Source from Justin K. Wang, Industry Consultant, LEDinside

Introduction

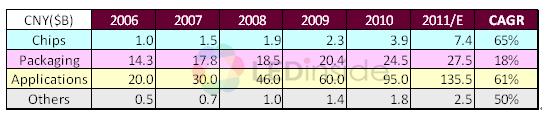

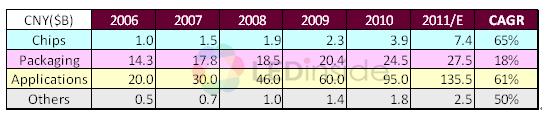

2010 and 2011 were the debut years for China LED industry. Not only the numbers of MOCVD system increased from ~50 in 2007 to over 700 in 2011(see Fig 1), but also the LED industrial revenue has increased from the CNY$50 billion in 2007 to CNY$1,730 billion in 2011 (See Table 1).

Figure 1. China MOCVD installed base projection. (source: GG LED and LEDInside)

Among all, the LED chip manufacturing and the application segments grow the most rapidly with the CAGR of 65% and 61% respectively. The phenomena are not coincident.

Table 1. The growth trend of the China LED industry. (source: Topology Research Institute,2011/09)

As we all know that most of the LED chips were imported to meet the domestic demands from 2008 Olympics to 2010 Shanghai Expos. The domestic supply for the LED chips was lagging behind the demand even up till now(see Fig 2). The central government is fully aware that the LED is a strategic and critical opportunity for China to focus after failing to establish a strong foothold in both the semiconductor and the flat panel arenas. Unlike the complexity of semiconductor or the long cycle time for the flat panel factory to establish, LED is very straight forward in terms of realizing the Return of Investment and perceiving the multiple benefits in the energy saving and the environment preservation.

Thus since 11th 5-year plan, the policy makers have steadily increased the funding to LED industry. Toward the end of the 11th 5-year plan, several regional governments were giving out the subsidy to purchase the MOCVD. The policy planted the seed of market dis-order later.

Figure 2. The LED chip demand and domestic capacity trend chart of China. (Source: combination of GG LED and LEDInside 2011/08)

How the booming started

Let’s go back and look at what happened in 2009. The main reason for LED to become a hot selling ticket item was due to the LED TV created by Koreans. The Koreans invented the Edge style to provide the backlight with LED (see Fig. 3). They cut back on the number of LEDs needed for the backlight and they promoted the sleek thinner design to the early adopters of the new technology. The result was an instant success. LED TV quickly became a buzz word in the consumer electronic industry. As Koreans could not produce enough HB LED themselves, they bought from Taiwan. Pretty quickly, Taiwan started increasing epi manufacturing capacity in late 2009. By the early 2010, China LED industry also benefited from the Shanghai Expo and other domestic lighting projects. Koreans sucked up most of the MOCVD equipment in 2009, this caused the

Figure 3. The evolution of the LED TV backlight. (Source: LEDInside, 2010/07)

Taiwanese to catch up. Due to the shortage in MOCVD, the Chinese epi manufacturers were afraid of being left behind. Several mega projects were announced in Q1’10. Incidentally, Koreas found out the LED TV did not attract the early majority of the consumers from NA and Europe. The CCFL back-lighted TV is still 15% cheaper than the LED TV. Samsung, LGI, and SOC almost simultaneously cancelled the MOCVD shipments in Q2’10 while the Chinese and Taiwanese customers were buying like crazy. Nevertheless, the 2” sapphire price doubled from US$12 to US$25 in 1H’10. Likewise, Mo source shortage induced the pricing hike during the same time. The fanfare accelerated the investment into sapphire and Mo sources as some people saw the lucrative margin in the raw materials.

