From 2011 to 2015, the global

LED general lighting market undoubtedly underwent the most dramatic changes.

LED lighting technologies witnessed unprecedented advancements during these 5 years, contributing to expanded range of applications: from indicator lights to lighting fixtures; from lighting fixtures to outdoor landscape lighting; and from display backlighting to general lighting. LEDs have been invincible and grabbed the market shares of incandescent lamps, fluorescent lamps, and HID lamps.

However, after the third quarter in 2015, LED lighting, which had grew at a CAGR of over 100% every year, seemed to slow its pace. Having said that, LED penetration rates in Japan, China, the U.S. and some emerging countries have continued to increase year over year, and the game-changing LEDs have quietly reshaped the traditional lighting landscape.

In 2015 to 2016, although the LED lighting market did not show the same exponential growth like previous years, it still expanded at a 10% to 20% rate. Judging from annual lighting shipments, LEDs still occupied over 50%. However, the share of LED lights in global lighting market has been hovering at 20% for quite a while. 2011 to 2015 marked the period when LED lights were widely adopted. But in the present “post LED lighting era”, it is still unclear what changes will occur and where the industry is heading towards. In this article, LEDinside will look at the industry from three different aspects: product, channel and brand.

Product Evolution

We all know that in the lighting industry, LED was initially used as a retrofit light source and for making retrofit lamps. Then there came integrated luminaires and LED-based innovative light sources and lamps. Leveraging its programmability, LEDs helped facilitate the analog-to-digital transformation in the lighting industry. In addition, thanks to its small size, LEDs allow for a wide range of luminaire design. Since the 1970s, the past 4 decades have been a slow and long process where energy-saving lamps initiated the digitalization in the lighting industry. Over the next 10 years, we might witness another wave of change toward connected lighting that has been led by LEDs.

Channel Evolution

Over the past years, due to discount LED light bulb sales in major retailers like IKEA, The Home Depot, and Lowe’s, LED products have grown so rapid in popularity in retail channels. Plus, e-commerce giants like Amazon and Alibaba have further boosted retail sales of LED lights. For government projects, India’s state-run joint venture Energy Efficiency Services Limited (EESL) has procured over 400 million LED light bulbs through competitive bidding over the past years, and the number is still increasing at a rate of 200 million units per year. This is a new business model that is worth paying attention to.

In China, over the past decade, the government has procured LED lights for urban landscape lighting and mega construction projects. Driven by this, Chinese local manufacturers who were originally OEMs have moved towards ODM and replaced global companies as lighting solution providers. Some even became ECSOs. It is fair to say that retail market, government projects and professional lighting market, the three sectors that had long been monopolized by the three lighting giants Philips Lighting, OSRAM and GE, have undergone certain changes.

Brand Evolution

Philips Lighting, OSRAM and GE, for over a century, have dominated the global lighting market with their innovative products and technologies, global production bases, extensive sales networks, and strong brand equity. They have also contributed a lot to LED light development at different stages. The LED lighting market, during 2011 to 2015, prospered vigorously, and sustained a steady growth in the second half of 2015. One would expect these three lighting giants to take the opportunity to strengthen their business operations and continue to expand market shares during these pivotal periods. However, this was not the case.

In the new era of low-cost LEDs, they have adopted new strategies respectively. For instance, Philips lighting shed its lighting business Lumileds and automotive lighting unit, and launched IPO. OSRAM sold its general lighting business LEDVANCE, while GE established Current as a startup subsidiary and withdrawn from Asia and Latin America Market. Moreover, rumors suggesting GE may sell its lighting business have surfaced again and again over the past few years.

On the other hand, young LED companies like MLS, Cree, Acuity Brans, Eaton, Panasonic, OPPLE Lighting, FSL, Guangdong PAK Corporation, and Shanghai Feilo Acoustics Co. Ltd. have all become competitive players overtime. But how will they perform in the future?

Looking back at 2011 to 2015 when the LED replacement lamp market grew rapidly, in every 6 to 9 months, there was a new technology solution launched, and a short product life cycle of only 9 to 12 months exhausted most brands. This LED boom, however, offered companies that excel in manufacturing and control key technologies a chance to thrive. Some good examples are MLS, Zhejiang Yankon Group Co., FSL and LEEDARSON.

In recent years, as integrated LED luminaires have become more and more popular, companies like Acuity Brands, Eaton, OPPLE Lighting and Guangdong PAK Corporation have secured leading positions in the market. Moreover, since lighting fixtures are high-margin products and are sold mainly through wholesalers and specialized channels, brands who have established strong partnership with these channels can be greatly benefited.

It is thus expected that North America and Europe, where most of the brands are based, will be the major battlefields for global lighting companies. That is probably why MLS spent a fortune to acquire LEDVANCE, and Feilo Acoustics bought Havells Sylvania with a huge amount of money. Considering the LED lighting market has been taking a breather, it is wiser to work with companies who have sales channels in over 100 countries than to build new channels from scratch like OPPLE Lighting.

In both advanced and emerging markets, though having the advantage of energy savings, the penetration of LED products has been hindered by their high prices. In addition, consumers now demand products with premium light quality that can create a comfortable environment at home. Thus, constant flicker and glare in LED lights are still some of the major setbacks against increasing adoption, even if prices decline to a more acceptable range for consumers. Furthermore, comprehensive interface design and increasing awareness of LED options for job site lighting will also pose challenges to LED adoption.

