The iPhone X has sparked a heated discussion of 3D sensing technology in 2017, and Apple will continue to develop 3D sensing. On the other hand, vendors of Android smartphones will also follow the trend, pushing up the demand for Vertical Cavity Surface Emitting Laser (VCSEL), a key component for 3D sensing technology. Therefore, VCSEL manufacturers now race to lay the foundation in this segment.

VCSEL is a key component for biometric recognition

What is 3D sensing technology? It is at the core of face recognition, which captures the shape of objects through 3D laser scanning (3D sensing). In face recognition, a digital matrix is created to define the appearance of faces. For example, it allows phones to capture the shape of the users' faces in a more accurate way than capturing them from pictures.

Why does 3D sensing uses VCSEL? With the advancement of technology, VCSEL has the advantages of high accuracy, small size, low power consumption, and high reliability, etc., making it the commonly used infrared light source in 3D camera systems.

The iPhone X embeds 3D sensing, and the market follows the trend

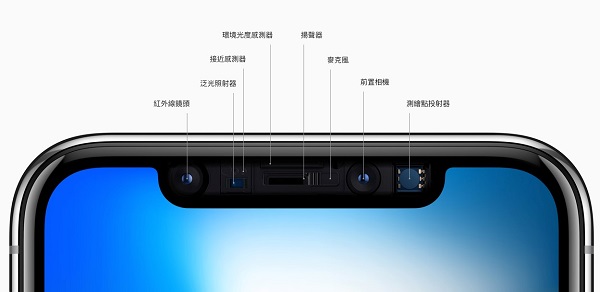

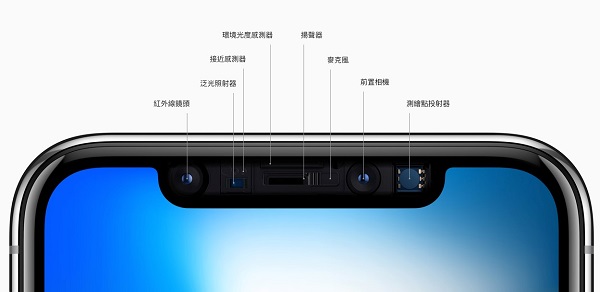

As for the structure in iPhone X, the 3D sensing system and front camera are at the top of the screen. The components from left to right include infrared camera, flood illuminator, proximity sensor, ambient light sensor, speaker, microphone, front camera (7-megapixel) and dot projectors. When 3D sensing modules work, the dot projector first produces more than 30,000 dots of infrared (IR) light on the object, then the infrared camera receives the light reflected back from the object to create a 3D landscape of the depth and distance of object. Last, the data will be passed to the chips to identify faces for authentication. If the data match the user authentication information, the phone will be automatically unlocked!

As for other parts of the system, flood illuminator is a component of VCSEL which assists in shining the infrared light and makes the system work in low lighting conditions and even in the dark. The ambient light sensor detects the light in the environment and automatically adjust the phones’ brightness, while the proximity sensor detects the distance between the phone and the user. The screen will turn off automatically if users are too close, for instance, when users answer the phone. Therefore, both ambient light sensor and proximity sensor are key to the power-saving mode of phones.

|

|

(Image: TechNews) |

However, iPhone X is not the first product to commercialize VCSEL system. Apple has already adopted this technology in its AirPods, where the sensor is used to detect whether the earphones are in use or not. At present, iPhone X uses three VCSEL chips, but the demand for chips from Apple has begun to increase as shipments of iPhone X gradually rise. Apple reveals that its purchases of VCSEL chips has a tenfold increase in the fourth quarter of 2017 compared with 2016.

Android smartphones have joined the competition with relevant models to release in 2018

At present, 3D sensing have become the focus of smartphone market. Although Apple intends to control the supply chain of VCSEL, the market for related technologies has been growing for more than 20 years and has been applied to various sectors like optical communication and optical transceiver. Moreover, as the application market expects explosive growth, LED foundries with MOCVD systems will also join the competition apart from existing manufacturers of laser optical components and gallium arsenide foundries.

Existing VCSEL suppliers include Lumentum, Finisar, Princeton Optronics and so on. And upstream VCSEL wafer and chip suppliers include IQE, Epistar, HLJ, etc. Moreover, Qualcomm and Himax Technologies, who jointly enter the 3D sensing market, are expected to receive orders from Android phones. Among them, Xiaomi uses the 3D sensing solutions provided by Qualcomm and Himax Technologies.

