-

Revenue for fiscal year 2017 rises by just over 8 percent to more than €4 billion

-

Operating profit rises by €43 million to €695 million, resulting in a margin of 16.8 percent

-

Management Board proposes dividend of €1.10 per share, an increase of 10 percent

-

Osram Board expects continued growth in fiscal year 2018 and plans further capital expenditure

-

Planned joint venture with Continental in the preparation stage

"We delivered another peak year in 2017 on the back of a strong performance whilst also making good progress on our way to becoming a high-tech company,” said Olaf Berlien, CEO of OSRAM Licht AG. “Osram is in a great position thanks to its expertise in innovation and it is setting its sights on attractive future markets. Our operating performance is on track, and this is reflected in our outlook for 2018. The proposed dividend of €1.10 per share underlines the effectiveness and financial strength of the business."

|

|

(Image: Osram) |

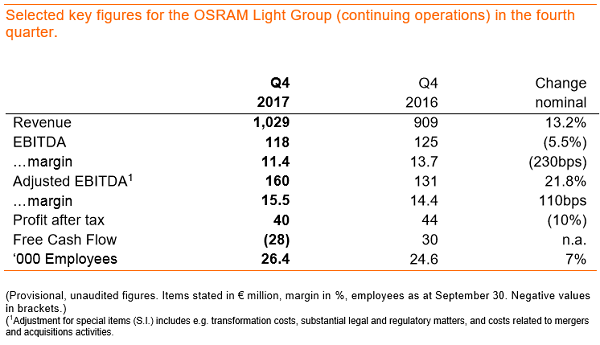

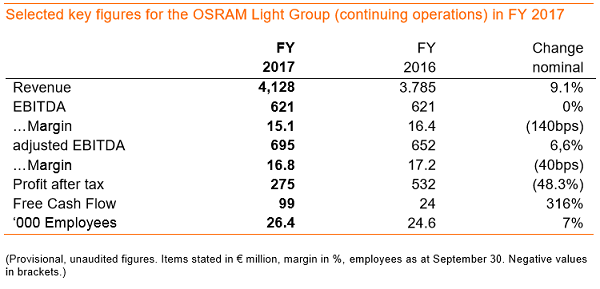

In the last fiscal year, Osram benefited from persistently strong demand for its high-tech products, and particularly its opto-semiconductors. On a comparable basis (i.e. adjusted for portfolio and currency effects), revenue rose by just over 8 percent year on year to reach more than four billion Euro. The operating margin reached 16.8 percent, the EBITDA adjusted for special items was up by more than 6 percent to €695 million. Profit after tax came to €275 million. A dividend of €1.10 per share is to be proposed to the supervisory board. That means an increase by ten percent. Encouraging progress is being made with the 'Diamond' innovation and growth initiative, two years after it was launched. We are on track with our strategy. Despite negative currency effects and investments, Osram will continue to grow in 2018.

|

|

(Source: Osram) |

In the strong fourth quarter of fiscal year 2017 (ending September 30), the company registered significant increases in both revenue and earnings compared to the prior year while continuing with a program of capital spending. Osram's transition to a high-tech business will continue to feature strongly in fiscal year 2018. Optical semiconductorbased products already account for two thirds of the company's revenue. To lay the foundations for sustained profitable growth, Osram is investing around the world in its locations and technologies. This expenditure as well as headwinds from currency trends will be dominant factors in the current fiscal year.

|

|

(Source: Osram) |

Outlook for fiscal year 2018

In fiscal year 2018, Osram will continue to build on its foundations for the future. Revenue is expected to increase by between 5.5 and 7.5 percent. The EBITDA adjusted for special items is likely to be around €700 million and will be influenced by factors such as currency effects, ramp up costs for Kulim and increased capital expenditure on research and development which in total sums up to a three digit million Euro amount. The currency effects alone have a negative impact of roughly €70 million. Diluted earnings per share is expected to be between €2.40 and €2.60. We are expecting a free cash flow between minus €50 million and minus €150 million. The Managing Board is confident about Osram's positive medium-term prospects and is therefore aiming for a dividend of at least €1.10 per share once again in fiscal year 2018.

Trends in the segments

|

|

(Source: Osram) |

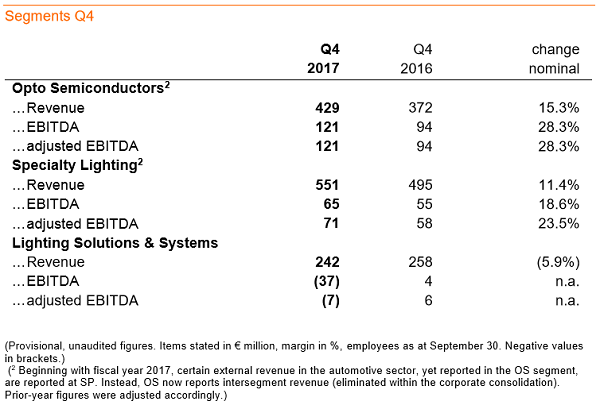

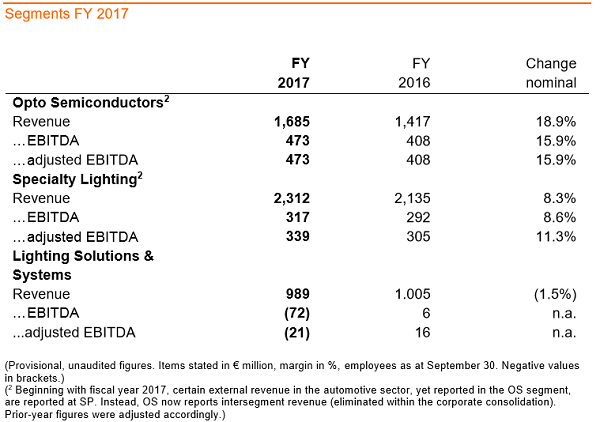

The growth trends and operational strength of Osram's Opto Semiconductor (OS) segment remain undiminished. The start-up costs related to the Kulim plant, together with currency effects, will impact on the operating margin in fiscal year 2018. Specialty Lighting (SP) is expanding because of the increased use of LEDs in the automotive sector. The Asia region delivered the highest rate of growth recently. The performance of Lighting Solutions & Systems (LSS) remains unsatisfactory. The Managing Board has taken action and with a new management team is exploring all options for the luminaires business (LS). There will be a strategic decision in the current fiscal year.

|

|

(Source: Osram) |

Planned joint venture with Continental in the preparation stage

Osram and Continental took a major step forward in their planned alliance in the automotive sector by setting out the key financial parameters. Revenue in the mid-triple digit millions of euros is the initial target for the 50:50 joint venture, which is called Osram Continental GmbH. After launching in fiscal year 2018, the joint venture will operate in the market as an independent company and will be fully consolidated in Osram's financial statements. All that is now needed is the signing of final contracts and the required antitrust authorizations to be issued.

The joint venture will combine innovative lighting technologies with electronics and software, and will develop, manufacture, and market intelligent lighting solutions for the automotive industry and set makers. Today, lighting and electronics in the automotive market are becoming increasingly integrated: Sensors, for example, are now able to scan oncoming traffic and partially dip the headlamps so that drivers using full beam do not dazzle other road users; Osram's infrared sensor lights are also used by a number of driver assistance systems.