As a result, lighting manufacturers looking for future growth opportunities have to focus on determining favorable selling prices of products, reducing discomfort glare or flicker, providing user-friendly interface and adding value to their products. Even though companies can still sustain steady growth in revenues if they fail to achieve one of the above four goals, having these key areas covered will definitely offer companies powerful competitive advantages for them to expand market share, increase brand equity and boost their bottom lines.

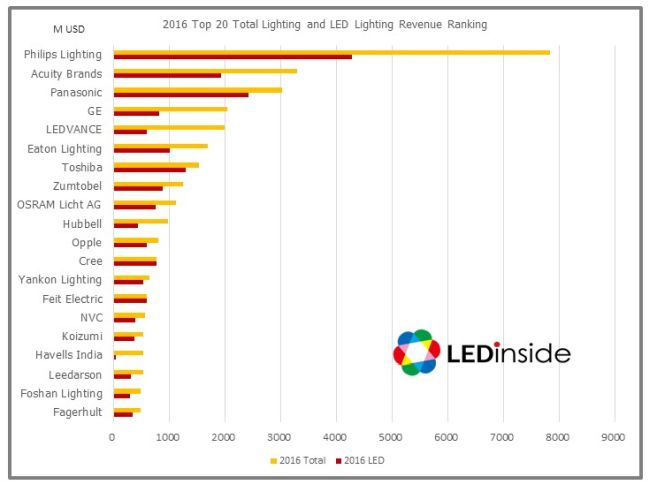

Below is LEDinside’s 2016 revenue analysis on global lighting manufactures, which can be divided into four categories:

*Note: Revenues include those from general lighting businesses, and excludes those from LED components and automotive LEDs. (Data: LEDinside)

First, for global lighting companies, traditional lighting still maintains a significant share of total production. Thus, although they have gradually transitioned to LED lighting, and developed a clear vision for their LED businesses, LED lighting revenue still fell short of expectations. Looking ahead, companies will focus more on creating innovative LED products and expanding this business to generate more revenue. Companies in this category include Philips Lighting, OSRAM Licht AG, GE (Current) and LEDVANCE.

Second, dominant light makers in their respective regional markets – the so-called state-supported companies or Local King – are able to prevent foreign companies from entering the markets through product specifications, government bidding or customs. Also, governments will offer subsidies or incentives to encourage these local players to ramp up production of lighting products. Companies in this category include Acuity Brands, Panasonic, TOSHIBA, Feilo Acoustics and OPPLE Lighting. Though traditional lighting is still a major part of their business, thanks to greater consumer awareness towards the benefits of LEDs, penetration of their LED lighting products all hit 60% to 70% in 2016 in the respective regional markets.

Third, for emerging lighting companies who have a niche, especially sales channel advantage, plus advanced technologies, when they venture into a specific market, they will be able to sell LED light bulbs and LED-based fixtures from the very beginning. This can contribute a lot to strengthening their balance sheets. The key to successful operation for these companies is production cost.

The fourth category covers companies who transformed from upstream/midstream manufacturers or OEMs to OBMs, such as MLS, Cree, Yankon Group Co., and LEEDARSON. Based in China, the largest production and manufacturing base for lighting products, they have obtained manufacturing scale positions and provided low cost production, allowing them to successfully and effectively expand into the global lighting market. MLS, for instance, was established in 1997 as a LED packaging provider. From then on, its packaging capacity has grown by 1 to 2 fold every year, making it the largest LED packaging firm in the world. Among the global top 10 LED manufactures, MLS has had the highest annual growth rates in recent years. Since 2011, MLS has further expanded into the LED lighting business with LED replacement bulbs and tubes. In recent years, it has also produced LED luminaires for residential, commercial, and job site lighting.

MLS adopts a “Three Pillar Strategy” in expanding its lighting business:

In terms of OBM business, MLS has established its own brand Forest Lighting. MLS’s products are sold in China, North America, the Middle East and Southeast Asia, including residential lighting, commercial lighting, job sight lighting and smart lighting. As for EMS business, through acquiring Super Trend Lighting and establishing a joint venture, Global Value Lighting, with Lighting Science Group, MLS is able to provide excellent solutions to brands and private label manufacturers at competitive prices.

Moreover, Chinese consortium including MLS acquired LEDVANCE, originally the general lighting business of OSRAM Licht AG. MLS will be benefited from the strong brand equity of OSRAM, SYLANIA (North America), and LEDVANCE. In addition, LEDVANCE has partnered with retailers and wholesalers and has distribution channels in over 120 countries, which will help MLS create a strong market presence just like Philips Lighting, OSRAM Licht AG and GE. If MLS is able to hold 100% stake in LEDVANCE, it will be among the global top 5 lighting manufactures by revenue, and will possibly be ranked among the global top 5 lighting giants.

In conclusion, in the post LED lighting era, companies who have production cost advantage will provide manufacturing services to brand and channels. And for those who have strong brand equity and extensive distribution channels, they will focus on R&D, innovation, marketing, and channel operation. These companies will lead the way in lighting development on the global stage, and continue to provide premium energy-efficient lighting to end-users around the world.