LEDs are a popular choice in the automotive industry for functional and aesthetic purposes. There are several demands that need to be addressed, such as size, light output, thermal management, efficiency, and long-term performance.

European Photonics Industry Consortium (EPIC) organized a conference on microLEDs for automotive apps today. Jeremy Picot-Clemente, Technology Manager for Optics and Green Photonics, EPIC, welcomed the audience.

Paul-Henri Matha, Technical Leader, Volvo, Sweden, presented on microLEDs for automotive lighting: stakes for car makers. MicroLEDs are used for lighting, road marking, and signaling and communications. The target is to always have maximum light on the road to improve traffic safety. We need adaptive driving beam with partial high beam that will not glare oncoming vehicles. Volvo has different concepts for these. Usage of microLED is required for high-definition headlamps.

Volvo offers DLP solution, with light source and micro-mirrors. The estimated power is 60W. There is HD headlamp with microLED. Estimated power is 55W. HD headlamp with microLEDs also have estimated power of 30W. We have complete high beam field of illumination with two HD modules. He demonstrated some solutions. Complete low beam of illumination does not seem enough. There is the MIND digital lighting and development process. Volvo is looking at 100kPx in 2026. We are on the way to our goal.

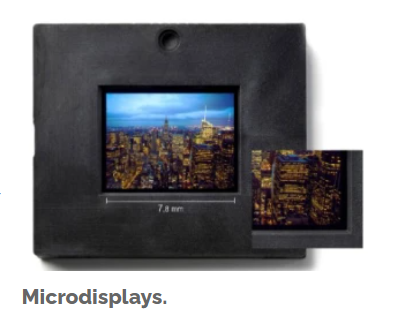

Hetero-integration of emissive frontplanes onto Si-CMOS backplanes for microdisplays and sensors was presented by Dr. Uwe Vogel, Director Microdisplays and Sensors, Fraunhofer FEP, Germany. X-on-silicon has core competencies, such as backplane IC design, and 200mm X-on-silicon wafer line for frontplane processing. Microdisplays are very small, less than 1.3″. They have high information content, and low power consumption. Enlarged images are viewed via magnifying optics. Fraunhofer develops microLEDs for customers.

Microdisplays can be emissive, reflective, transmissive, and scanning. Fraunhofer has smart eyewear with head-up displays. VR immerses viewer into the 3D environment. AR is supplement or modified direct view of the real world. Next-to-eye displays can be head-mounted. They are fully immersive for video-see-through for VR and MR, optical see-through for AR, and lookaround for context-aware information display, etc.

If we look at the expectations of uLED vs. uOLED, some apps are not reachable so far, such as automotive and aviation HUD, LiDAR, holographic displays, etc. We need some years of public and industrial R&D funding in technology, devices, apps, etc. Regional, national, and EU value chain/sovereignty is feasible to establish microelectronics. In future, we are looking at high-brightness, high-resolution, new form factors, and extended spectral emission and detection range. Fraunhofer is seeking collaborations with the industry for devices/technology evaluation, R&D, technology transfer/licensing, apps, etc.

Large-area nano-imprinting for automotive

Jan Matthijs ter Meulen, Co-founder and CTO, Morphotonics, The Netherlands, presented large-area nano-imprinting for automotive applications. Key enabler for Morphotonics is the large-area nanoimprinting technology. They address demand for nanoscale surface customization for new visual experiences.

Morphotonics delivers large-area nanoimprinting solutions with any optics for any device. We can have large-area imprinting for automotive apps, such as 3D displays, anti-glare, HUD, etc. We also have smaller optical products in high volumes. These are available across wide application range. There can be more efficient interior lighting, using enhanced light management features.

We can also have pixel-level beam shaping/collimation. Morphotonics develops dedicated Portis X-NIL for aligned imprinting. It can enhance lower-pixel-pitch microLED-based displays with MLA measurement. The company has European pilot line for manufacturing free form micro-optical components. Large-area nanoimprinted can enhance design, function, and affordability if automotive displays. Aligned large-area imprinting is available from 2023 onward

PHABULOuS is the European one-stop shop for the manufacturing of free-form micro-optics offering accelerated innovation and production cycles from prototypes to piloting and large volume production. PHABUlous is meant to unify European RTOs and industrials into a pilot line for design and manufacturing of free-form micro-optics. It is now developing headlights with Forvia, interior lighting with Seisenbacher, Swarovski for decorative lighting, and displays with Microoled.

uLED displays for luxury and sports vehicles

William Liu, Product Manager, AUO, Taiwan, presented on how uLED displays are quickly becoming prevalent in super luxury and sports vehicles. AUO has automotive display market share of 18 percent for center stack displays. AUO offers several microLED displays. Advantages include free form that enables new format of displays or seamless design, sunlight readable, wide viewing angle, best durability with inorganic materials, high transmittance, and vivid colors.

MicroLEDs perform the largest viewing angle without brightness decade and color shift. Hence, it offers the premium viewing angle. He showcased a range of displays. ALED is the ultimate automotive display from AUO. Features include high-brightness, long life, best optics and transparency.

Focus on DPT

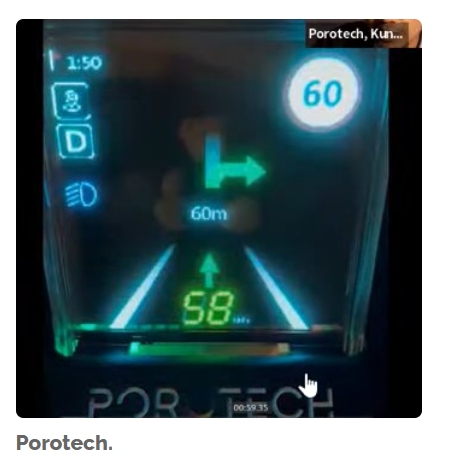

Dynamic pixel tuning (DPT) – the ultimate solution for microdisplays, was presented by Dr. Kunal Kashyap, VP, Display & Head of Taiwan, Porotech. A University of Cambridge spin-out, Porotech has over 15 years of R&D experience, and over 70 patents, and patents pending. It created the world’s first native red InGaN microdisplay. InGaN-based blue and green, and AllnGaP red are also used.

Porotech is offering DPT, thereby, making a paradigm shift to monolithic RGB microLED visual display. You can get 4X pixels per inch. It announced the world’s first ‘all-in-one’ full-colour microLED display. The display uses DPT that enables a single pixel to emit light across the entire color spectrum. It also reduces power consumption, and improves the pixel density and picture quality.

Porotech is simplifying production of large-area displays. It also has a concept demo — transparent display for automotive HUD. DPT is going to reduce the materials for displays. DPT is also going to impact all types of displays. DPT is set to unlock new uses for displays in the society.

Dr. Benjamin Willeke, Innovation Management & Scouting, Forvia, France, presented on exterior displays for automotive. One in two automotives globally, are equipped with Forvia’s products. Through Digital FlatLight, an innovative multicolor and multifunctional rear lamp system, it can create luminous surfaces that ‘communicate’ through signature lighting. It also offers SSL high-resolution intelligent headlamp systems, and vision systems. Parent company, Faurecia acquired Hella, Germany, creating the world’s seventh largest automotive supplier.

Desired resolution is defined by content and viewing distance for displays. Forvia offer segmented and pixelated displays. It also offers emissive, transmissive, and reflective displays. Customer demands are for LED matrix and SmartGlass, than OLEDs. LED matrix offers high contrast and brightness, and multi-color. SmartGlass offers high fill factor and precision. It offers customized content in mid-resolution. SmartGlass lighting modules are with <8mm depth in monochrome. Hella and Forvia are working on exterior displays. We are also interested in new technologies.

Finally, Vygintas Jankus, Business Development, CEA-Leti presented on microLED technology at CEA-Leti, France. Leti has world-class facilities for future business needs. It works on LCD, GaN microLED, and OLED. It has experience in all types of bonding. That includes microtubes, direct metal bonding, and hybrid bonding. There are potential collaboration opportunities available.

Release date: 31 May 2022 / 30 November 2022

Format: PDF

Languages: Tradional Chinese / English

Pages : 130–150 in total (subject to change)

|

If you would like to know more details , please contact:

|