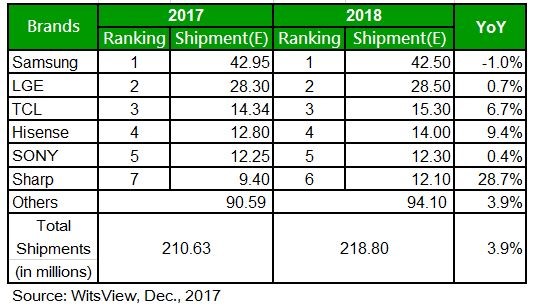

WitsView, a division of TrendForce, reports that the global shipments of branded LCD TV sets for 2017 will total 210 million units, a decrease of 4.1% compared with prior year. For 2018, the shipments decline will reverse, and grow by 3.9% to 218 million.

“The panel prices have tumbled more than 17% on average since 2Q17,”says Jeff Yang, assistant research manager of WitsView, “coupled by the sales on China’s annual Singles Day and Black Friday, the shipments continue to rise”. TV brands expect to continue the rise till the Chinese New Year, and to further expand their shipments during global sports events such as Winter Olympics, Super Bowl and World Cup.

Samsung will remain the market leader despite of 1% drop in shipments, TCL expects shipments rise due to vertical integration

In 2018, Samsung’s TV business will continue to be profit-oriented with product development focusing on QLED TV for high-end market segments. The shares of high-resolution (4K) and large-size (49'' or greater) TV sets will both surpass 50% in the shipments. As for small-size (under 49'') ones which have a lower gross margin, Samsung will increase the percentage of outsourcing in its manufacturing process to optimize the costs. Overall speaking, Samsung will remain the market leader in 2018 despite of 1% shipments drop led by its strategy of maximizing profit.

OLED TV market shows remarkable performance this year, resulting in global shipments of 1.5 million units, a 72% rise compared with the previous year. WitsView expects that LG Electronics (LGE) and SONY will continue to expand their OLED offerings in the high-end market, both brands will record slight shipment rise in 2018.

TCL Corporation records a shipment of 14.3 million units, ranking the third, as the result of effective vertical integration of its panel, TV assembly and brand business. It is expected to achieve constant shipment rise in 2018 and a yearly growth of 6.7%. Its vertical integration will be a valuable reference for other brands because this strategy not only secures stable in-house panel supply, but also allows more flexible configuration of costs for the TV sets.

Sharp recorded 97.5% YoY rise in shipment because of Foxconn’s effective integration of upstream and downstream resources

Hisense, another Chinese TV brand in the list, is unfavorable in competition due to the lack of in-house resources in the panel market. Whether it can improve the unfavorable status quo and keep the growth will depend on its performance in developing overseas market. Hisense has already taken steps to deploy overseas by purchasing Toshiba’s television business.

Foxconn has already owned Sharp’s panel resources and TV assembly supply chain, its subsidiary, Innolux, also expands its television assembly business in 2017, bringing Sharp’s shipment to 9.4 million units, a massive growth of 97.5%. Sharp will race to achieve its annual target of over 12 million units next year. Although Sharp is not likely to enter the global top five in 2018, but will emerge as a threat for other Chinese TV brands in lack of in-house panel resources, such as Hisense and Skyworth.

To sum up, TCL secures its place in top 3 in 2017 and Sharp regains its competitiveness in the TV market, showing that the vertical integration of panel, TV assembly and brand business operations will be a key for brands to strengthen their position in market and to sustain growth. For 2018, large-size, high-resolution and OLED TV sets will remain the key products in TV market. In addition, major global sports events will also boost the demand. Therefore, WitsView forecasts an increase of 3.9% in global branded LCD TV shipments, totaling 218 million units.