As Apple introduces 3D sensing technology in iPhone X, the company paid about US$390 million to Finisar, its VCSEL suppliers. Thus rumors came out that Apple made equity investment in Finisar. However, the parties later clarified that it was a prepayment for future orders.

According to insiders, Finisar will improve its plants at Sherman, Texas with Apple's funds, and will contribute to new production capability of VCSEL in the second half of 2018. Backed by the VCSEL production of Finisar, Apple will be able to adopt the TrueDepth camera to more iPhone product lines, or add a second sensor system to the back of iPhone, not only for face recognition, but also for scanning the surrounding environment. Apple intends to lay the foundation for augmented reality applications through VCSEL technology.

U.S.-based Lumentum, another key player in the 3D sensing supply chain, is rumored to have a short supply. Suppliers say that, in fall of 2018, Apple will adopt face recognition not only in new iPhones, but also in high-end large-size iPad in order to extend its AR applications. So it is necessary for Apple to find the second supplier to ensure the supply of components in the second half of 2018.

At present, Huawei, Oppo, Xiaomi, Vivo, Samsung and other mobile phone brands are accelerating to develop new models, which will come out in the second quarter of 2018 at the earliest. LEDinside predicts that the market of infrared laser modules consisting of VCSELs and EEL will reach US$1.953 billion in 2020.

Supply chain in Taiwan also follows the trend

As Android phone manufacturers actively develop 3D sensing applications, Taiwan factories in the supply chain also follow the trend. In particular, gallium arsenide, a part of infrared light sources in VCSEL systems, has become the focus of market. The domestic gallium arsenide suppliers, including WIN Semiconductors, Advanced Wireless Semiconductor Company (AWSC) and Visual Photonics Epitaxy Co., (VPEC), have deployed in the market of VCSEL applications. Among them, WIN Semiconductors will have its main revenue growth momentum from VCSEL. VCSEL manufacturers must have wafer fabrication ability and use 6-inch wafer fab, and WIN Semiconductors is now a major foundry of optical fiber and microwave communication equipment worldwide, together with construction of new fab and ongoing capacity expansion.

AWSC has seen revenue rebound since 2017 as it expanded the main products from a power amplifier (PA) to VCSEL, and its VCSEL products have been shipped to Europe. AWSC is also a VCSEL foundry for Princeton, making it possible for AWSC to further involve in AMS’s supply chain and 3D sensing market.

Another supplier, VPEC, has its VCSEL wafers applied in mobile phones, moreover, it is developing more applications in automotive sector and surveillance camera. Currently, PA wafer accounts for 80% of VPEC’s revenue, with stable performance in wireless communication applications. As for its performance in mobile applications, it will depend on the market feedback.

3D sensing technology is faced with two challenges. First, it needs to accurately measure the distance, and the current solutions include time-of-flight (ToF) and structured light. Second, it needs to specifically interpret parameters of ToF or structured light, while carry out algorithm of facial or iris recognition. Therefore, Android phone vendors point out that the biggest problem for them to embed 3D sensing is the proper distance-measuring technology and the algorithm, rather than the hardware modules.

3D sensing will be in diverse applications in the future

VCSEL was mainly used for optical communication and data transmission in the past, and the suppliers all adopted the mode of “small but organized” in operation due to the steady supply chain. The shipments of VCSEL over the past 20 years totaled about 1 billion sets, and shipments of VCSEL used in optical transceivers was over 30 million in 2016.

Therefore, in the long run, the market for VCSEL has huge potential for growth due to the development of Internet of Things and cloud computing, etc. In particular, it will have wider application in data centers, automotive night vision camera, self-driving and other fields. In recent years, Chinese government has been actively supporting the industry of gallium arsenide and telecommunication components, entering the VCSEL market. As the result, the competition will become increasingly fierce.

Therefore, it is believed that the rapid development of consumer electronics has brought disruptive changes in the VCSEL industry. In 2018, the cooperation between mobile phone vendors and the upstream suppliers will emerge. However, Apple has taken initiatives in obtaining patents on VCSEL and algorithm. For other players in the industry, they have more crucial concerns beyond production capacity expansion. They may need to look for ways to improve the accuracy of 3D sensing and make it more cost-effective without patent infringement.

[Editor's Note: A correction was made at 09:50 am, January 5th 2018. The consumption of VCSEL in the optical communication sector stands the highest despite the recent boost in the VCSEL demand from smartphones.]