-

Comparable revenue rises by more than 3 percent; or by more than 8 percent if adjusted for a prior-year non-recurring effect

-

At more than 16 percent, adjusted EBITDA margin remains at a high level

-

Managing Board confirms its outlook for fiscal year 2017

-

Osram acquires stake in a company specializing in navigation technology for self-driving cars

"Osram's operating performance continues to be very strong. We are forging ahead with our transformation into a systems provider. By acquiring a stake in LeddarTech, we are paving the way for success in the key future market of autonomous driving," said Olaf Berlien, CEO of OSRAM Licht AG.

|

|

(Image: Osram) |

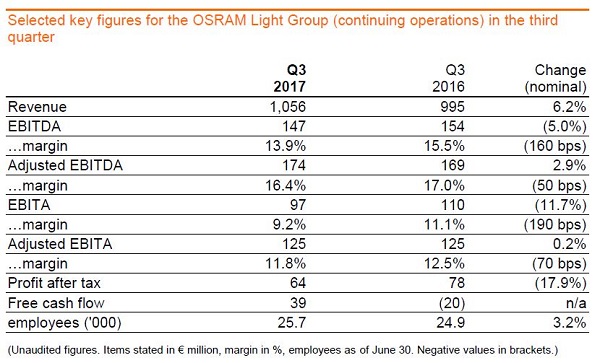

Osram continued to grow in the third quarter of fiscal 2017. On a comparable basis (i.e. adjusted for portfolio and currency effects), growth in the third quarter stood at just above 3 percent. Additionally adjusted for a €47 million carve-out related revenue spike in the previous year, revenue increased by more than 8 percent to €1.06 billion in the period from April to June 2017. This growth was driven by persistently high demand for opto semiconductors and continued strong demand from the automotive sector. At €174 million, EBITDA1 adjusted for special items was again on a par with the high level of the prior year, giving a margin of 16.4 percent (prior year: 17.0 percent). Profit after tax from continuing operations came to €64 million (prior year: €78m) in the third quarter.

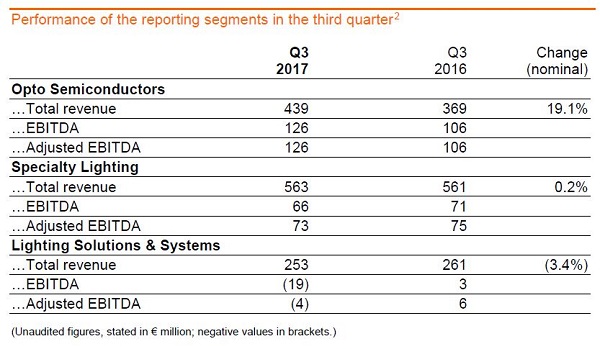

The LED business (Opto Semiconductors, OS segment) benefited among others from the high demand for consumer goods products, such as components used in iris-scan smartphone unlocking, and from the strong growth in the general lighting business. The Specialty Lighting (SP) segment reported a healthy level of business in the automotive market. The LED modules business and the entertainment business both performed strongly. In the Lighting Solutions & Systems (LSS) segment, the challenges remained, particularly in the US business. However, the many measures taken to raise profitability in this area are making further progress. Two weeks ago we reached a reconciliation of interests at the Traunreut plant where headcount will be reduced with the minimum social impact.

Osram takes the next step towards autonomous driving

Osram has acquired a strategic 25.1 percent share in LeddarTech Inc., a Canadian company that develops a proprietary LiDAR technology integrated into semiconductors and sensor modules for self-driving cars and driver assistance systems. LeddarTech specializes in solid-state LiDAR (Light Detection And Ranging) systems that use infrared light to monitor the area around them, and its advanced optical sensing technology is highly complementary with Osram’s semiconductor products. The two companies already work together and Osram has now made an investment in LeddarTech in the mid double-digit million euros. “Osram is already the world’s leading provider of sensor lights for autonomous vehicles and is experiencing steadily rising demand in this field. We see the investment in LeddarTech as a logical step on the way to becoming the leading provider of solutions in this area,” said Stefan Kampmann, Osram's Chief Technology Officer.

Through partnerships, equity investments and takeovers, Osram is expanding its existing technology base in the field of components and modules with everything from software and electronics to system solutions. This is opening up new applications and markets in autonomous driving, intelligent light control, and Industry 4.0 (the industrial Internet of Things). Osram's recent takeover of LED Engin, a Silicon Valley-based vendor of customized LEDs, and its purchase of a stake in Munich-based horticulture start-up Agrilution highlight this approach.

Outlook for fiscal year 2017

In light of how the business has performed so far this year and the current market trend, Osram confirmes its outlook for fiscal year 2017. For the current fiscal year, the Managing Board anticipates comparable revenue growth of between 7 and 9 percent and an EBITDA margin adjusted for special items of between 16.5 percent and 17.5 percent. Diluted earnings per share is forecast to be within a range of €2.70 to €2.90. The company is aiming to achieve a free cash flow at break-even level.

The company will hold a conference call for journalists featuring the Managing Board of OSRAM Licht AG today, starting at 9 a.m. CEST. The conference will be broadcast online at www.osram-group.com/en/media/media-calendar. A recording will be made available there afterwards.

You can follow the conference call for analysts, which starts at 1 p.m. CEST, at http://www.osram-group.de/en/investors/publications/2017.

|

|

|

Figures for 2016 in 'Performance of the reporting segments in the third quarter' have been restated because, from the beginning of 2017, OSRAM reported further revenue with LED components for automotive customers in the Specialty Lighting segment. (Figures & Footnote Source: Osram)

|