% and an EBIT margin of around 25% to 27%.

“The current megatrends of sustainability, electrification and digitization create a continuously high demand in our core markets for our products. Accordingly, we were able to continue our strong growth from 2021 also in 2022," says Dr. Felix Grawert, CEO of AIXTRON SE. "The order situation, especially for GaN and SiC power electronics, is developing very positively. Since the third quarter of 2022, our new G10-SiC deposition tool has made a significant contribution to this as it generated very strong demand. And it is providing a key to the transition to electromobility and CO2 reductions in the mobility sector. We are also already receiving very positive feedback on our new system for optoelectronics and micro LEDs, the new G10-AsP. With all this, we are making a decisive contribution to a more sustainable and connected world."

"Our spirit at AIXTRON is characterized by the awareness that we as a Company have great responsibility, both towards our employees and towards the environment and future generations," says Dr. Christian Danninger, CFO of AIXTRON SE. "Therefore, sustainability is an important key element in our own actions as well as for our targeted research and development activities. Our latest tool generations are already making a significant contribution here. Accordingly, in 2022 the majority of our revenues were ecologically sustainable in alignment with the EU taxonomy – showing a further increase from 2021."