Bridgelux’s strategic partnership with one of China’s largest electronic company China Electronics Corporation (CEC) and its LED industry strategy has made CEC the ideal acquisitor among potential buyers, wrote Bridgelux CEO Bradley Bullington in an email correspondence with LEDinside.

“Discussions with CEC and other companies became serious over the last few months and ultimately we believed CEC was the best fit,” stated Bullington.

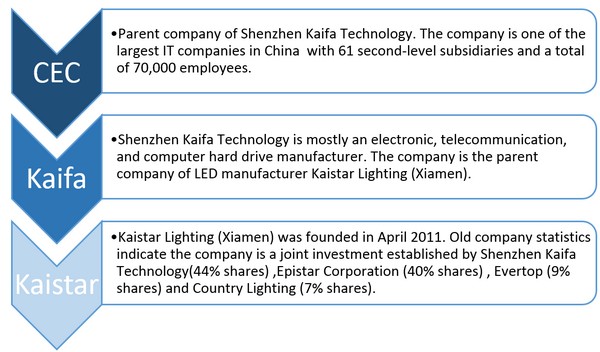

The U.S. LED manufacturer has developed a strategic partnership with CEC and its LED arm Kaistar since 2012, wrote Bullington. The fact that Kaistar was a CEC subsidiary played a significant role in Bridgelux’s decision to enter into this agreement, since the U.S. company had already established a strong manufacturing partnership with Kaistar.

|

|

|

The relationship between CEC, Kaifa and Kaistar. (LEDinside)

|

Bullington emphasized Bridgelux was seeking LED companies with the size, scale and a coordinated supply chain of like-minded LED companies to assist it in delivering the best technology and business model solutions to serve clients.

“We are convinced that CEC is the perfect partner to help Bridgelux achieve its next level of growth,” wrote Bullington. “With its existing investments in lighting fixture and lamp manufacturing as well as other IT and consumer electronics technologies, CEC’s captive businesses is expected to offer substantial scale and growth for Bridgelux.”

Additionally, with more than 61 subsidiaries, CEC has developed manufacturing operations across the LED supply chain. Alignment with these partners would give Bridgelux a long-term cost advantage, while complimenting its existing technology advantages that would enable Bridgelux to focus on innovative applications to better serve its customers, he added.

|

|

|

Bridgelux LEDs in Apple billboards featuring the iPhone 6. (Bridgelux/LEDinside)

|

According to Bullington there are currently no plans to change Bridgelux’s management at this time.

Responding to the question of whether Bridgelux will be transferring its broad portfolio of LED patents to Kaistar as suggested in the Chinese company’s press release, Bullington replied its patents will stay within the company during and after the transaction. The exception being the company’s smart lighting patents, which are mostly related to the modular level that will be transferred to Xenio Corp.

In a statement released on July 21, 2015, Bridgelux announced its smart lighting division will be spin-off into a separate legal entity Xenio Corp. “The decision to spin out Xenio was based on the conviction of Bridgelux management and its investors that the smart lighting space currently lacks solutions that blend the power of networked light fixtures with the potential of advanced sensors and IoT software,” wrote Bullington.

The smart lighting division has been developing the technology for over two years, and the company felt the time is ripe to bring the product to the global market. The company’s Xenio team is vying not just the smart lighting industry, but also aims to become a major player in the broader smart building and IoT space.

Asked why Bridgelux and other major European and U.S. LED manufacturers including Cree, Lumileds and Osram have decided to split their LED lighting businesses over the past year, Bullington explained many in the industry shared the viewpoint that the maturing LED industry was behaving more similarly to the semiconductor industry. These developments indicate manufacturers have to adopt business strategies that emphasized economics of scale.

“For the last 5-6 years, Bridgelux management and its investors have believed that as the industry became more mature, it would behave much more like the semiconductor industry than the lighting industry,” wrote Bullington. “As such value would be derived in equal parts from core technology development and economies of scale.”

In response to these market developments, Bridgelux has decided to adopt a fabless model and partner with larger manufacturers including Toshiba, Epistar and CEC to generate economies of scale through large manufacturing investments. By further building upon its partnership with CEC through the acquisition deal was a natural extension of the strategy, which would enhance Bridgelux’s ability to spend on technology development, while providing further leverage and scale to its supply chain and manufacturing, wrote Bullington.

(Author: Judy Lin, Chief Editor, LEDinside)

Related articles for further reading: