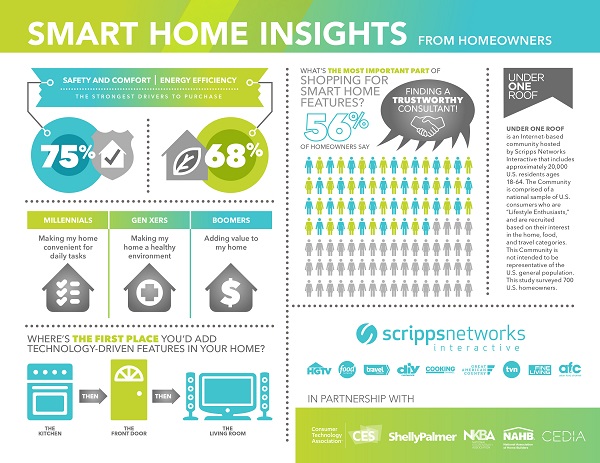

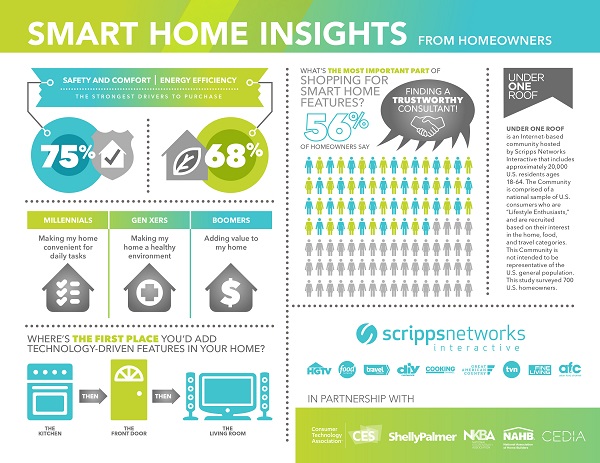

Scripps Networks Interactive, the leader in lifestyle media, surveyed 700 U.S. homeowners of all ages, finding that safety and comfort are the primary reasons consumers invest in smart home technology. The study was conducted through the company’s Under One Roof consumer panel, in partnership with the Consumer Technology Association; the National Kitchen and Bath Association; the National Association of Home Builders; CEDIA; and Shelly Palmer Strategic Advisors. The research findings will be presented at CES® 2017 and at Design and Construction Week 2017.

Overall, consumers are interested in improving their homes and quality of life through the addition of technology, citing safety, comfort, efficiency, value and convenience as desired results. The study uncovered the following new information:

Safety and comfort drive tech purchases, not ego or “keeping up with the Joneses.”

|

|

Scripps Networks Interactive, the leader in lifestyle media, surveyed 700 U.S. homeowners of all ages, finding that safety and comfort are the primary reasons consumers invest in smart home technology. (Scripps Networks Interactive/LEDinside)

|

Three-quarters of respondents attributed their purchase motivation to the desire to keep their family safe and comfortable, while only 18% attributed it to the desire to meet others’ expectations.

Nearly 68% of respondents cited energy efficiency as a driving factor enticing them to add technology, in order to see a tangible pay-off in dollars saved, to add resale value to their home, and to comply with social pressure to be Earth friendly.

Millennials want to make their home “convenient for daily tasks;” Generation Xers want to make their home “a healthy environment;” and Baby Boomers wish to “add value” to their home.

The kitchen is the No. 1 spot in the home to add technology.

A quarter of all homeowners surveyed named the kitchen as the top spot in the home to add smart tech. Respondents listed top options as smart refrigerators, connected and app-enabled appliances, voice-activated wireless speakers and motion sensor lighting.

Gen Xers led this kitchen-friendly group at 28%, while 27% of Millennials and 23% of Boomers listed the kitchen as top priority.

The front door or entryway is the next most desired place for adding technology (15%), while the living room comes in third (13%).

Energy monitoring and light automation are consumers’ most desired smart home projects.

While only 11% of homeowners surveyed have firm plans to purchase energy monitoring and light automation technology for their home, nearly 44% of respondents listed these items as tools they’d most like to add.

Mobile device-operated or computer-controlled home systems, a doorbell camera and surveillance equipment also topped the homeowner wish list.

A third or more of the respondents want to add home audio automation, HVAC automation, motion lights and a security system to their home.

Finding a trustworthy consultant to help with smart home purchases is an extremely important part of the consumer journey.

As homeowners consider smart home technology, more than half said they want to find a professional to help them make the right decisions.

In the process of adding smart home tech, homeowners also expressed importance in professional installation and education, having product demonstrations and trial periods of use.

While expense is the top barrier to purchase, respondents also cited tech phobia and an overwhelming number of choices as other deterrents.

Millennials, followed closely by Gen Xers, are the most likely to add smart home technology to their home.

-

85% of Millennials indicated they are likely to add smart home technology to their home, more than half within the next year.

-

73% of Gen Xers are likely to add smart home technology, 38% within the next year.

-

67% of Boomers are likely to add smart home technology, 28% within the next year.

Under One Roof is an internet-based community hosted by Scripps Networks Interactive that includes approximately 20,000 U.S. residents ages 18-64. The community is comprised of a national sample of consumers who are “lifestyle enthusiasts,” recruited based on their interest in the home, food and travel categories. The community is not intended to be representative of the U.S. general population.