How did it end

In Figure 4, it is not difficult to see that the ill-prepared new LED chip companies are increasing. Majority of the new comers have very little experience in setting up the LED facility, let alone in producing HB LED. Just like every gold rush or stock market run, when the typical Joe-six-pack wants to get into the LED market, it spells the end of the booming period. By the early 2011, the number of the LED companies had mushroomed to the unsustainable level. Unfortunately, this is also the time the world wide economics started to deteriorate. The turmoil in US financial market, the slump in the housing/job market, plus the increasing European government debts were just the prelude of what was coming in 2011. In fact, if we are smart enough, we should be able to predict the LED TV would never get to the 50% penetration rate in 2011. China’s booming LED TV market can not offset the weak worldwide market demand. To keep the LED TV market momentum, Samsung decided to cut the cost of LED BL module by reducing the quantity and raising the brightness spec of HB LED in Q1’11(see Fig. 2). When this happened, 70% of HB LED will not be qualified for LED TV BL. This created a huge inventory problem for everybody. In 1H’11, Koreans started dumping the LED chips into the general lighting market, then Taiwanese following the suit. Within two

Figure 4. The operation status of China LED companies. (Source: GG LED Research Institute, 08/2011)

months, the WW LED market became a red sea. Coming back to China LED market, at this point, the inventory level from Q1’11 to Q3’11 has been increasing steadily. According to DigitImes 11/21/12 news, Sanan has over RMB$1billion worth of LED inventory, and Changelights has over RMB$100 million worth of Red/Yellow LED inventory. Every LED chip manufacturer is suffering the similar problem. These inventory will not get consumed at least until Q2’12.

In the meanwhile, the slowdown in LED manufacturing started its domino effect on the raw materials supply chain. The 2” sapphire price peaking out at $35 in Q4’10 is now plummeting to ~US$9. The excessive investment in sapphire capacity becomes a huge overhang in China LED industry. Central government has issued warnings through different channels. Only by July 2011 did the MOCVD subsidy start tapering off. Companies in China were blind-sided by two things: the easy money from everywhere , and the huge untapped market in solid state lighting. Now they are all gone.

The sad reality is that China is having its own problem. When the inflation is running high due to the unrealistic housing market and appreciated RMB, the central government had no choice but to tighten the monetary policy. When money stopped to flow in Q2’11, the weak ones first felt the pinched. A lot of lighting companies sought the loans through private institutes with >10% interest rates. As for the LED epi manufacturers, they saw their products obsolete overnight as the results of the dumping from Koreans and Taiwanese. The results are exit of epi manufacturing, such as GCL, and the run-away of lighting company executives in Wenzhou and Foshan.

Hope is on the horizon?

Despite the announcement of phasing out of the incandescent light bulbs, the general lighting market will not be able to make up the slack created by LED TV BL demand. At least, I do not expect this will happen in 2012. New incentive program is rumored to come out in December to selectively subsidize the general lighting products. The trick is that the general lighting products need to be certified first (just like Energy Star system in US), and the lighting companies need to be qualified by the government as the legitimate suppliers. This will only keep a few larger companies stay floating. For the typical household to adopt the LED light bulbs, the 50% subsidy is critical for the initial adopters. I also doubt that this will take effect in 2012 unless the quality and the price of LED light bulb improved dramatically. To put the timing of SSL activation in more prospective, I believe we also need to consider the ramping of China LED chip capacity. My understanding is that nearly 50% of newly added MOCVD capacity has not been put into production. In Figure 4, it shows the situation prior to 2011. If China indeed imported over 400 more MOCVD systems in 2011, the untapped capacity is enormous. Some makers boast the world will need more than 6000 MOCVD systems to support the general lighting demand. The estimation is not only flaw, but also deceiving. It overlooked the fact that there will be innovations and improvements to increase the productivity. Fortunately, most of the people will learn from the past mistakes. Those who can emerge from the current slump will be the strong ones to survive in the long run.

Final Words

The traditional wisdom tells us that the only thing that does not change is the change itself. Despite the current situation is very gloomy, the market will work its way out. Having said that, a lot of epi capacity is not on line now, probably will not be on line in the next 6 months. The market will sort out the weak ones, to re-baseline the supply side. China economics along can not modulate the overall LED market. The world wide economics should recover once the FUD (Fear, Uncertainty, Doubt ) about the European debts and US housing/job markets subside. Then the LED demand will resume. As soon as that happens, the raw material suppliers will be the first one to feel it. The MOCVD suppliers will need to wait till the end of 2012. This is because all the added capacity in the last two years need to be utilized first. Once the bad ones phased out in this down turn, the LED industry will become healthier and stronger to embrace the general lighting up turn in 2013. (Justin K. Wang)