Several recent commentaries have pointed out a chance of OLED experiencing an oversupply due to the tepid sales of the iPhone X, especially when there will be three OLED suppliers, namely Samsung, LG Display and BOE. Last month, it was also learnt that some Chinese phone brands, such as Huawei and Xiaomi, consider to upgrade its LCD smartphone screens with Mini LED backlights.

|

|

(Image: shutterstock) |

Before they are confident at mass producing Micro LED, LED companies, Taiwanese ones in particular, are manufacturing Mini LED instead as a transition. They consider to use it in backlight modules that can upgrade the LCD displays they integrate with. LCD displays with Mini LED backlight modules have strong local dimming capabilities, and thus can present images of better color contrast and resolution. As LED makers can utilize existing equipment to produce and test Mini LED, the production cost should not be a big concern, plus it might also help relieve the oversupply of LED chips.

Now, here begins a debate: when Mini LED is ready to enter the smartphone display market, it has to face an oversupply of OLED screens. Does Mini LED still have chances to grow in this space? And for how long can it last?

Yes, there will be a chance for Mini LED

|

|

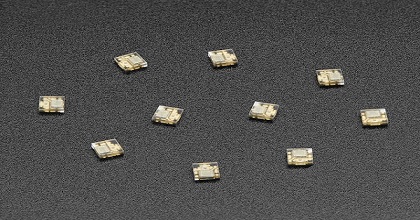

(Image: Samsung Display) |

Some hold a perspective that the entry of Mini LED to the smartphone display market will not be affected much in the short term, based on an assumption that LED makers will roll out Mini LED-based displays in the next one and a half year.

Let’s try to understand a bit more deeply about the oversupply of OLED that the media has been reporting around. Yes, the fact that Apple cuts OLED display orders does make Samsung face an OLED oversupply and leave it no choice but to lower its output. However, that doesn’t mean OLED is in general overloaded in the market.

There are two types of OLED displays: rigid and flexible OLED displays. The former is manufactured with glass substrates, while the latter with polyimide substrates.The popularity of rigid OLED slides as flexible OLED becomes a new focus. Rigid OLED displays are now mainly used for production of mid-range smartphones, such as the Samsung Galaxy A and J series and some Chinese ones. Undoubtedly, the price of rigid OLED falls and it is experiencing a situation of oversupply.

What about flexible OLED? As more companies start to make flexible OLED, it is not in short supply, but it is definitely not anywhere close to oversupply, either. The supply of flexible OLED is actually tight, in close-to-short kind of tight supply.

Judging by that and the trend that the majority of smartphone makers prefer flexible OLED, one side of the debate believes that quite an amount of smartphones will end up with Mini LED-lit screens when their makers want to upgrade the screen quality but have little chance to get flexible OLED screens.

How little will that chance be? Quite little, as they think. Over a billion of smartphones have been shipped in 2017. Only one seventh of them are iPhones and nearly one fourth of them Samsung phones. Among that many iPhones, only a portion of them are iPhone X. From simple maths, we can get an answer that those spare flexible OLEDs originally intended for the iPhone X is still far from sufficient to support 50% of the phones, let alone the whole rest.

Hmm, the chance is small

|

|

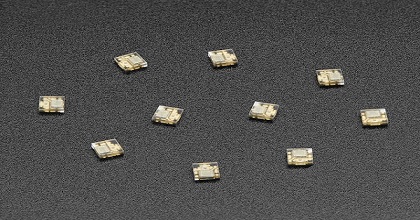

(Image: Micro LED Adafruit Industries via Flickr CC2.0) |

The other group of people is less optimistic about the possibility to manufacture, verificate and commercialize quality Mini LED-lit displays in such a short time. Also, cost wise, OLED is still more competitive than Mini LED.

Although the supply of flexible OLED is tight, the amount is still enough for smartphone makers who would like flexible OLED screens on their products, the other side of the debate believes. Despite the fact that Samsung may schedule a bit later the capacity expansion plan for its A5 flexible OLED plant, a few more Chinese manufacturers, especially BOE, will start their OLED production very soon. The expansion of the OLED capacity is expected to be significant.

Even if Huawei and Xiaomi will sport their new smartphones with Mini LED-lit screens, other phone brands have not made their moves to follow suit yet. For some reasons—some say it’s because of the great demand from Apple— Huawei is not able to get OLED displays from Samsung. Therefore, it partners with Taiwanese LED companies to launch Mini LED phones in 2H18. As for other phone makers, instead of turning to Mini LED right away, they are more likely to observe the performance of those new screens first before tapping it for specification upgrade.

Another point they made to support their opinion is cost. Taking a 5.5” Full HD smartphone screen as an example. A 5.5” rigid OLED screen is currently sold at USD 35, with some room to be lower, somewhere close to USD 30, which suggests the production cost of rigid OLED is even lower. However, the cost to produce a 5.5” Mini LED-based screen is already around USD 35-40. It is hard to say at this point whether a USD 5 upgrade would be worthwhile or not.

Running against time

Still, both sides agree on a fact that at the end OLED will supplant all other display technologies in the smartphone market after 2019 when BOE ramps up the OLED capacity in it’s Gen 6 plant in Mianyang. Mini LED backlight makers should really seize the time before a new wave of OLED is shipped to the market.

Mini LED is projected to stay in the smartphone screen market for 2-3 years. That can be somehow considered enough time for a transitional technology. After all, the final goal of those LED manufacturers is Micro LED.